California SR-22 Insurance

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: May 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

What Is SR-22 Car Insurance in CA?

SR-22 car insurance forms are documents, obtained through insurance providers and filed with the California Department of Motor Vehicles, that provide proof of insurance for motorists who are considered to be at-risk for driving uninsured and/or for being unsafe drivers. A California SR-22 form is not the same thing as the proof-of-insurance documentation provided by insurance companies, though it does serve a similar purpose. California SR-22 forms allow the state of California to monitor insurance policies to ensure that at-risk drivers do not allow their insurance to lapse while continuing to drive. Even those motorists who do not currently own a vehicle must carry state-mandated liability coverage, verified by means of an SR-22 filing. The minimum insurance requirements for California (which should be reflected in the California SR-22 filing) are $15k in personal liability per person injured by the insured motorist with a maximum of $30k in personal liability coverage for a single accident and $5k in property damage liability coverage.

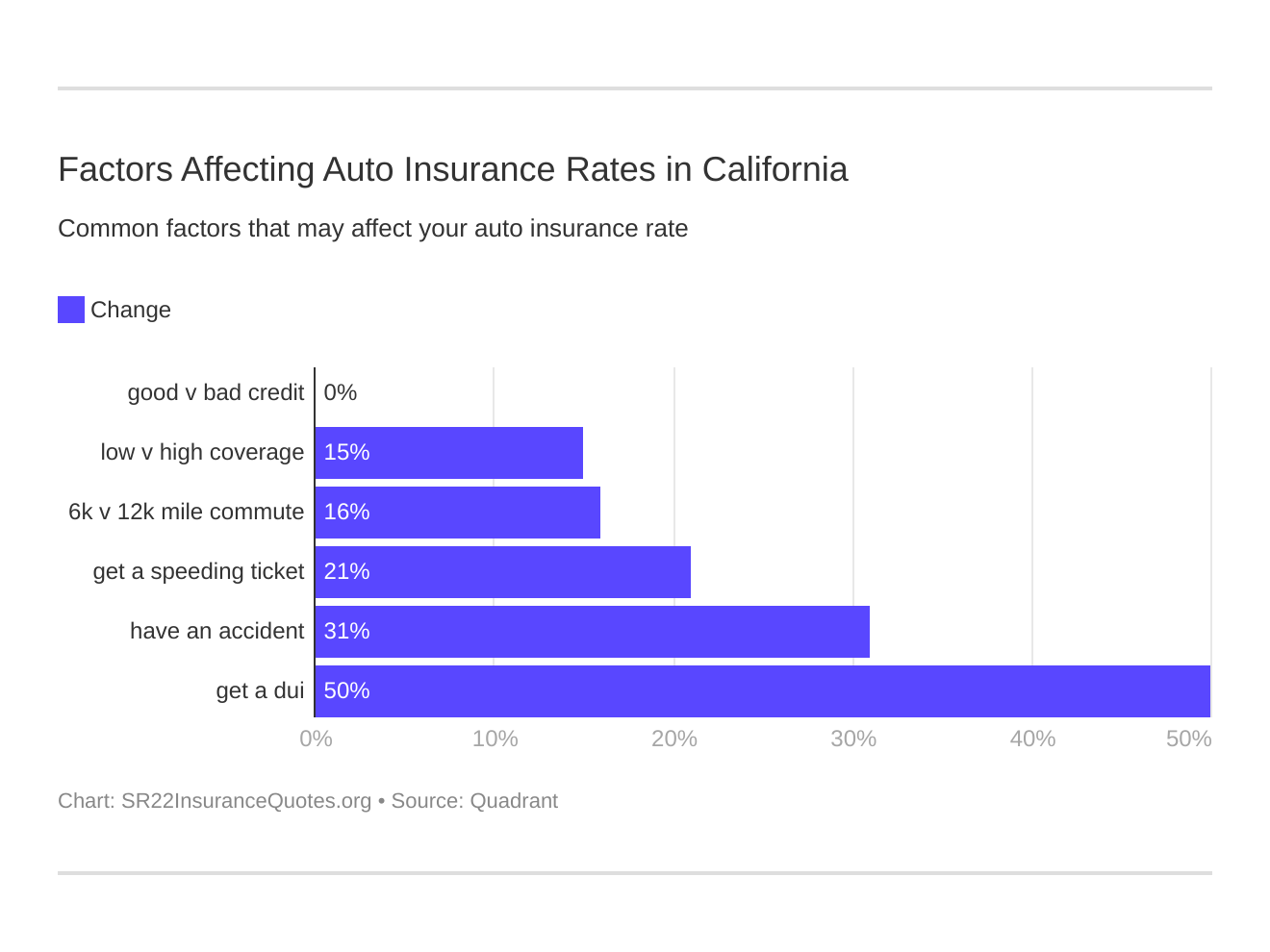

Six major factors affect car insurance rates in California. Which auto insurance factors will affect SR-22 rates the most? Typically that’s a CA DUI but it could be affected by road violations, tickets, and other infractions that add up. Some states have banned discrimination based on your credit score when it comes to auto insurance rates, and this is one of those States.

Who Needs California SR-22 Insurance?

Motorists who are considered “high risk” by way of either different types of moving violations or having had a driving while intoxicated conviction. Drivers who have had their licenses revoked or suspended, or who are facing unsatisfied judgments as well as those with too many points on their licenses may need California SR-22 auto insurance forms filed.

Are There Different Types of California SR-22 Insurance Forms?

There are three types of California SR-22 car insurance. Owners’ Policy Certificates are used to demonstrate that a motorist carry the required insurance for the vehicles they own. Operators’ Policy Certificates guarantee that motorists carry policies that cover any vehicles they operate. Motorists may also file Broad Coverage Policy Certificates, indicating coverage for their owned vehicles and any other vehicles operated by the insured.

Is SR-22 Insurance Required in California?

Motorists who have had their licenses revoked or restricted must file SR-22 car insurance forms. Those convicted of Driving Under the Influence must also file California SR-22 car insurance forms. Motorists who lose their licenses due to unsatisfied judgment suspensions or safety responsibility suspensions must also file SR-22 forms before having their licenses reinstated. SR-22 forms must be filed for at least 3 years.

How Do I File a California SR-22 Form?

California SR-22 car insurance forms must be filed with the California Department of Motor Vehicles. Only California DMV-authorized insurance providers can file California SR-22 car insurance forms with the California DMV. The processing fee for filing a California SR-22 car insurance form differs from one insurer to the next and may vary depending on what type of SR-22 form is being filed. To get the best rates on California SR-22 auto insurance filing fees, enter your information here.