Kansas SR-22 Insurance (Rates, Companies, + More)

Kansas SR-22 insurance costs $100-$1,000 in fees, with car insurance rates going up another $42-$84/month. An SR-22 form can be filed by any company, but some specialize in high-risk car insurance.

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Mar 24, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Key Kansas Auto Insurance Statistics

| Kansas Statistics Summary | Details | Source |

|---|---|---|

| Road Miles | Total in State: 142,047 Vehicle Miles Driven: 32,103 | National Association of Insurance Commissioners (NAIC) |

| Vehicles | 2,553,489 | NAIC |

| State Population | 2,913,314 | US Census |

| Most Popular Vehicle | Ford F150 | USA Today |

| Uninsured Motorists | 11.50% State Rank: 26th | Insurance Information Institute (III) |

| Total Driving Fatalities | Speeding: 94 Drunk Driving: 88 | U.S. National Highway Traffic Safety Administration |

| Annual Average Premiums | Collision: $267.91 Comprehensive: $267.91 Liability: $529.21 | NAIC |

| Cheapest Providers | American Family Mutual and USAA | Quadrant Data |

Shopping for SR-22 insurance in Kansas doesn’t have to be too difficult. If you’ve just been told that you need SR-22 car insurance in Kansas due to a motor vehicle violation and need to know what that’s all about, keep reading. We’ll also tell you about the average cost of SR-22 insurance. Kansas is a no-fault state, and we’ll explain what that is as well.

Our experts have done the work of researching Kansas SR-22 insurance so you don’t have to. We’ll get started with some basics and then dive right into this SR-22 business and how to find cheap SR-22 car insurance.

Wouldn’t you like to spend your time on things you enjoy, rather than researching car insurance? To find the best SR-22 insurance in KS, find out where to get an SR-22, or just to get an SR-22 insurance quote in Kansas, enter your ZIP code above to get fast car insurance quotes.

What is Kansas SR-22 insurance?

So what is SR-22 insurance in Kansas? You might never have heard of an SR-22 until you were told you needed one.

SR is short for Safety Responsibility. The 22 is just the number of the form. There are other SRs too—for example, SR-1, SR-19, SR-21—but we won’t be discussing those further here.

An SR-22 form is provided by your car insurance company and presented to the Kansas Department of Revenue. This form shows that you’ve met the Kansas minimum requirements for car insurance liability coverage.

Unlike some other states, Kansas doesn’t have a financial responsibility law. In these other states, proof of your financial ability to meet the state’s minimum insurance requirements is required before reinstating your license. In Kansas, you just need the SR-22 to prove that you’ve obtained the minimum level of car insurance.

You’ll often hear and see the phrase “SR-22 Insurance.” Just remember that the SR-22 refers to an insurance form, not an insurance policy.

A Kansas SR-22 auto insurance form can be filed by any insurer. There are no specific Kansas SR-22 insurance companies, but some do specialize in it. Now that we’ve got these terms squared away, let’s talk about some aspects of the SR-22—such as why you need one, how you get one, and how much it costs.

