Michigan SR-22 Insurance for 2025

Michigan SR-22 insurance is specifically for high-risk drivers. SR-22 insurance in Michigan can cost as much as 40% higher than the state average. Speeding, reckless driving, racing, and DUI are some of the reasons you might be required to obtain an SR-22 in Michigan.

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Mar 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Do you need SR-22 car insurance in Michigan? Are you looking for cheap insurance in Michigan? Whether you are purchasing your first policy or renewing an old one, finding the right car insurance company for you can be a hassle, especially if you are required to carry Michigan SR-22 insurance.

What is SR-22 insurance? What factors affect SR-22 insurance cost? How much coverage do you need? Which company offers the cheapest insurance in Michigan? How does SR-22 insurance in Michigan work?

You can find the answers to all of these questions and more right here on this page. We hope to make finding the right Michigan car insurance policy for you as simple as possible.

How much is SR-22 insurance in Michigan? Whether you need an SR-22 or are just looking to save money, we can help. Start comparison shopping for affordable Michigan SR-22 auto insurance today using our free online tool. Enter your ZIP code to get started.

- Insurance quotes in Michigan for SR-22 insurance are even more expensive than the state average of $84.15/month or $1,009.38/year since it’s required for high-risk drivers

- Michigan SR-22 insurance may raise your rates by up to 40 percent

- A DUI in Michigan is the most likely reason you’ll be required to obtain an SR-22, but other reasons include speeding, reckless driving, racing, and fleeing the scene of an accident

What is Michigan SR-22 insurance?

Let’s begin by taking a look at SR-22 insurance in the Wolverine State.

A Michigan SR-22 auto insurance form, also called a financial responsibility insurance certificate, is proof of your financial responsibility to carry the minimum car insurance required by the state.

Keep scrolling to find out who may be required to carry SR-22 car insurance and everything you need to know to find the best policy for you.

