Alaska SR-22 Auto Insurance

In Alaska, you will need to have the minimum liability insurance to drive around the state without penalty. Having car insurance is essential if you own a car or if you drive, but you may also need more than liability insurance if you have gotten driving convictions. Driving recklessly can get you into trouble. Being a high-risk driver can come with its consequences.

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rachael Brennan

Licensed Auto Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health in...

Licensed Auto Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

- SR-22 insurance is a certificate for high-risk drivers

- An SR-22 shows that you have proof of financial responsibility

- There are two different kinds of forms for an SR-22 in Alaska, the Owner’s Certificate and the Operator Certificate

- Getting an SR-22 can be expensive and hard to find

Alaska is the largest state in the U.S. Like many of the other states, Alaska has rules to keep its drivers safe and make sure to reduce reckless driving on the road.

In Alaska, you will need to have the minimum liability insurance to drive around the state without penalty. Having car insurance is essential if you own a car or if you drive, but you may also need more than liability insurance if you have gotten driving convictions.

Driving recklessly can get you into trouble. Being a high-risk driver can come with its consequences. If you are reckless, you will have to get an SR-22.

You can enter your ZIP code above to start looking for insurance quotes near you.

What do I need to know about an SR-22 in Alaska?

If you have several driving convictions, you are considered to be a high-risk driver. There are a few things you should know about being a high-risk driver. An SR-22, while necessary to get yourself back behind the wheel, does come with penalties that can be expensive.

What is SR-22 insurance?

In Alaska, an SR-22 is a document that shows proof of financial responsibility. Even though it has insurance in the name, SR-22 insurance is a certificate for high-risk drivers. In Alaska, the SR-22 form shows that the motorist has obtained and is carrying continuous liability coverage. Your insurance company will file an SR-22 with the Alaska Department of Motor Vehicles.

An SR-22 is not required for all drivers. If you only have one speeding ticket on your driving record, you will not need this type of insurance. Those who have had multiple moving violations that would make them high risk will need an SR-22.

An SR-22 is usually required for reinstatement of driving privileges once a driver’s license is revoked or suspended. Since the SR-22 is proof that you can maintain car insurance, you need to make sure that you have car insurance.