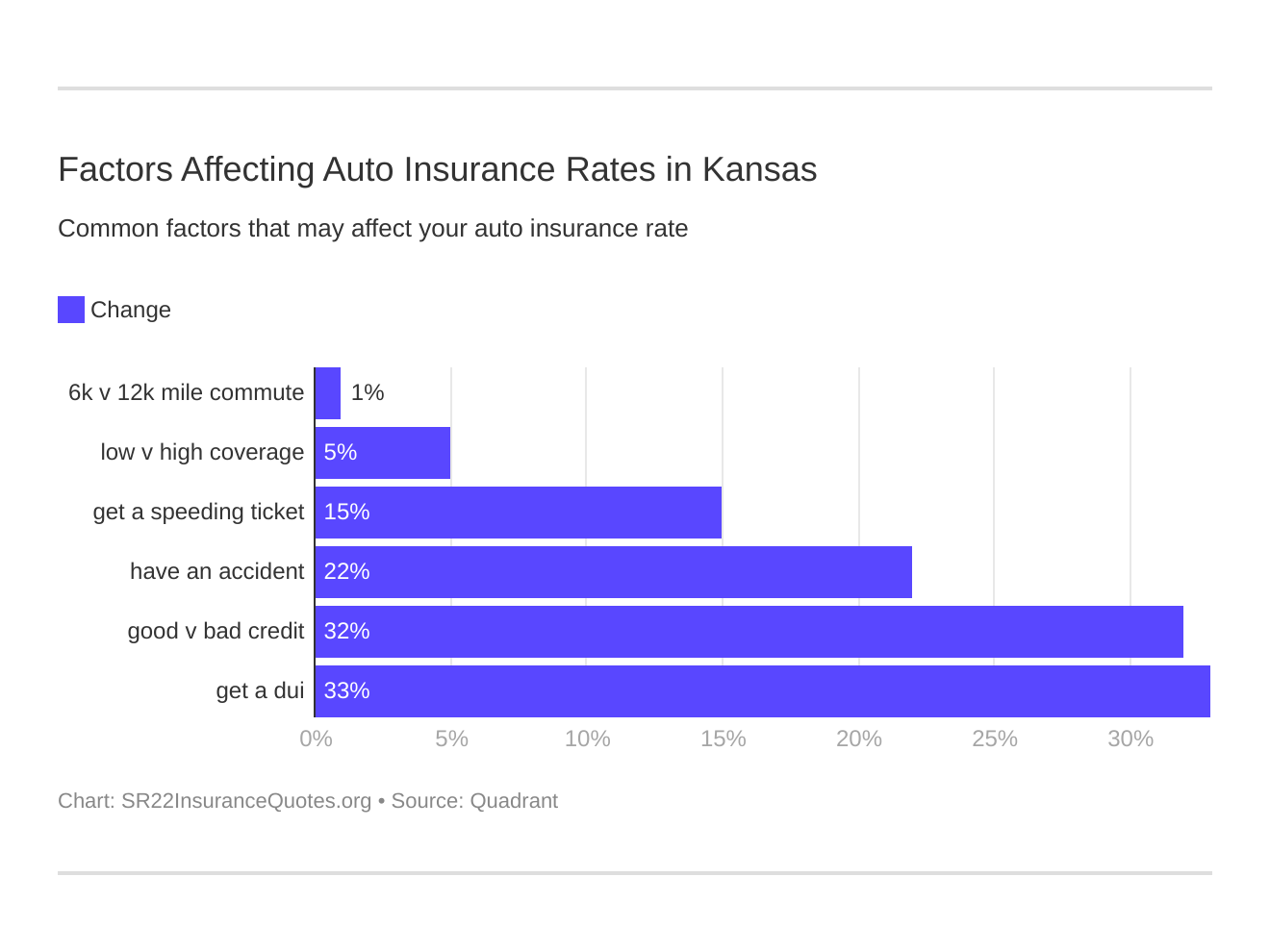

Six major factors affect car insurance rates in Kansas. Which auto insurance factors will impact SR-22 rates the most? Typically, that’s a KS DUI.

Why You Need SR-22 Insurance in Kansas

In Kansas, you’ll need an SR-22 to get your license reinstated if you’ve had your driver’s license suspended for any of the following reasons:

- Three or more moving violations within 12 months

- A moving violation when your license was restricted, suspended, or revoked

- Frequent serious traffic violations

- Conviction of driving under the influence, or failing or refusing a test for alcohol

- Two or more convictions for failing to pay for gas

The court or the Kansas Department of Revenue will inform you when an SR-22 is needed.

Kansas SR-22 Requirements

You need to contact your car insurance company as soon as possible to request an SR-22 form. Your insurance agent may submit the form directly to the Kansas Department of Revenue for you, or you may be required to file it yourself in person. The Kansas DMV, Department of Vehicles, falls within the Kansas Department of Revenue.

