Georgia SR-22 Insurance

SR-22 insurance in Georgia is required for high-risk drivers. Learn more about Georgia SR-22 insurance requirements and get Georgia SR-22 insurance quotes now.

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: May 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

What is SR-22 insurance in Georgia? SR-22 insurance in GA is a form sometimes called an SR-22 financial responsibility insurance form. It is a special type of insurance form that shows to Georgia authorities that the driver of a motor vehicle is financially responsible for carrying continuous car insurance with at least the minimum amount of liability coverage for the state.

The SR-22 form needs to be filed with the Georgia Department of Motor Vehicles so that they are confident that the driver is covered and can drive safely. The car insurance company and the driver are responsible for filing the SR-22 form with the state.

If you have to have SR-22 insurance, you will be paying much more for your car insurance than a driver with a clean driving record. That doesn’t mean that you are stuck with just one option, though. Cheap SR-22 insurance is available.

The best way to get car insurance that you can afford is to compare Georgia SR-22 insurance quotes. Enter your ZIP to receive quotes to find cheap SR-22 insurance in Georgia.

- SR-22 insurance in Georgia is a requirement if you are a high-risk driver

- SR-22 insurance is a form that shows the state that you carry at least the minimum amount of insurance required

- Your insurance company will file the form for you

What is SR-22 insurance in Georgia?

First – – what is SR-22 insurance? The SR-22 form is usually required if you are considered a high-risk driver. Drivers who have had multiple accidents, traffic tickets, a DUI, or no proof of insurance are all considered high-risk, meaning the likelihood of an insurance company having to pay is high.

Does Georgia require SR-22 insurance? In Georgia, SR-22 car insurance needs to be filed by drivers who are considered “high risk.” These drivers are those who have received multiple moving violations, been involved in multiple accidents, or received a citation for a serious accident like a DUI. In this case, getting an SR-22 is part of Georgia DUI insurance requirements.

In Georgia, SR-22 auto insurance forms are required for drivers who have been convicted of a DUI or have had their license suspended for driving without insurance, for having multiple violations or serious violations like reckless driving.

The state requires that these high-risk drivers file the Georgia SR-22 Insurance Certificate to prove that they are financially responsible for holding continuous auto insurance coverage. If you fail to pay for your insurance while carrying the SR-22, your license will be suspended.