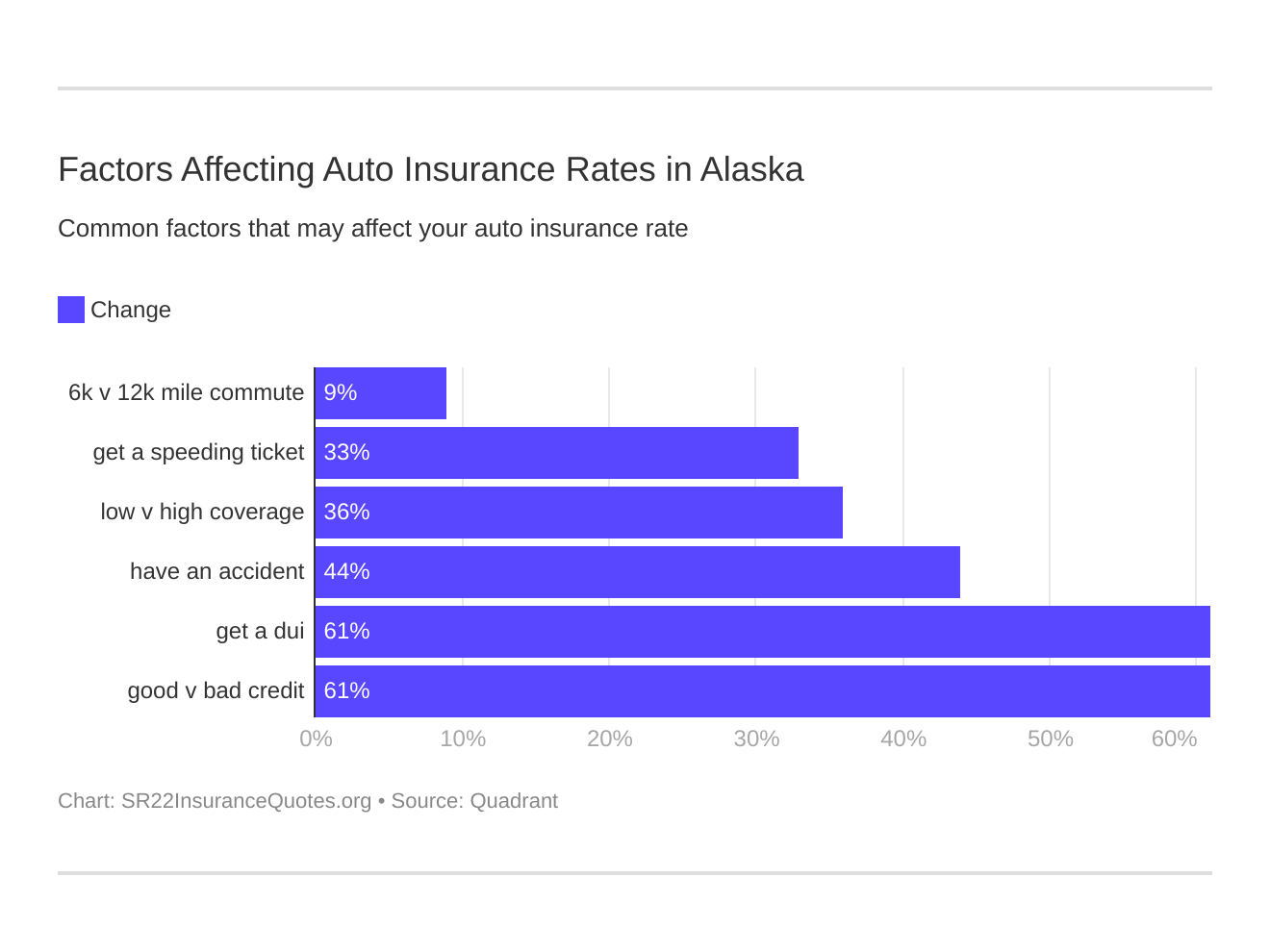

Six major factors affect car insurance rates in Alaska. Which auto insurance factors will impact SR-22 rates the most? Typically, that’s an Alaska DUI conviction.

Who needs an SR-22?

SR-22s are not a special kind of insurance. You will need an SR-22 if you:

- are convicted of a DUI or DWI

- have multiple speeding violations

- are convicted of reckless driving

- are in too many car accidents

- are driving without insurance

There is 15.4 percent of drivers in Alaska that are uninsured.

Not having insurance can cause you to have your license suspended for 90 days. If you continue to drive without car insurance, you can have your license suspended for up to a year. You should carry your insurance card, either as a physical copy or an electronic version, on your mobile phone or tablet. Not all companies provide electronic versions of insurance cards.

Is SR-22 car insurance required in Alaska?

Yes. For the majority of offenses that require Alaska SR-22 auto insurance, coverage must be continuously maintained for a minimum of three years from the end date of your revocation. Depending on the moving violation, SR-22 insurance will be required for a longer period. For cases involving DUI or DWI convictions, the SR-22 will need to be kept for at least five years.

Are there different types of Alaska SR-22 forms?

There are two different kinds of forms for an SR-22 in Alaska, the Owner’s Certificate and the Operator Certificate. If you drive and own a vehicle, you will need an owner’s certificate. You will need an operator’s certificate if you drive and not own a vehicle.

How do I get an SR-22 form?

If you need an SR-22, your insurance company will send you the form. You can also contact your insurance company and ask for the form.

How do I file an Alaska SR-22 insurance form?

Some states have discovered that having drivers file an SR-22 reduces the number of repeat offenders. SR-22s are not the end of the world, but they are still very important.

A motorist files an Alaska SR-22 form through their insurance provider, usually after paying a small fee, which can be added to the premium. The insurance carrier then files the form with the Department of Motor Vehicles. The State of Alaska takes this very seriously, and the penalties are fairly steep — coverage amounts for the state minimums are 50/100/25.

- $50,000 for injury or death to one person.

- $100,000 for injury or death to more than one person.

- $25,000 for property damages.