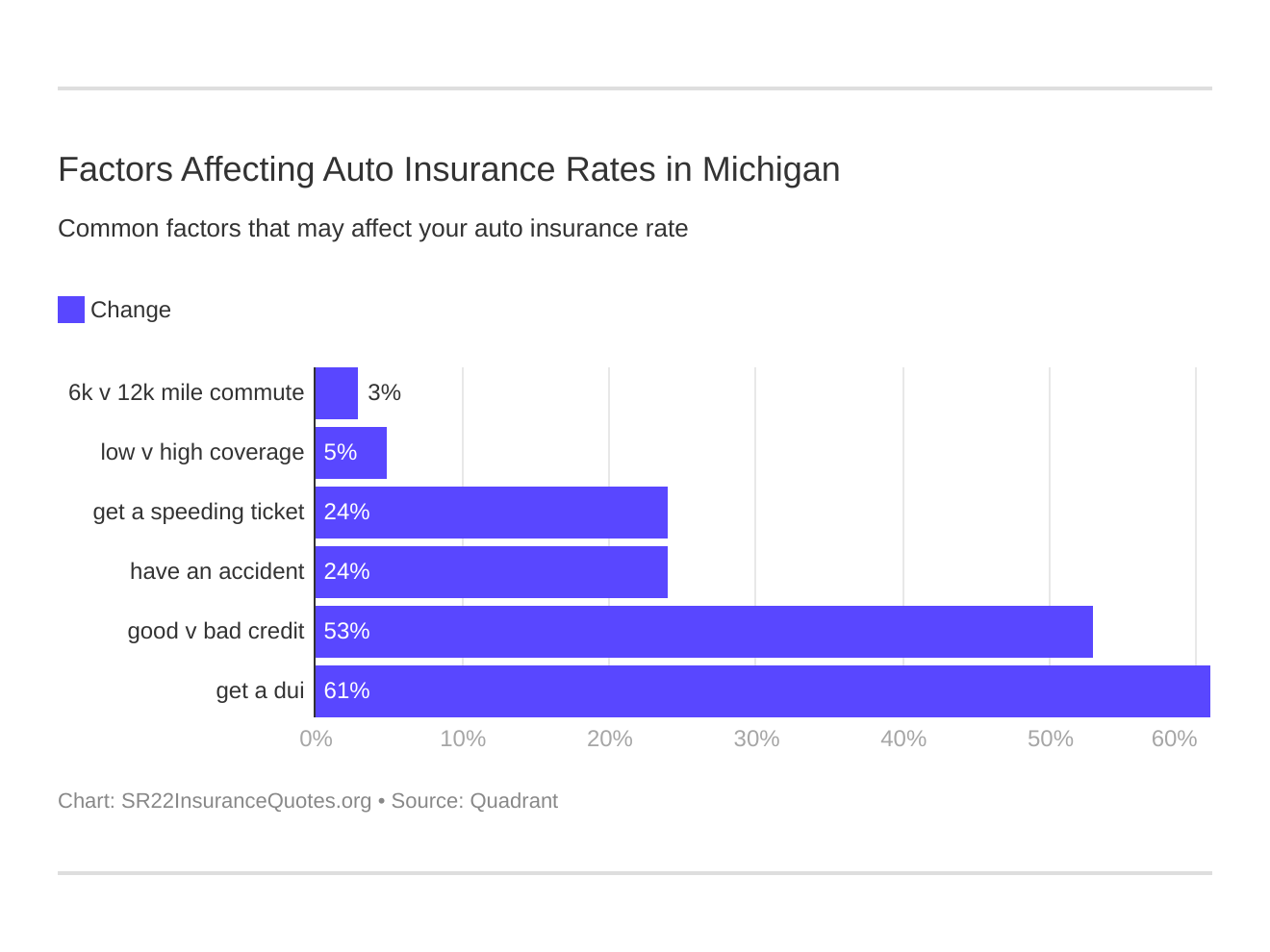

Six major factors affect car insurance rates in Michigan. Take a look at this chart for more.

Which auto insurance factors will impact SR-22 rates the most? Typically, that’s a Michigan DUI conviction.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

Does Michigan require an SR-22?

Why might you be required to purchase Michigan SR22 Insurance? There are several reasons why the state may require you to carry this type of insurance. Some of those reasons include:

- At Fault Collision – If you are involved in an accident that is ruled to be your fault, you may be required to maintain SR-22 insurance for a specified period of time

- Speeding – If you are convicted of speeding in the Wolverine State while driving over 20 miles over the posted speed limit, you may be required to carry SR-22 insurance for a specified period of time

- Reckless Driving – If you are convicted of reckless driving, you may be required to carry SR-22 insurance for a specific period of time, along with fines and court costs

- Racing – Similar to speeding, racing in unauthorized areas may result in a judge ordering you to purchase an SR-22 policy as a high-risk driver

- Leaving the Scene – If you leave the scene of an accident, a judge may order you to carry SR-22 insurance as a high-risk driver for a period designated by the court

- DUI – Driving under the influence is ne of the most common causes of the SR-22 requirement. Drinking and driving will result in mandatory SR-22 insurance along with other fines and punishments

- Excessive Points on Driving Record – If you receive enough traffic violations and accumulate a certain amount of points on your driving record, the court may order you to purchase SR-22 insurance as a high-risk driver

SR-22 car insurance is usually mandated after an offense that results in the suspension of your license, such as a DUI, point accumulation, or at-fault collision. It is a requirement to reinstate your license. The court may also issue other requirements, as well, before your license may be reinstated, depending on the nature of the violation.

You will have to file your SR-22 insurance with the Michigan DMV to receive a temporary license or have your license reinstated.

The cost of SR-22 insurance can be high, so it’s always best to look around and compare prices for the best prices.

Read more: SR-22 Insurance State Guide

Are there different types of Michigan SR-22 insurance forms?

You might be wondering if there are different SR-22 forms in Michigan and how to know which one you need. There are actually three different types of Michigan SR-22 insurance coverage:

- Operator’s SR-22 Insurance – Covers financial responsibility for drivers who operate but do not own a vehicle

- Owner’s SR-22 Insurance – Covers financial responsibility for drivers who own and operate a vehicle

- Operator’s-Owner’s Certificate Insurance – Covers financial responsibility for all vehicles a driver owns or does not own, also called non-owner SR-22 insurance

The type of SR-22 car insurance you need depends on your circumstances and whether or not you own a motor vehicle.

Is Michigan SR-22 insurance required?

Michigan only requires SR-22 car insurance if your driver’s license was suspended or revoked due to any reasons listed above or for being involved in an automobile accident while uninsured.

Drivers with unsatisfied judgments or more than seven points on their driving records must also carry SR-22 insurance in the Wolverine State.

The length of time that you must carry SR-22 insurance depends on the nature of the violation.

If you are not considered a high-risk driver, you are only required to carry the minimum liability coverage set by the state, which we will discuss later in this article.

If you are moving to or away from Michigan with a suspended or revoked license, you will have a Michigan driver’s license hold. This hold means you will be unable to obtain a driver’s license—with or without SR-22 insurance—until you apply for a Michigan license clearance and appear in court.

What are the limitations of Michigan SR-22 insurance coverage?

Depending on the terms and conditions of the SR-22 insurance policy you have, you may find that it is voided if you are caught using the insured vehicle as a part of a crime.

You may also find that you are limited on the types and amount of coverage you can purchase during the period of time you’re required to maintain an SR-22. Once you’ve met your obligations and you’re no longer required to maintain the SR-22, you’ll have the ability to purchase coverage of varying types and amounts.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

How do I file a Michigan SR-22 insurance form?

Once you have found a company that offers SR-22 insurance and purchased a policy, your insurance company will file the proper SR-22 paperwork with the Michigan Secretary of State. You will be responsible for a processing fee that varies among agencies.

Within two-to-four weeks, you should receive your paperwork in the mail with your new insurance cards from your insurer as well as a letter from the Michigan Secretary of State. SR-22 insurance in the Wolverine State must be maintained for three years.

If you do not make your insurance payments and fail to renew your SR-22 insurance at least 15 days before expiration, your insurance company is obligated to notify the state of Michigan, and your license will be suspended until you provide proof of a valid SR-22 insurance policy.