The steps involved are:

- Contact your insurance company to obtain an SR-22 form. Keep in mind that filing this form through your insurance company qualifies you as a high-risk driver, and your insurance rates will increase accordingly. Some insurance companies may not provide SR-22 insurance, meaning that you may need a new insurance provider before you can drive legally again.

- Plan to wait at least 30 days. An SR-22 form will be issued after it has been paid for through your insurance company. The SR-22 filing fee in Kansas is $15–$35. From there, your insurance provider will submit it to the Kansas Department of Revenue, which could take up to 30 days to process. Driving privileges won’t be reinstated until the SR-22 form is processed.

- Keep your SR-22 form in your vehicle. After an SR-22 certificate has been submitted and processed through the Department of Revenue, you’ll be required by the SR-22 insurance Kansas statute to keep it in your car at all times. If you’re ever pulled over, you must show the SR-22 form to the police officer along with your proof of insurance.

- Make sure your SR-22 form stays current. Failure to maintain SR-22 insurance will result in your license being suspended automatically. The same holds for if the policy is canceled at any time or if you make a late payment close to the grace period. If you no longer carry valid SR-22 protection, your insurance company, by law, must notify the Department of Revenue of this infraction. Failure to comply with Kansas SR-22 insurance requirements means a newly suspended license.

- Watch out for SR-22 deadlines.

- An SR-22 form should be renewed at least 15 days before it expires.

- Make sure your coverage doesn’t lapse.

- The law requires that an SR-22 form for a suspended license in Kansas be kept on file for one year.

- Your SR-22 form will need to be updated if you switch insurance companies or move to a different state.

Now that you’re squared away with the SR-22 process, let’s take a look at some of the costs you’ll be facing.

Average Kansas SR-22 Insurance Quotes

The costs involved with restoring your license might make the SR-22 filing fee seem very small.

The state of Kansas will also charge you a license reinstatement fee, which can run anywhere between $100 and $1,000 depending on your driving history, and an examination fee of $25.

You’ll also have court costs associated with your conviction. Don’t forget to pay for these.

With one of these serious violations on your driving record, you’ll likely have to pay a lot more for car insurance as well. Insurance companies assume that past behaviors can predict future ones, and they’ll expect you to be more costly to them. As a result, they’ll consider you a high-risk driver and will charge you higher premiums.

How much is Kansas SR-22 insurance?

You’ve completed the SR-22 process and your driver’s license is restored. But now you have a serious violation on your driving record. Many insurance companies will now classify you as a higher-risk driver and will charge you more for car insurance. Therefore, expect your SR-22 insurance cost to be higher than what you’ve had in the past.

These increased insurance costs can add up. If we look at average annual car insurance rates in Kansas, we can see what happens when you have one of these incidents on your driving record:

Average Annual Auto Insurance Rates by Driving Record for Kansas

| Driving Record | Average Annual Premium |

|---|---|

| Clean record | $2,746.94 |

| 1 Speeding violation | $3,243.79 |

| 1 accident | $3,505.79 |

| 1 DUI | $4,075.27 |

In terms of SR-22 insurance costs in Kansas, the average annual premium for a Kansas driver will increase by about $500 for a speeding violation, $750 for an accident, and $1,300 after a DUI conviction.

Several car insurance companies, such as Serenity car insurance, specialize in high-risk driver insurance that requires an SR-22 form. Be sure to shop around for quotes—you may be able to find low-cost SR-22 insurance in Kansas from another provider, even after obtaining an SR-22 certificate.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

Kansas SR-22 Insurance vs Regular Insurance

From an insurance perspective, there might not be any difference between regular car insurance and SR-22 insurance. In both cases, you still have to meet the minimum requirements for car insurance coverage in Kansas.

