Maryland SR-22 Insurance

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: May 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

What is Maryland SR-22 Insurance

Maryland SR-22 car insurance certificate, or financial responsibility insurance form, is a document a driver carries in his vehicle as proof that he is financially responsible for carrying the minimum amount of car insurance as required by law.

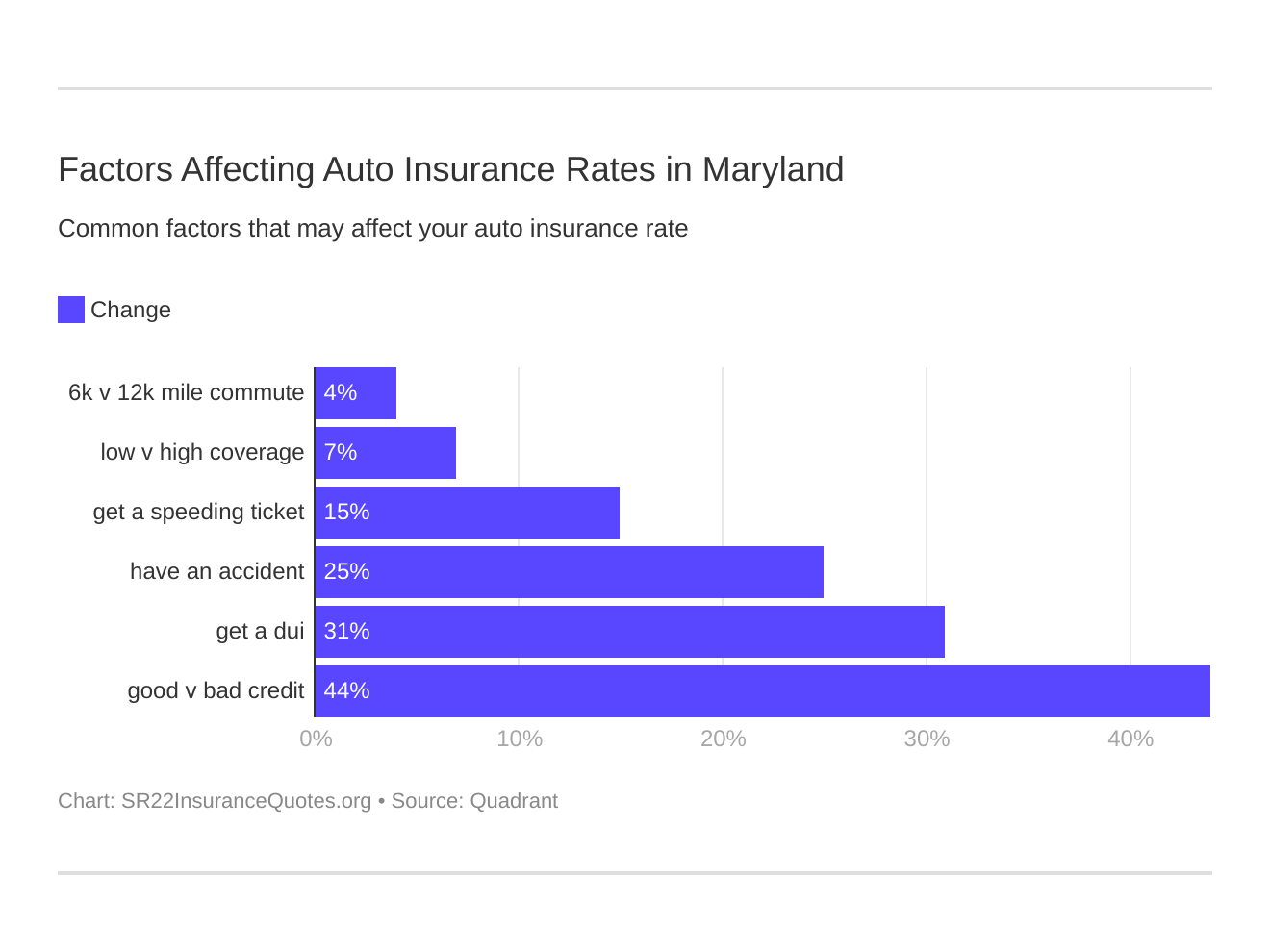

Six major factors affect car insurance rates in Maryland. Which auto insurance factors will affect SR-22 rates the most? Typically that’s a MD DUI.

Who Needs SR-22 Car Insurance?

In the state of Maryland, SR-22 car insurance must be carried by motorists who were involved in an accident and was uninsured at the time and failed to pay compensatory damages; drivers with unsatisfied judgments; drivers whose licenses were revoked for other reasons; or drivers with three or more mandatory insurance violation convictions.

Are There Different Types of SR-22 Forms?

There are three types of SR-22 car insurance: Operator, Owner and Operator-Owner. An Operator SR-22 form covers drivers who operate but do not own a car. An Owner SR-22 form covers drivers who own and operate a car. An Operator’s-Owner SR-22 form covers all vehicles owned or not owned by the driver.

Is SR-22 Car Insurance Required in Maryland?

The state of Maryland does not require motorists to file a SR-22. Drivers who are required to file a SR-22 in another state should continue to do so. Suspension of your driver’s license in another state could result in losing your driving privileges in the state of Maryland.

How Do I File a MD SR-22 Car Insurance Form?

You can ask your insurer to file an SR-22 with the state requiring the SR22. Your insurer will charge a processing fee, which can vary among agencies. You can go (here) to request a quote from state-authorized agencies in your area. Upon acceptance of the SR22, your insurer will send you the SR-22 form. The SR-22 must be maintained for one to three years, depending on the insurer, and renewed in a timely manner. If you fail to renew your SR22, the insurer is required by law to notify the State and your driving record will be suspended until the SR-22 is reinstated.