Nevada SR-22 Insurance

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rachael Brennan

Licensed Auto Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health in...

Licensed Auto Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

What is Nevada SR-22 Insurance?

Nevada SR-22 car insurance is used to help protect motorists against uninsured drivers by making sure that certain motorists are carrying continuous and adequate amounts of liability coverage. The state does require that insurance carriers file the form to act as proof that a driver remains financially accountable in the event of an accident.

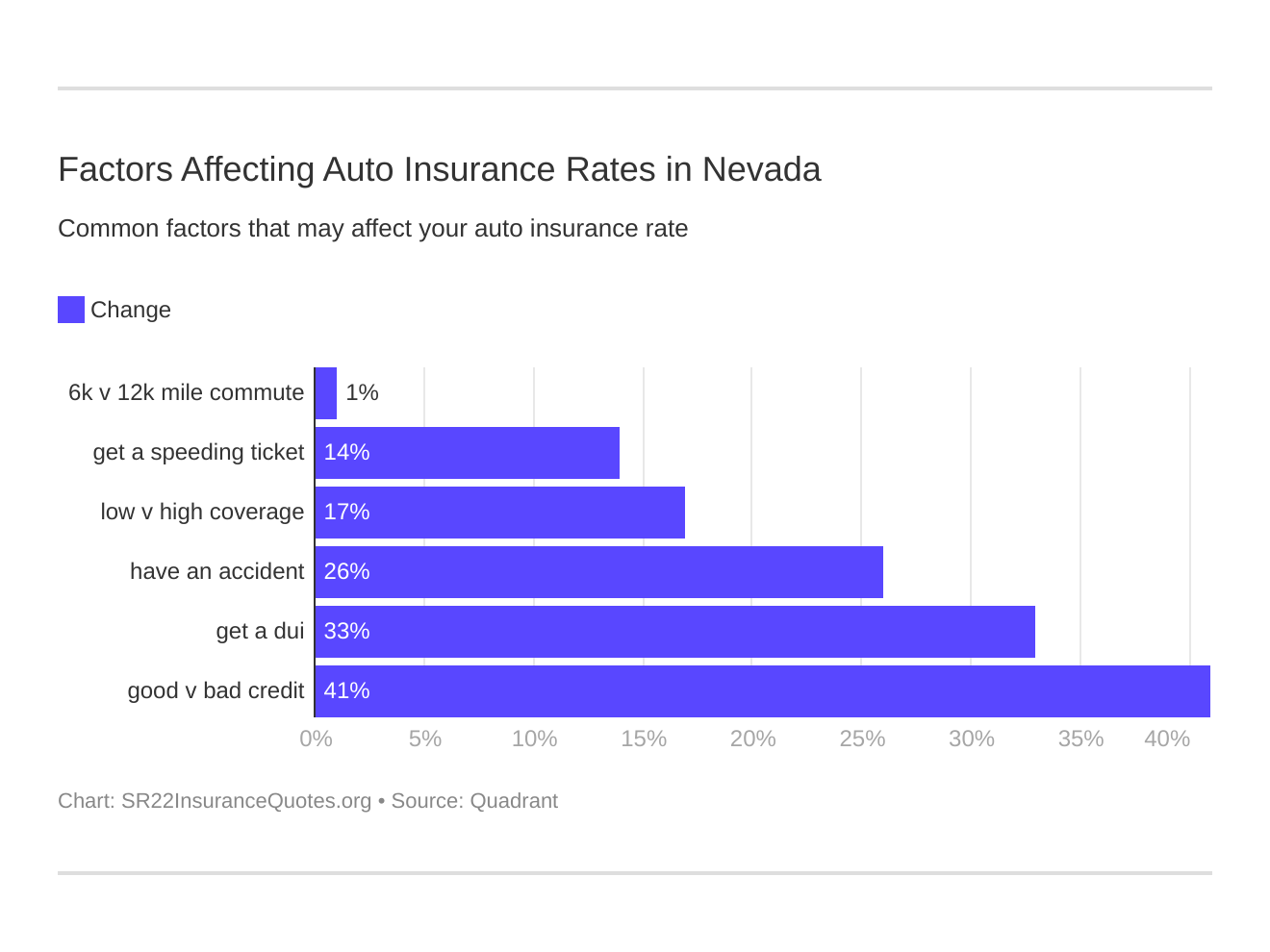

Six major factors affect car insurance rates in Nevada. Which auto insurance factors will affect SR-22 rates the most? Typically that’s a NV DUI arrest.

Who Needs SR-22 Insurance in Nevada?

Those who have any safety responsibility violations will need to file an SR-22 in the State of Nevada. This means that if a motorist has been involved in an accident but did not have insurance and did not pay the required compensation, they will need to file. Also, those who have had their licenses revoked and wish to have it reinstated will need to file a Nevada SR-22 insurance form, as well as those with unsatisfied judgment suspensions.

Are There Different Types of Nevada SR-22 Forms?

The State of Nevada recognizes three certificates in terms of SR-22 forms. The first of these is the Owner’s Certificate, used in the event that the motorist does own a vehicle, the second is the Operator’s Certificate, which would be used when a motorist drives but does not own a vehicle. An Owner-Operator Certificate may be used for motorists who drive both vehicles that do and do not belong to them.

Is SR-22 Car Insurance Required in NV?

Yes. In Nevada, SR-22 auto insurance is required in accordance to Nevada State Law requiring 15/30/10 liability coverage. Additionally, this coverage needs to be maintained for a minimum of 36 months. Failure to maintain coverage will result in the insurer notifying the Department of Motor Vehicles that coverage has lapsed and this may result in penalties.

How Do I File a Nevada SR-22 Car Insurance Form?

Customers that need to file a Nevada SR-22 auto insurance form would want to contact an insurance carrier that is authorized in the State of Nevada. The insurance agency may apply the fee for this to the insurance premium, and this fee will vary between companies. Upon receipt of the request, it may take up to 30 days for the central office to send the form on to the Department of Motor Vehicles. Get your Nevada SR-22 insurance quote quickly; fill in your information to find out more!