This is only the minimum, and you can get more coverage if you want. If you do not own a car, you are still responsible for having the minimum liability insurance.

Is a financial responsibility insurance certificate different from an SR-22?

A financial responsibility insurance certificate and SR-22 are the same. It is also referred to as SR-22 insurance or an SR-22 form.

Do I need an FR-44 in Alaska?

FR-44 insurance (FR-44 certificate of insurance) is similar to an SR-22, but they are not the same. An FR-44 requires more liability coverage for drivers. Only Florida and Virginia require drivers to have an FR-44.

Do I have to get car insurance again?

If you already have car insurance, you will not need to get another car insurance policy. You can add your SR-22 to your already existing policy. Some car insurance companies do not provide SR-22 insurance, and there are insurance companies that cater to high-risk drivers. You should talk to your insurance company to see if they provide the insurance you need.

When does my SR-22 sentence start?

Your SR-22 can start as soon as the certificate is issued. It can take 30 days for your SR-22 to be issued. You will receive your SR-22 once payment is received. Until you receive your certificate, you will not be able to use your driving privileges. Make sure to have your SR-22 certificate in your car at all times.

Which companies offer SR-22 insurance?

Not all companies offer SR-22 insurance. Some companies may provide insurance coverage in Alaska, but not SR-22 insurance. Below is a list of companies that provide SR-22 insurance.

- Dairyland

- Esurance

- Farmers

- Foremost

- Geico

- Good2Go

- National General

- Progressive

- Safeco

- State Farm

- The General

You can use these companies to get SR-22 insurance in Alaska.

How much is an SR-22?

The cost of an SR-22 filing can vary from state to state. The filing fees can range from $15 to $25, which is pretty low. The cost of insurance after getting an SR-22 can be expensive. If you have an SR-22, it will not be impossible to find insurance at decent rates, but it will take some research. Once you are considered a high-risk driver, lower premiums can be harder to come by. You will have to pay more for insurance than you did before.

Filing an SR-22 will be taken into consideration when your insurance gives you rates. Make sure you compare quotes from different companies before making your final decision.

| Company | Clean Record | With 1 Accident | With 1 Speeding Violation | With 1 DUI |

|---|---|---|---|---|

| Allstate | $2,510.60 | $3,541.27 | $2,987.51 | $3,541.83 |

| Geico | $2,058.90 | $3,044.11 | $2,096.36 | $4,320.46 |

| Progressive | $2,740.77 | $3,512.71 | $3,086.55 | $2,911.35 |

| State Farm | $2,031.37 | $2,424.84 | $2,228.13 | $2,228.13 |

| USAA | $1,928.44 | $2,473.74 | $2,182.92 | $3,231.71 |

The rates you pay for your car insurance will be based on how many speeding tickets, accidents, and DUIs you have. You will just pay more than someone with a clean record.

Free High-Risk Insurance Comparison

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

How do non-owners get SR-22 insurance?

Even if you don’t own a car, you can still be considered a high-risk driver. If you do not have a car, you can get non-owners insurance, so you can get an SR-22. A non-owner policy is for drivers that drive but don’t have a car. Be sure to keep your non-owner policy while you have an SR-22.

How do you know if you qualify for non-owner insurance?

Here are the qualifications.

- You don’t own a car.

- You do not have a car available to you at all times.

- You did not meet an interlock ignition device requirement.

- Once your SR-22 is filed your license will be active.

If you do not meet the criteria, you don’t need to get a non-owners policy.

How much is non-owners insurance?

Non-owner insurance can vary from company to company. A non-owners policy can be less than other policies. If you get a car while you have a non-owner policy, you will have to change your policy to a different one.

Do I need an SR-22 for being convicted of a marijuana DUI?