The SR-22 process helps the Kansas Department of Revenue keep track of your insurance situation following a motor vehicle violation. Once the duration of your SR-22 has ended, it’s possible for you to keep the same insurance you had with the SR-22.

When you have regular insurance, you could decide that you need more than the Kansas minimum coverage levels. You could, for example, choose to purchase comprehensive coverage.

Insurance companies consider drivers with violations on their record to be high-risk and will charge them more for car insurance. A driver with a clean record would most likely get lower rates and possibly lower them even further with an additional safe driver discount when it’s an option.

Average Kansas Car Insurance Coverage and Rates

Let’s start by talking about how Kansas is one of several states that have adopted a no-fault approach to car insurance. This means that in the event of a car accident, each driver is responsible for paying for their own damages.

Kansas law does, however, allow you to sue the other driver for your losses if they were at fault if you’ve exceeded your insurance coverage for medical expenses and if your losses include:

- Permanent disfigurement or injury

- Fracture of a weight-bearing bone or a compound, compressed, or displaced fracture of any bone

- Permanent loss of a body function

Think about this for a moment. Nearly 12 percent of Kansas drivers are uninsured. In conjunction with Kansas’ no-fault approach, it’s more important than ever that you protect yourself and your family by getting an affordable car insurance policy that works for you.

Kansas SR-22 Insurance Requirements for Coverage

Kansas law requires that each driver obtain a minimum coverage level of 25/50/25 for any policy issued or renewed after January 1, 2018. This translates into the following:

- Coverage up to $50,000 for all persons injured in an accident

- Subject to a limit of $25,000 for any individual

- Property damage coverage of $25,000

Kansas also requires that each driver obtain personal injury protection or PIP. Benefits related to a no-fault or PIP claim include:

- $4,500 per person for medical expenses

- $900 per month, for up to one year, for disability/loss of income*

- $25 per day for in-home services (housecleaning, other chores)*

- $2,000 for funeral, burial, or cremation expenses

- $4,500 for rehabilitation expenses

* Describes benefits that also fall to family members in case the policyholder dies as a result of their injuries.

Safe and Responsible Driving

Let’s take some time to understand some other reasons why safe driving is so important.

Impaired Driving: Alcohol

In Kansas, the legal limit for safe driving is a blood alcohol content (BAC) of 0.08 percent. For drivers who are 21 years of age or younger, the limit is 0.02 percent.

Kansas, like most states, has an enhanced penalty if your BAC is 0.15 percent or higher. This comes with even greater penalties if you’re found to have this much alcohol in your system while driving.

According to experts, drivers with BACs higher than the legal limit who are involved in a fatal crash are 4.5 times more likely to have prior DUI convictions. These drivers also cause about one-third of all impaired driving deaths each year. Kansas has increasingly tough penalties for drivers with multiple DUI convictions that include a felony conviction, prison time, large fees, and permanent license revocation.

The Centers for Disease Control and Prevention tells us that the average drunk driver will have driven under the influence 80 times before being arrested. Once convicted, 50 to 75 percent of drunk drivers will continue to drive illegally on a suspended license—without taking the time to complete necessary court requirements and reinstate a license with an SR-22 form.

Impaired Driving: Other Drugs

It’s not just alcohol that we need to avoid when driving—it’s a host of other drugs as well, both legal and illegal.

If you’re taking prescription drugs such as muscle relaxants, and your ability to drive is impaired, you can be charged with a DUI just as if you were caught drinking and driving. Be sure to read the warning labels on your prescription bottles for any mention of the impact of driving.

Kansas is a zero-tolerance state when it comes to marijuana, so there are no laws establishing acceptable minimum levels or amounts. According to the National Institute on Drug Abuse, after alcohol, marijuana is the most common drug found in the blood of drivers who have been in a motor vehicle accident.

And remember: If a police officer believes that you’re too impaired to drive, no matter what your BAC might be, they have the right to detain you on a DUI charge.