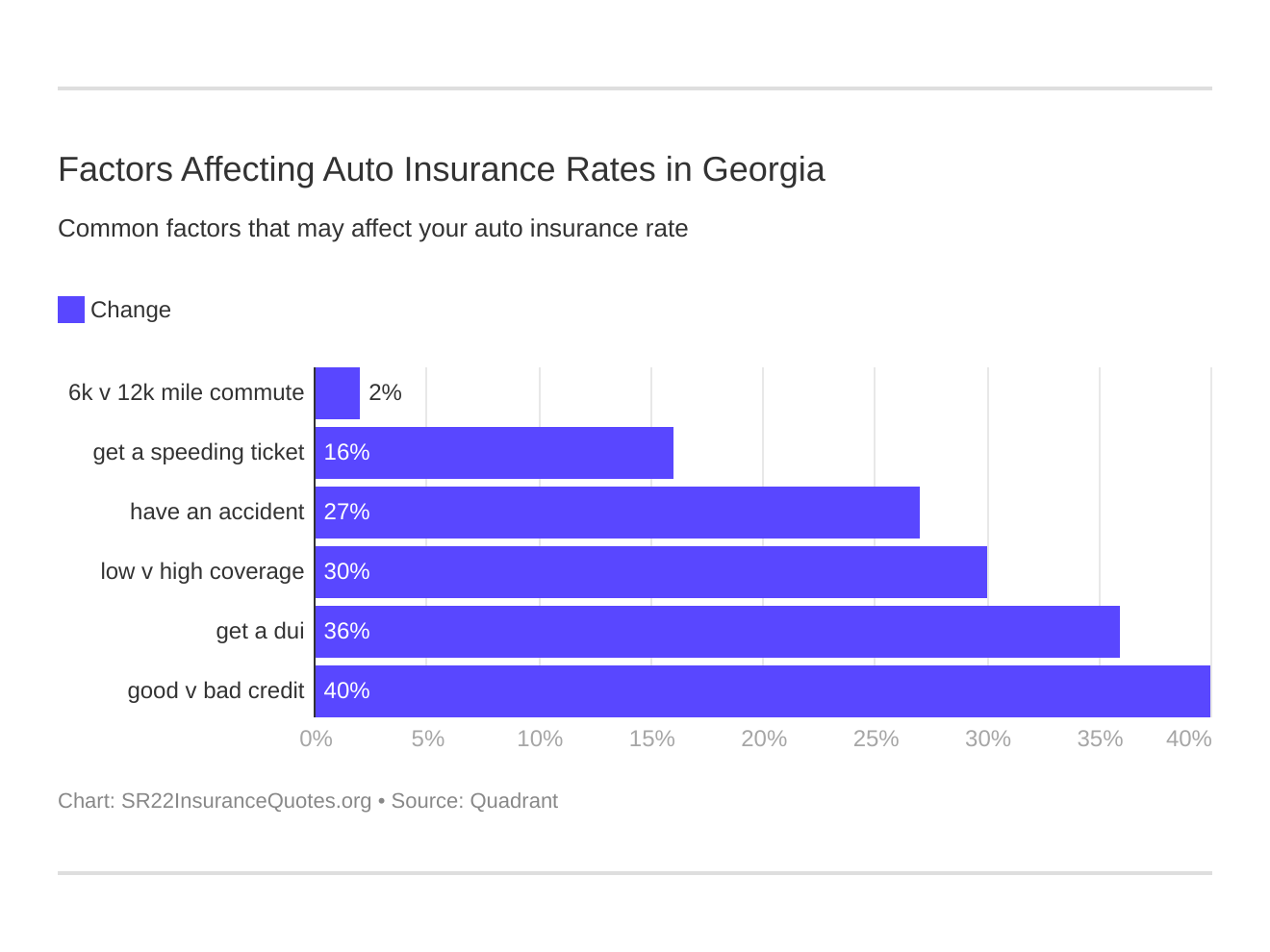

Six major factors affect car insurance rates in Georgia. Which auto insurance factors will impact SR-22 rates the most? Typically, that’s a GA DUI conviction.

How long do you have to carry SR-22 insurance in Georgia? You have to carry this insurance form for three years. That is a long time to pay for higher rates.

Just how much is SR-22 insurance on average? There are many factors that go into determining the average cost of SR-22 insurance. Let’s look at what high-risk driving does to your car insurance costs.

This table shows you just how much one accident or DUI can increase your rates in Georgia.

Average Annual Rates in Georgia Based on Driving Record| Company | Average Annual Rates with Clean Record | Average Annual Rates with 1 Accident | Average Annual Rates with 1 DUI | Average Annual Rates with 1 Speeding Violation |

|---|---|---|---|---|

| Allstate | $3,465.70 | $5,365.97 | $4,363.29 | $3,647.83 |

| GEICO | $1,991.22 | $2,493.90 | $5,179.25 | $2,244.40 |

| Liberty Mutual | $7,632.75 | $10,428.16 | $11,988.03 | $10,164.83 |

| Nationwide | $4,993.04 | $5,859.64 | $9,033.42 | $6,053.51 |

| Progressive | $3,524.11 | $6,212.74 | $4,157.29 | $4,102.75 |

| State Farm | $3,084.80 | $3,684.98 | $3,384.88 | $3,384.88 |

| USAA | $2,416.20 | $3,058.95 | $4,461.07 | $2,693.63 |

So what does Georgia SR-22 insurance cost, and how much does an SR-22 make your insurance go up? The average monthly rate for a clean driving record in Georgia is $322, but one DUI takes that up to $506. And that doesn’t include any extra fees associated with SR-22. Georgia DUI insurance is significantly higher than average insurance rates.

It’s also important to note that not all car insurance companies will offer SR-22 insurance. These companies don’t want to take on high-risk drivers since it is very likely the company will have to pay a claim at some point.