Marijuana is legal in Alaska, but you shouldn’t drive while under the influence of it. If you are convicted of driving while impaired (DWI), you will still need an SR-22. Below are the marijuana DUI penalties for Alaska.

| Offense | Jail | Fine | License Revocation | Other |

|---|---|---|---|---|

| 1st | 72 hours minimum | $1,500 + cost of imprisonment ($330) +$200 license reinstatement fee | 90 days | SR-22 liability insurance required for 5 years Possible attendance at ASAP endorsed treatment program |

| 2nd | 20 days minimum | $3,000 + cost of imprisonment ($1,467) + $500 license reinstatement fee | 1 year | SR-22 liability insurance required for 10 years |

| 3rd | 60 days minimum (misdemeanor) 120 days minimum (felony) | $4,000 - $10,000 + cost of imprisonment ($2,000 for misdemeanor; n/a for felony) | 3 years (misdemeanor) For life/10 years (felony) | SR-22 liability insurance required for 20 years |

| 4th | 120 days minimum (misdemeanor) 240 days minimum (felony) | $5,000 (misdemeanor) $10,000 (felony) + cost of imprisonment ($2,000 misdemeanor; n/a felony) | 5 years (misdemeanor) For life or 10 years (felony) | SR-22 liability insurance required for life |

| 5th | 240 days (misdemeanor) 360 days (felony) | $6,000 - $10,000 + cost of imprisonment ($2,000 for misdemeanor; n/a for felony) | 5 years (misdemeanor) For life (felony) | No |

| 6th | 360 days | $7,000 - $10,000 + cost of imprisonment ($2,000 misdemeanor; n/a if felony) | 5 years (misdemeanor) For life (felony) | No |

After the fourth offense, you will need an SR-22 for life.

How long will I need an SR-22 if I have a DUI?

If you are convicted of a DUI, you will need an SR-22 for five years. If you have more offenses, you will be required to have an SR-22 longer. If you have more than three DUIs, you will have to get an SR-22 for 20 years. If you get more offenses, you will have to get an SR-22 for life.

Below are the DUI penalties for Alaska.

| Statistic | Detail |

|---|---|

| Alcohol-Impaired Driving Fatalities Per 100k Population | 3.1 |

| DUI Arrest (Over 18 years old) | 3,063 |

| DUI Arrests (Over 18 years old) Total Per Million People | 5,523.23 |

| Total Arrests | 3,094 |

| U.S. Rank | 4 |

Alaska is ranked number four for the most DUIs in the United States. The table below is the DUI statistics for Alaska.

| Penalty | 1st Offense | 2nd Offense | 3rd Offense | 4th Offense | 5th Offense |

|---|---|---|---|---|---|

| Community Service | No | No | No | No | No |

| Fine | $1,500 min +$200 license reinstatement fee | $3,000 min +$500 license reinstatement fee | $4,000 min | $10,000 min | $10,000 min |

| Jail Time | Mandatory min 72 consecutive hours | Mandatory 20 day minimum | Mandatory 60 day minimum | Mandatory 120 day minimum | Mandatory 120 day minimum |

| License Revocation | 90 days | 1 year | 3 years | 5 years | 5 years |

| Other | SR-22 liability insurance required for 5 years, possible attendance at ASAP endorsed treatment program; mandatory interlock 1 year | SR-22 liability insurance required for 10 years, mandatory interlock 2 years | SR-22 liability insurance required for 20 years; 3 year interlock | SR-22 liability insurance required for life; 3 year interlock if licensed restored | SR-22 liability insurance required for life; 3 year interlock if licensed restored |

The most common group to have an SR-22 are drivers who have a DUI on their record.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

Can I get insurance if I’m a high-risk driver?

You can get insurance while you are considered a high-risk driver. Companies will increase your insurance rates because of it. Some companies will not take you on because you are high-risk.

Will my age or gender after how much I pay for high-risk insurance?

In the U.S., car insurance companies can not increase rates based on religion or race. Certain states have prohibited the use of gender to determine car insurance rates. Alaska does not have such a law. If you are getting car insurance and are a high-risk driver, your gender, age, and marital status will also be taken into consideration.

