South Dakota SR-22 Insurance

South Dakota SR-22 insurance can be required if you drive uninsured or have a DUI. SR-22 insurance in South Dakota with a DUI will cost you about $400/mo. An SR-22 filing in South Dakota is done by an insurance company to comply with South Dakota SR-22 laws.

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rachael Brennan

Licensed Auto Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health in...

Licensed Auto Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

- SR-22 insurance in South Dakota can be required in certain situations.

- Failure to maintain financial responsibility in South Dakota can result in an SR-22.

- South Dakota SR-22 insurance rates are much higher than normal.

- You may have to pay fees to file for your SR-22 insurance in South Dakota.

What is SR-22 insurance, and what are the South Dakota SR-22 laws? In the state of South Dakota, the SR-22 car insurance certificate, or financial responsibility insurance form, is a document of proof that a driver is financially responsible for carrying the minimum car insurance as required by the state. SR-22 insurance in South Dakota could be mandatory if you meet certain requirements, such as driving without insurance.

The best way to find the lowest priced South Dakota SR-22 insurance is to compare quotes from multiple companies. Enter your ZIP code to get quotes for SR-22 insurance coverage in South Dakota.

South Dakota SR-22 Insurance

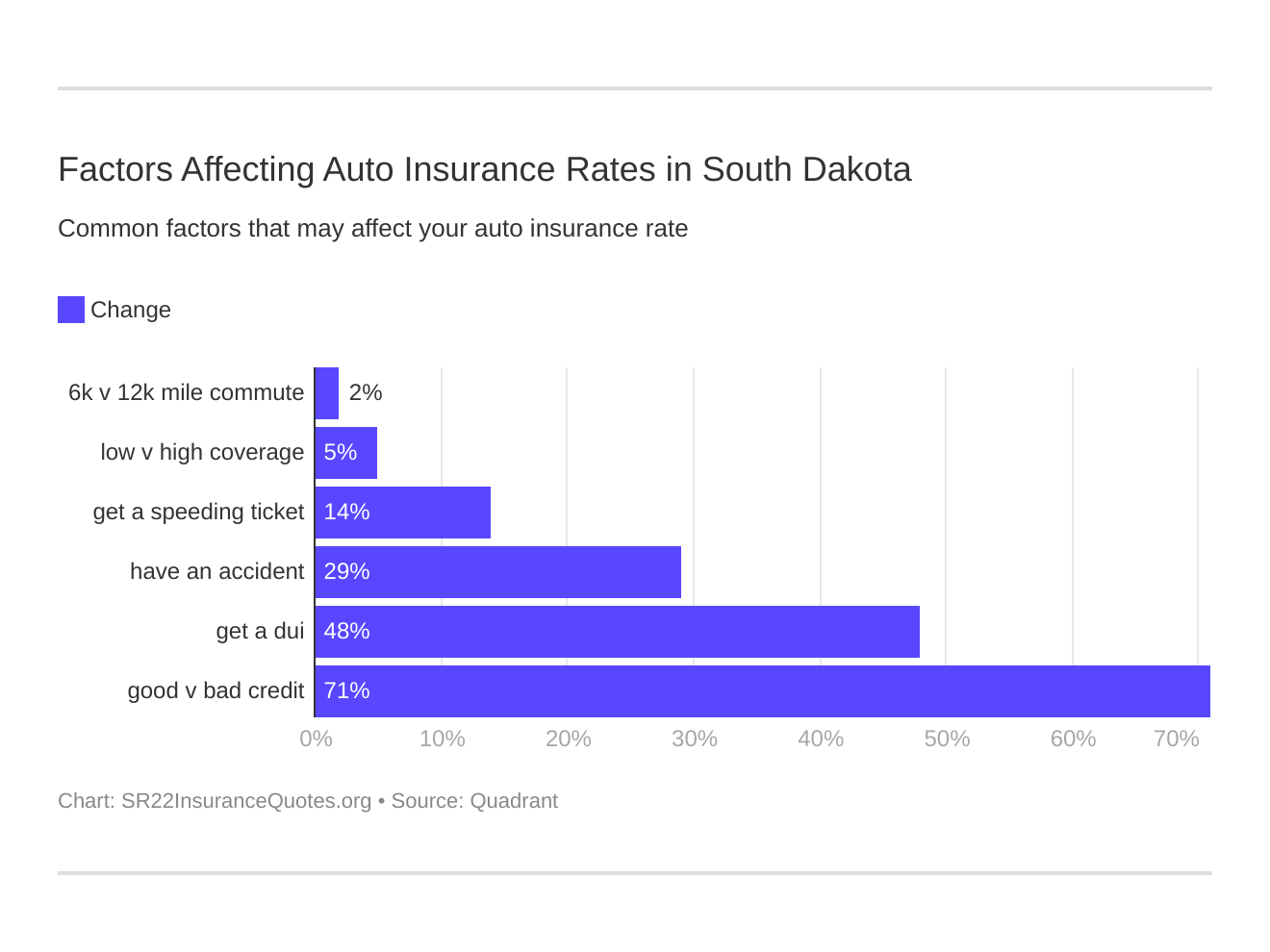

An SR-22 requirement is the state’s way of being certain that high-risk drivers maintain their coverage. However, high-risk behaviors will cost drivers big time. The average cost of SR-22 insurance will vary depending on many factors. Six major factors affect coverage rates in South Dakota. A DUI is among the main auto insurance factors that will affect South Dakota SR-22 insurance rates the most.

