Arkansas SR-22 Insurance

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: May 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

What is Arkansas SR-22 Car Insurance?

Arkansas SR-22 insurance is a form that proves financial responsibility for either a vehicle owner or someone driving a vehicle in the State of Arkansas. For motorists who file an Arkansas SR-22 insurance form, it is an important piece of documentation proving that they hold continuous liability coverage in the event of an accident. An insurance company, on behalf of the motorist with the Arkansas Department of Motor Vehicles and the State of Arkansas, will file this form.

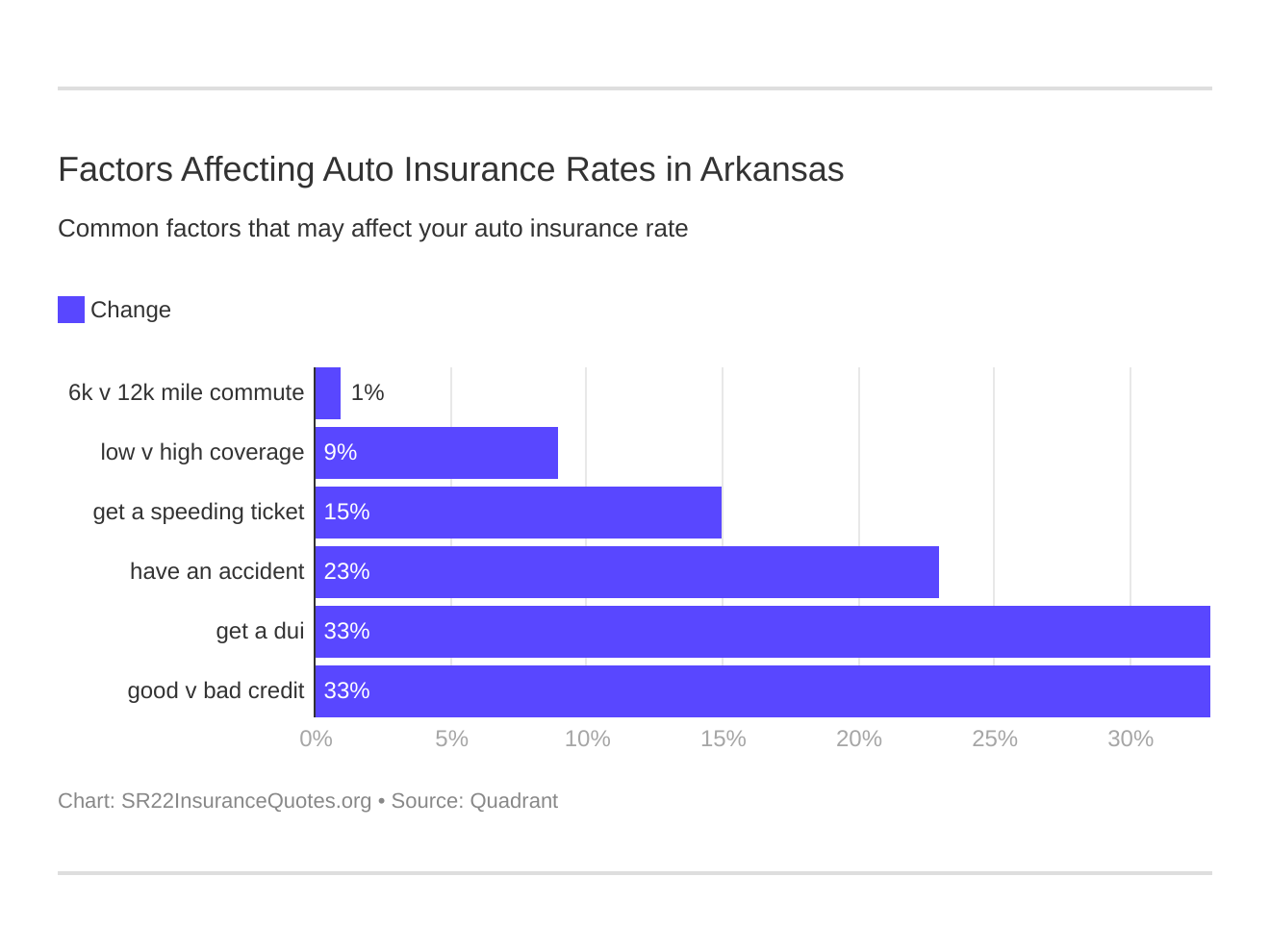

Six major factors affect car insurance rates in Arkansas. Which auto insurance factors will affect SR-22 rates the most? Typically that’s a AR DUI.

Who Needs SR-22 Car Insurance in Arkansas?

Motorists who are considered “high risk” need to file an Arkansas SR-22 auto insurance form. Such motorists are those who would have DUIs, multiple speeding infractions, reckless driving or have been found to have inferior driving skills. Additionally, those who have any safety responsibility or unsatisfied judgment suspensions, or those who have revocations of license will also need Arkansas SR-22 insurance. As well, motorists who have had their licenses revoked or any insurance suspensions will need this insurance, also.

Are There Different Types of Arkansas SR-22 Forms?

Yes. In the State of Arkansas, there is first the Owner’s Certificate, which is coverage for those who do own vehicles. Also, there is the Operator’s Certificate, which would cover those who do not own a vehicle.

Is SR-22 Car Insurance Required in Arkansas?

Arkansas State Law mandates that all drivers carry at least $25,000 worth of liability coverage in the event of an accident that injures or causes the death of one person, $50,000 for two, and $25,000 for property damage. For those who have any of the above conditions, obtaining the Arkansas SR-22 insurance form would be required for a minimum of 36 months, but may be required for the maximum of 5 years. If no violations occur during that time frame, the requirement may be removed.

How Do I File an Arkansas SR-22 Car Insurance Form?

Those who need to file will want to look for an insurance carrier that is authorized by the State of Arkansas to obtain an SR-22 filing. Though there may be a small fee for this, it will often vary from carrier to carrier. Many times this fee is included in the first premium. Fill out the form here to obtain an Arkansas SR-22 auto insurance quote today!