The rates in the table below are based on insurance purchased in-state.

| Company | Married 35-Year-Old Female | Married 35-Year-Old Male | Married 60-Year-Old Female | Married 60-Year-Old Male | Single 17-Year-Old Female | Single 17-Year-Old Male | Single 25-Year-Old Female | Single 25-Year-Old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $2,133.71 | $2,133.71 | $2,037.18 | $2,037.18 | $5,100.22 | $6,679.06 | $2,407.00 | $2,634.39 |

| Geico General | $2,118.66 | $2,053.39 | $1,999.69 | $1,902.76 | $4,667.64 | $5,955.63 | $2,094.53 | $2,247.33 |

| Progressive Direct | $1,846.21 | $1,631.16 | $1,551.21 | $1,588.18 | $6,507.31 | $7,248.95 | $2,075.99 | $2,053.77 |

| State Farm Mutual Auto | $1,340.30 | $1,340.30 | $1,200.62 | $1,200.62 | $4,158.63 | $5,390.65 | $1,578.13 | $1,615.68 |

| USAA | $1,439.39 | $1,435.84 | $1,341.61 | $1,334.71 | $4,660.59 | $5,168.23 | $2,065.08 | $2,188.18 |

The data includes high-risk drivers and drivers that purchased more than the minimum liability insurance.

Do I need an SR-22 to get car insurance?

No. An SR-22 is proof that you have insurance. You can not get insurance without it. SR-22s are for high-risk drivers. If you are not a high-risk driver, you can go to any car insurance company available in Alaska to get coverage.

| Company | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| Allstate Insurance Group | $59,507 | 45.56% | 12.70% |

| Country Insurance & Financial Service Group | $14,042 | 65.14% | 3.00% |

| Geico | $82,637 | 68.23% | 17.63% |

| Hartford Fire & Casualty Group | $10,332 | 66.49% | 2.20% |

| Horace Mann Group | $4,748 | 67.08% | 1.01% |

| Liberty Mutual Group | $16,337 | 63.73% | 3.49% |

| Progressive Group | $50,922 | 67.86% | 10.86% |

| State Farm Group | $133,816 | 77.95% | 28.55% |

| Tiptree Financial Group | $4,938 | 20.10% | 1.05% |

| USAA Group | $83,687 | 68.67% | 17.86% |

| State Total | $468,681 | 67.54% | 100.00% |

Above are the largest car insurance companies in Alaska. Not all the companies mentioned above provide high-risk insurance, but they provide good coverage for drivers that are not high-risk.

Can I be kicked off my insurance for being a high-risk driver?

If you are a reckless driver, your car insurance company can cancel your insurance policy. If you are caught driving under the influence, this can lead to your policy being canceled. Getting into too many car accidents can also lead to your policy being canceled.

When your policy gets canceled, it can be tough trying to find a new one. You need car insurance to drive your car. If you drive without car insurance, you can face penalties and possibly get an SR-22.

How many car insurance companies are there in Alaska?

There are four domestic car insurance companies in Alaska. Domestic car insurance companies operate in the state. Alaska also has 397 foreign companies. Foreign car insurance companies operate out of the state but have licenses to do business in another state.

Will I need an SR-22 to register my vehicle?

You do not need an SR-22 to register your car. You may need one to get your car registration back. If you need to register your vehicle, you can go to the Alaska Department of Motor Vehicles.

Do teens need SR-22 insurance?

Teens can also be guilty of reckless driving. If your teen gets multiple traffic violations, they will have to get an SR-22. If your teen loses their license, you will have to sign a form at the Alaska DMV office or send a form to be notarized to get your teen’s license back.

Make sure to add your teen to your car insurance policy so that they can have liability insurance.

Can my SR-22 be withdrawn?

You will need to keep your SR-22 insurance for the time the state has given. The state does not reduce the time for a person carrying the certificate. The state of Alaska will not recognize your clean driving record until your insurance company tells the court that you have had the SR-22 for the required time.

What if I let my SR-22 lapse?

If this coverage lapses or is otherwise canceled, the insurance company reports this to the Division of Motor Vehicles. Your insurance company will legally have to file an SR-26 with the state. Letting your SR-22 insurance lapse can lead to suspension of your license and fines.

You should not let your SR-22 lapse, nor should you cancel it. You will have to start your probation again if you do not keep your SR-22 insurance for the allotted time. If you do not file out an SR-22 form, you could face license suspension and even legal action.