Reckless Driving

Driving behavior that may result in a reckless driving charge includes extreme speeding, tailgating, or violating other traffic safety laws.

An aggressive or reckless driver exhibiting signs of carelessness or road rage may follow too close to a vehicle, change lanes erratically, drive illegally on a sidewalk or shoulder of the road, fail to yield, or neglect to obey traffic signs or zones altogether.

A driver that has been charged with reckless endangerment, aggressive driving, or another related traffic violation may be required to obtain an SR-22 form to reinstate a suspended or revoked driver’s license.

Distracted Driving

We should also mention here that there are risks to distracted driving as well. Even something as routine as eating, drinking, or talking on your phone can shift your focus away from the road.

Texting while driving has grown to be a major cause of car accidents, which then can result in higher car insurance costs. Texting while driving is specifically prohibited in Kansas, and you can receive a $60 fine if you’re caught doing it.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

Cheapest SR-22 Insurance in Kansas City

Who has the cheapest car insurance in Kansas? And who has the cheapest SR-22 insurance in Kansas? In terms of getting the best rates for insurance in Kansas, your best bet is with American Family Mutual and USAA, although the rates for Allied and State Farm aren’t much higher, giving you some choice in terms of finding cheap SR-22 insurance in Kansas:

Kansas Average Annual Auto Insurance Rates by Company

| Companies | Average Annual Rates |

|---|---|

| American Family Mutual | $2,146.40 |

| USAA | $2,382.61 |

| Allied NW Affin PPBM | $2,475.59 |

| State Farm Mutual Auto | $2,720.00 |

| Geico General | $3,220.65 |

| Farmers Ins Co | $3,703.77 |

| Allstate F&C | $4,010.23 |

| Progressive NorthWestern | $4,144.38 |

| Travelers Home & Marine Ins Co | $4,341.43 |

| SAFECO Ins Co of America | $4,784.42 |

With such a range in cost for car insurance, it’s important to shop around for the right company, especially if you’ve had a motor vehicle violation conviction and are likely going to have to pay a higher rate as a result. Be sure to look at some local companies as well as national companies such as GEICO. SR-22 insurance won’t be cheap relatively speaking, but shopping around will help you find the lowest rate that’s available to you.

What are the rules of the road in Kansas?

Even though Kansas has a lot of open highways, there are still some significant safety laws in place to protect drivers and their passengers.

Set Belt and Car Seat Laws

Kansas law requires that seatbelts be worn by all occupants of a vehicle. Failure to do so can result in a fine.

Kansas also requires that children ages 0-3 ride in a rear-facing car seat until they’ve outgrown the seat manufacturer’s height and weight limits. Children aged 4-7 are required to ride in a booster seat unless they’re taller than 4 feet 9 inches, weigh more than 80 pounds, or have no other option but to use a lap belt in the back seat.

Keep Right and Move Over Laws

Except for within city limits, it’s illegal in Kansas to drive in the left lane unless passing another vehicle, preparing for a left-hand turn, or as otherwise directed by traffic officials.

Speed Limits

The Kansas Highway Patrol (KHP) publishes the list of speed limits within Kansas:

- 75 mph maximum on rural segments of freeway

- 75 mph on the Kansas Turnpike

- 70 mph on some improved highways in rural areas

- 65 mph on improved two-lane highways

- 55 mph on two-lane paved highways

- 30 mph in residential areas

The KHP also notes that any exceptions to the above will be posted.

Teen Driver Laws

Kansas Teens as young as 14 can apply for an instruction permit or a farm permit. An instruction permit allows the teen to drive as long as another licensed driver older than 21 years of age is sitting in the passenger seat. A farm permit allows the teen to drive to and from any farm job or farm-related activity.

Teens who turn 15 and have held an instruction permit for a year can apply for a restricted license, which comes with the requirement of a driver’s education course and 25 hours of supervised driving. They must also have the permission of their parents.

Because an SR-22 designates the policyholder as high-risk, their insurance premium goes up while it’s on file with the state.

