Iowa SR-22 Insurance

In Iowa, SR-22 car insurance must be carried by drivers who have had their drivers' licenses revoked/suspended for any reason. Use our free tool below to compare rates on Iowa SR-22 insurance.

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Mar 24, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

What is Iowa SR-22 Insurance?

An Iowa SR-22 car insurance form, or a financial responsibility insurance certificate, is a document that serves as proof of your financial responsibility to carry the minimum amount of car insurance required by law.

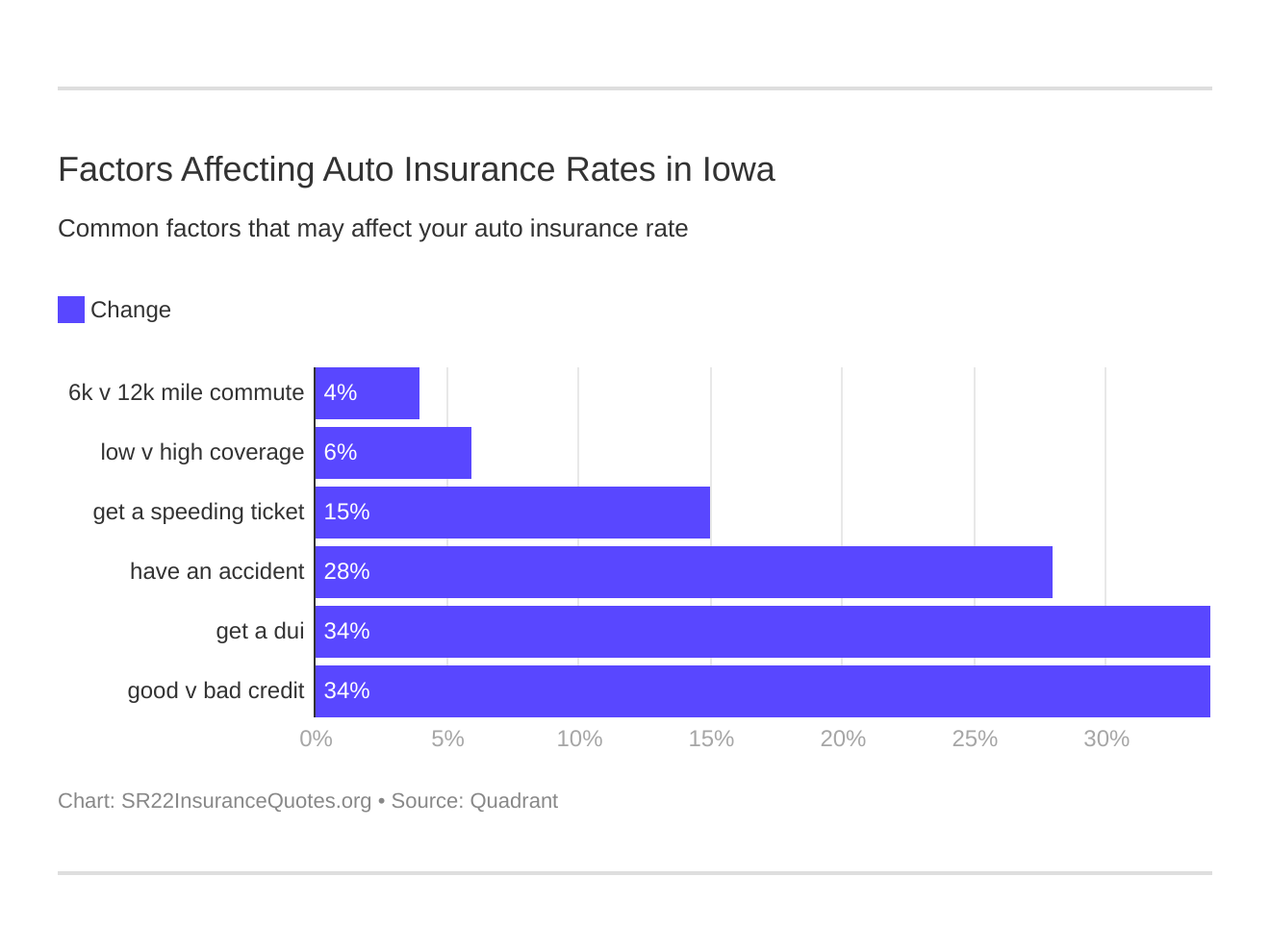

Six major factors affect car insurance rates in Iowa. Which auto insurance factors will impact the rates for SR-22 insurance in Iowa the most? Typically, that’s an IA DUI.

Who needs Iowa SR-22 Insurance?

In Iowa, SR-22 car insurance must be carried by drivers who have had their drivers’ licenses revoked/suspended due to driving or being in an accident while uninsured and failing to pay compensatory damages; drivers with unsatisfied judgments; drivers whose licenses were revoked for other reasons; drivers with DUI convictions on their driving record; and drivers convicted of six or more moving violations or who have accumulated six or more demerits within a two-year period.

Are there different types of Iowa SR-22 Forms?

Motorists can file one of three types of Iowa SR-22 auto insurance forms. An Operator’s Certificate covers financial responsibility for motorists who operate but do not own a vehicle. An Owner’s Certificate covers financial responsibility for drivers who own and operate a vehicle. An Operator’s-Owner’s Certificate covers financial responsibility for vehicles a motorist owns or does not own.

Is SR-22 Car Insurance required in Iowa?

Drivers in the state of Iowa must carry at least liability insurance or file a SR-22 form with the Iowa Department of Transportation. Failure to file an Iowa SR-22 auto insurance form results in a $500 fine and suspension of your license and registration if you are ever stopped by an officer during an accident or routine traffic stop. Reinstatement of your registration and license may require payment of a fee.

How do I file an Iowa SR-22 Insurance Form?

Your auto insurer, upon your request, files an Iowa SR-22 car insurance form with the Office of Driver Services of the Iowa Department of Transportation. You may be charged a processing fee. You can go online here to request a quote from state-authorized agencies in your area. Once you receive your SR-22 insurance in Iowa, you must maintain it for two years. If you fail to renew your Iowa SR-22 car insurance before it lapses, your insurer is required by law to notify the state of Iowa and your driver’s license will be suspended.

What is the cost of Iowa SR-22 Insurance?

On average, drivers in Iowa pay 9 percent more for high-risk insurance than safe drivers, with an average premium of $354 for a year of coverage. In addition, the filing fee for an SR-22 ranges from $15 to $25 depending on the provider. However, there are ways to find cheap SR-22 insurance if you compare rates. After two years, you no longer need SR-22 insurance in Iowa if you maintain a safe driving record. Whatever reason you were ordered to get an SR-22 Iowa certificate in the first place, it is going to be the driving factor behind your rising insurance costs.

Iowa SR-22 Insurance: The Bottom Line

When an auto insurance company receives your SR-22 request, it will provide the proof of insurance form to the state Department of Transportation on your behalf. Some insurance companies do not write SR-22 insurance policies. Others will increase your auto insurance premiums if you get a violation that requires an Iowa SR-22.

The SR-22 Iowa form serves as proof that you have at least the minimum insurance requirements of legal Iowa insurance coverage, which includes: $20,000 per person for bodily injury liability and $40,000 per accident for bodily injury liability.