If your driver’s license is suspended, you will not get it back. In Alaska, if you drive on public roads and do not have a valid license, you can get your vehicle registration suspended.

Should I not drive after I receive an SR-22?

You can decide not to drive once your SR-22 is filed, or you can continue to drive. Practice safe driving and avoid traffic violations. If you allow someone else to drive your car, be sure that they also practice safe driving.

Does Alaska use a negligent operator system?

Alaska uses a point system to keep up with its residents’ driving records. The system was put in place to penalize drivers for committing traffic violations. If you have too many points, you can lose your driving privileges and have your license suspended or revoked. Drivers get points for every moving violation they commit.

If you do get points on your license, your license will not be suspended immediately. You will receive a warning if you get:

- six points within 12 months

- nine points within 18 months

Your license can be suspended if you get:

- 12 points with 12 months

- 18 points within 24 months

Certain violations are higher points than others.

- Speeding three to nine miles over the speed limit (two points)

- Speeding 10 to 19 miles over the speed limit (four points)

- Speeding 20 miles over the speed limit (six points)

- Racing (10 points)

- Driving with no insurance (six points)

- Reckless driving (10 points)

- DUI (10 points)

Points can add up quickly. If you get two speeding violations for driving 20 miles over the speed limit, you can get your licenses suspended and likely need to get an SR-22 to get them back.

How do I get my driving record?

Your driving record will let you know how many points you have received. It will also give you the details behind the points. You can get a copy of your driving record at the Alaska Department of Motor Vehicles. Knowing your driving record will let you know where you stand as a driver.

What should I do while I have an SR-22?

If you have an SR-22, you can start driving again. You should keep a clean driving record and avoid getting points put on your driving record. Once you no longer need to file for an SR-22, you will not have to file for one again. If you get another traffic violation that requires you to get one, you will have to file for one again. If you are not sure whether you still need SR-22 insurance, contact the Alaska DMV.

Will my SR-22 follow me to Alaska?

If you are moving from another state, and you have an SR-22, you should keep it. You will have to continue paying your premiums. If your policy lapses before you reach your SR-22 requirements, you could have your license suspended; it will be harder to get a license or car insurance in Alaska.

Can I improve my driving record?

Yes, you can improve your driving record to get points removed. You can talk to your insurance provider about getting discounts to reduce your car insurance rates. After a few years, points will disappear from your license, but you can help speed up the process.

If you take a defensive driving course, it can remove a couple of points. You will have to check and see if you are eligible to complete a driving improvement program. Keeping your driving record clean and avoiding getting traffic violations is also a good way to reduce your car insurance rates and point violations.

How to avoid getting an SR-22?

Getting an SR-22 can be a nuisance, it’s expensive and requires a lot of research to find a company that offers SR-22 insurance. After having an SR-22 for a while, you are probably wondering how to not get another one. If you have never had one, and want to know how to not get one, here are some tips. You can learn about driving safely to avoid receiving another one.

Avoid getting multiple DUI offenses. Do not drive if you have been drinking. The minimum BAC limit is 0.08.

Know the speed limits and don’t speed. Speeding can be a convenient way for you to get places, but it can be dangerous also. As mentioned before, having too many speeding tickets can get you another SR-22. If you don’t know the speed limits in Alaska, they are in the table below. Just know that speed limits will decrease in residential areas and school zones.

| Road | Speed Limit |

|---|---|

| Rural | 65 |

| Urban | 55 |

| Limited access roads | 65 |

| Other roads | 55 |

Make sure to have the minimum liability insurance. Be sure to have it even if you do not own a car. Also, do not let your liability insurance lapse. Practice good driving techniques. Avoid being a distracted driver. If you already have an SR-22, do not let it lapse. Make sure to keep it for the required time. You do not want to start the probation over again.

The Bottom Line

An active SR-22 insurance policy is a certificate of insurance that shows the department proof of insurance for the future, as required by Alaska law.

In Alaska, the average rate of a minimum car insurance policy for a driver with an SR-22 filing due to a DUI is $760 per year.

To get select quotes from Alaska SR-22 auto insurance providers, enter your zip code to compare and save on SR-22 insurance today.