Knowing and obeying the driving laws in Kansas becomes even more important when you’ve already had a motor vehicle violation conviction. You don’t want to risk losing your driver’s license permanently. Need Kansas sr-22 insurance quotes? Enter your ZIP code below to find cheap SR-22 insurance in Kansas, so you can get back on the road.

Frequently Asked Questions: Kansas SR-22 Insurance

Below are some SR-22 FAQs regarding the SR-22 process in Kansas.

#1 – What does Kansas SR-22 insurance cover?

The SR-22 form provides proof that you’ve met the Kansas minimum required car insurance coverage, which includes bodily injury and property liability coverage.

#2 – Do I need Kansas SR-22 insurance if I don’t own a car?

A court can require that you need an SR-22 even if you don’t own a car. Their assumption is that you could just as easily borrow someone else’s car, in which case you’ll still be driving.

Be aware that these so-called non-owner SR-22s often take a backseat to the car owner’s insurance policy. So if you’re driving your friend’s car and you have an accident, payment for any damage will fall to your friend and their insurance.

For the sake of your friendship, it’s probably a good idea to get non-owner SR-22 insurance. Kansas is a big state, but it might not be big enough if your friend gets angry about their insurance rates going up because of the accident you caused. How much is a non-owner SR-22 insurance policy? That depends on your driving record. Check out Kansas non-owner sr-22 online insurance quotes to find out.

#3 – What happens when you ignore an SR-22?

If you choose not to meet Kansas’ minimum driving and liability insurance requirements, including filing an SR-22, or if you allow your coverage to lapse at any time, you could face further legal action.

#4 – What happens with my SR-22 if I move out of state?

If you move out of state within the one-year time frame that you require an SR-22, you’ll need to take action. Your new state motor vehicle department will be notified, and you must submit a new SR-22 form.

#5 – What if I move to a state that doesn’t require an SR-22?

You’re still obligated by law to meet minimum SR-22 requirements in the state where your driving infraction occurred.

#6 – How do I add my SR-22 to Progressive or another insurance company?

As an existing insurance customer, you can call your current insurance company and ask them to help you with submitting an SR-22 for the state you need it in.

If you don’t currently have insurance, shop online to get quotes and be sure to include small companies as well as the larger ones like Progressive. SR-22 insurance will be more expensive than regular insurance, so you’ll want to get the lowest rates with a company you want to work with.

#7 – How much is a reinstatement fee in Kansas?

The Kansas driver’s license reinstatement fee will cost you anywhere between $100 and $1,000, depending on your driving history.

#8 – How much does Kansas SR-22 insurance cost per month?

High-risk car insurance can cost you an additional $50-$150 per month over and above what you’re currently paying for car insurance. This amount will vary depending on your driving record, other factors, and which insurance company and coverage you choose.

#9 – Do I need to live in a big city in order to get cheap Kansas SR-22 insurance?

You can find out what companies will offer you the best rates by shopping for insurance quotes online, including SR-22 insurance. Wichita, KS, is the largest city in that state, but you don’t need to live there to be able to find the best rate for car insurance.

#10 – What if I need SR-22 insurance in KCMO?

If you need SR-22 insurance in Kansas City, Missouri, most of the general information in this guide applies to you as well. Every state is different, however, so you’ll want to be sure to understand the specifics of the car insurance laws and any additional SR-22 specifics in Missouri.

#11 – Does GEICO provide SR-22 insurance?

Many of the national car insurance companies, such as GEICO, offer SR-22 filing services and high-risk insurance policies. Be sure to shop around for quotes, so you can find the best rate that’s available to you.

#12 – How long does SR-22 stay on insurance?

How long do you have to carry sr-22 insurance in Kansas? Kansas requires that you maintain 12 months of continuous SR-22 insurance, with no lapse in coverage and no additional violations. If any lapse or violation occurs, the 12-month clock resets, and the timing starts all over again.