Let’s look at how a DUI affects South Dakota SR-22 insurance costs. This table displays how insurance rates will increase based on your driving history.

South Dakota Average Annual Car Insurance Rates Based on Driving Record| Companies | Average Annual Rates with a Clean Record | Average Annual Rates with 1 Speeding Ticket | Average Annual Rates with 1 Accident | Average Annual Rates with 1 DUI |

|---|---|---|---|---|

| Geico | $1,844.41 | $1,844.41 | $3,122.25 | $4,892.57 |

| Nationwide | $1,969.85 | $2,286.53 | $2,734.85 | $3,916.68 |

| State Farm | $2,153.28 | $2,297.20 | $2,441.12 | $2,297.20 |

| American Family | $2,936.19 | $3,360.82 | $4,319.26 | $5,566.74 |

| Farmers | $3,199.03 | $3,826.05 | $4,042.76 | $3,943.83 |

| Progressive | $3,224.37 | $3,885.70 | $4,361.30 | $3,478.27 |

| Allstate | $3,910.81 | $4,378.82 | $4,544.34 | $6,045.15 |

| Liberty Mutual | $6,315.12 | $7,659.25 | $7,827.02 | $8,145.94 |

The monthly average for a South Dakota driver with a clean driving record is $266, but one DUI jumps the monthly average to $398.

Your driving record isn’t the only thing that influences your car insurance rates. The following video further explains what companies look at to calculate your rates.

Improving your credit score and driving safely are two factors that you can work on to improve your auto insurance rates.

Who Needs SR-22 Car Insurance in South Dakota

In South Dakota, SR-22 car insurance must be carried by:

- Uninsured drivers who caused an accident that resulted in damages or injuries for which they failed to pay compensation.

- Drivers with unsatisfied judgments.

- Drivers whose licenses were revoked.

- Drivers who are under mandatory insurance supervision.

- Drivers with three or more mandatory insurance violation convictions on their driving record.

According to the South Dakota DMV, SR-22 insurance must be carried for three years. Failure to maintain SR-22 insurance will result in the suspension of your driver’s license, vehicle registration, and license plates.

If your driver’s license has been suspended, you may qualify for a South Dakota hardship license. This would allow you certain driving privileges, such as driving to work.

Different Types of South Dakota SR-22 Auto Insurance Forms

There are three types of South Dakota SR-22 forms a driver can file. Drivers who operate but do not own a vehicle should file an Operator SR-22 insurance form. This would be for drivers who routinely borrow a car from friends or family. Drivers who own and operate a vehicle should file an Owner SR-22 car insurance form. Finally, an Operator’s-Owner SR-22 auto insurance form should be filed to cover all vehicles that are owned or not owned by a driver. Drivers who have multiple cars would need this type of form.

SR-22 Car Insurance is Required in South Dakota

Motorists in SD must carry liability insurance or file a South Dakota SR-22 car insurance form with the state. Failure to do so can result in a $500 fine and suspension of your driver’s license and registration if you are stopped by a police officer during a traffic stop or accident.

According to the Insurance Information Institute, uninsured drivers made up about 13 percent of all drivers on the road in 2015. During that same timeframe, South Dakota only had about seven percent of drivers that were uninsured.

Driving uninsured is very risky. Not only can you face fines and suspension, but you will also be responsible for any damage that you cause in an accident. That can quickly add up to thousands of dollars in fees.

Filing a South Dakota SR-22 Car Insurance Form

South Dakota SR-22 insurance filing is done by your insurer, who files with the South Dakota Secretary of State. You will be charged a processing fee, which varies among agencies. You can request a quote from insurance agencies in your area.

The South Dakota SR-22 car insurance form will be filed with the Secretary of State within 30 days. If accepted, your insurer will send you the SR-22 auto insurance form along with a letter from the Secretary of State. You must maintain an SR-22 insurance filing for three years and renew at least 45 days before the expiration date.

Your insurer is required to notify the State if the SR-22 insurance form is not renewed at least 15 days before expiration, and your driving record may be suspended until your South Dakota SR-22 car insurance form is reinstated.

South Dakota SR-22 Insurance: The Bottom Line

While SR-22 certificates are often associated with drunk driving, the SR-22 form in South Dakota sounds complex, but it isn’t too bad.

If an SR-22 certificate is required in order for you to get car insurance in South Dakota, you’re not alone. This relatively common insurance requirement is sometimes necessary after a driving citation, like a DUI/DWI, a ticket for driving without proof of insurance, an at-fault accident, a ticket for driving with a suspended license, or accumulating too many points on your license.

Even though it’s minimal, SR-22 insurance in South Dakota can be expensive. Auto insurance companies charge high-risk drivers more expensive rates to account for the increased risk of having to pay out a claim after a crash.

Since many companies offer the SR-22 form, compare quotes to get the best South Dakota SR-22 insurance price. Enter your ZIP now to look for the cheapest SR-22 insurance in South Dakota.