While large companies like Progressive, The General, and GEICO offer SR-22 insurance, other companies, like Serenity Insurance, specialize in SR-22. It’s important to shop around to find cheap SR-22 insurance in Georgia, so make sure to compare quotes from different types of companies.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

Different Types of Forms for SR-22 Insurance in Georgia

There are three basic types of Georgia SR-22 car insurance forms, called certificates.

The owner of the car needs an SR-22 Owner’s Certificate that shows the financial responsibility of the owner of the vehicle. This shows the state that should that driver be in an accident in that car, at least the minimum car insurance is in place. This is the certificate that most drivers will have.

It is also possible to get non-owner SR-22 insurance in Georgia.

The SR-22 Operator’s Certificate proves the financial responsibility of the operator of a vehicle if they do not own a vehicle. This would be needed if you do not own your own car but routinely borrow a car from a friend or family member, for example.

If you drive someone else’s car and don’t have non-owners insurance, you will be responsible for any damages from an accident you caused.

There is also an Operator-Owner’s Certificate that covers the driver and all the vehicles they drive, whether they own those vehicles. This type of certificate would cover you if you have your own car but sometimes drive someone else’s car, like your parent’s car.

SR-22 Car Insurance is Required in Georgia

AAA states that each state sets its own car insurance requirements. All states, except New Hampshire, require drivers to carry some form of car insurance and penalties can be hefty for not doing so.

As for Georgia SR-22 insurance requirements, Georgia is very strict with its car insurance laws, and the Georgia State Department of Motor Vehicles does require drivers who have received serious moving violations or received a DUI conviction to file a Georgia SR-22 certificate.

You can also be required to carry SR-22 insurance in GA if you have been caught driving without insurance. This way the state is certain that you will no longer be driving uninsured, at least during the three years you have to carry GA SR-22 insurance.

Typically, you have to pay for the insurance at least six months at a time. Most companies won’t let you pay by the month.

The Insurance Information Institute estimates that 12 percent of Georgia drivers don’t have car insurance. That’s only slightly lower than the US average of 13 percent.

If you are in an accident with an uninsured driver, you might not be able to have all of your damages covered. This would leave you paying out of pocket for damages and medical bills.

Drivers have the option of adding coverage to their car insurance in case they are hit by an uninsured driver. Considering how many drivers are uninsured in Georgia, this might not be a bad coverage to add to your policy.

Can I get a GA SR-22 insurance without having car insurance? No, you must carry car insurance if you are a driver in Georgia.

The Georgia SR-22 car insurance form should show that the driver has at least the state’s minimum amount of coverage. In Georgia, this is $25,000 per person per accident, $50,000 for more than one person per accident, and $25,000 in property damage liability car insurance.

Filing a Georgia SR-22 Insurance Form

How do you get GA SR-22 insurance? How is the form filed? Once you have chosen a car insurance company and acquired the SR-22 coverage, your insurance company normally takes over.

The car insurance company usually files the SR-22 form with the Georgia DMV, but you have to request that it be filed when you purchase your Georgia car insurance coverage.

Often, a processing fee is also associated with an SR-22 form, but this can be included in your premium. The filing fee is typically only $15 or $30. The car insurance is where you will feel the biggest hit to your wallet.

SR-22 Insurance in Georgia: The Bottom Line

To clarify, SR-22 insurance is not exactly a type of car insurance policy. It is a certificate submitted by auto insurance companies to the government after you commit a serious moving violation. The SR-22 insurance Georgia form indicates that you meet the state’s minimum coverage for car insurance.

Georgia DUI insurance can have costly premiums, as it is a severe offense. Your auto insurance provider needs to file the SR-22 form on your behalf, but you need to check with them about their policy regarding this service.

The SR-22 insurance GA requirement signifies you’re a risky driver, so your insurer may decide to cancel your coverage if you need one.

Just like with regular car insurance, different companies will charge different rates for SR-22 insurance. Your best option is to compare quotes from many companies to make sure you are getting the best deal.

To find cheap SR-22 insurance in Georgia, you can start by entering your ZIP for a free online quote!