Now that you know all there is to know about SR-22 insurance in Michigan let’s take a look at some things you might be interested in when it comes to automobile insurance.

Did you know there are multiple ways you could save money on your car insurance policy, including where to find cheap SR-22 insurance?

Keep reading to find out everything you need to know about getting the lowest possible car insurance rates in Michigan.

Michigan Auto Insurance Coverage & Rates

To drive in Michigan, you need insurance. Car insurance laws and rates are constantly changing, but we are here to help keep you in the know.

In Michigan, residents pay an average of $2,476 a year for car insurance, which is much higher than the national average of $1,474. In fact, Michigan residents pay more for car insurance than residents of any other state.

Car insurance rates vary depending on several factors, and it is important to get as much information as you can before purchasing your policy.

How does SR-22 insurance affect your rates in Michigan? You’ll find that coverage rates, if you’re required to obtain an SR-22, can be as much as 40 percent higher than the state average because drivers required to maintain SR-22 coverage are exceptionally high-risk.

Keep reading to learn all you need to know about finding the right car insurance provider for you in the Wolverine State.

How much coverage is required for Michigan minimum coverage?

When it comes to car insurance, Michigan is a no-fault state. This means that, regardless of who is at fault for the accident, drivers must file a claim with their own insurance company instead of filing a liability claim or lawsuit against the other driver.

The law is designed to keep people from being sued and to keep court cases involving automobile crash cases out of the court system. However, you can and probably will still be sued if you are found at fault for a car accident that causes extensive damage to a person and/or property.

The minimum liability amounts that a driver is required to carry by law in the state of Michigan are as follows:

- $20,000 – for bodily injury or death of one person in an accident caused by the owner of the insured vehicle

- $40,000 – for total bodily injury or death in an accident caused by the owner of the insured vehicle

- $10,000 – covers property damage (outside of Michigan)

It may seem silly to have to pay for car insurance in Michigan since you are ultimately the one responsible for filing a claim with your own insurance company and paying for any damages that the company doesn’t cover, no matter who caused the accident.

It may seem like you are paying for insurance for no reason at all and that stings, especially considering that the state of Michigan has some of the highest car insurance rates in the nation.

However, there are still some excellent reasons to obey the law when it comes to carrying liability car insurance in the state of Michigan.

First, you can and most likely will get a ticket and a fine if you are caught driving without auto insurance, and as mentioned above, you can still be sued if you cause an accident.

Liability insurance also helps to protect you if you are involved in a car accident with a driver from another state or if you are driving in another state. While it may seem pointless at first to carry liability car insurance in the Wolverine State, it is always in your best interest to obey the law.

It is important to note that the minimum liability coverage required by the state does not cover any damage done to your vehicle. An insurance policy that would pay to fix damages to your car after an accident would require you to purchase additional coverage. Does SR-22 cover accidents in Michigan? It depends on the type of insurance coverage you have.

Keep scrolling to learn more about what types of insurance are available to you in the Wolverine State.

What are the forms of financial responsibility insurance in Michigan?

Unlike some other states that allow for various ways to prove financial responsibility if you are in a car accident, Michigan has only one.

The only proof of financial responsibility acceptable for driving a motor vehicle in the Wolverine State is a liability car insurance policy.

The only exception to this rule is for those who own a fleet of vehicles, meaning they own 25 automobiles or more. If this is the case, you may apply for self-insurance in Michigan.

What are the core coverages in Michigan?

There are a lot of options when it comes to purchasing car insurance. The three main types of insurance in the state of Michigan are:

- Liability Insurance – the bare minimum required by the state of Michigan, although you may choose higher amounts of coverage than required

- Collision Insurance – coverage that helps pay to repair or replace your car if it’s damaged in an accident with another vehicle or object

- Comprehensive Insurance – coverage that helps pay to replace or repair your vehicle if it’s stolen or damaged in an incident that’s not a collision

These three types of coverage typically make up the three parts of a full coverage insurance policy. This table shows the average rates for each of these coverage types in the Wolverine State and compares them to average national rates.

Average Annual Michigan Auto Insurance Rates by Coverage Type| Coverage Type | Average Annual Rates in Michigan | Average Annual National Rates |

|---|---|---|

| Liability | $795.32 | $538.73 |

| Collision | $413.83 | $322.61 |

| Comprehensive | $154.85 | $148.04 |

| Total | $1,364.00 | $1,009.38 |

As you can see, residents in Michigan pay a lot for their car insurance. The Wolverine State has the most expensive car insurance rates in the nation.

What are the cheapest auto insurance companies in Michigan?

When purchasing a car insurance policy, price is usually a key factor in making that decision. After all, who doesn’t want to save money on car insurance?

When it comes to finding the best deal on your next car insurance policy, we are here to help. Check out this table to see some of the cheapest rates available to you as a Michigan driver.

Auto Insurance Companies With the Cheapest Average Annual Rates in Michigan| Insurance Companies | Average Annual Michigan Rates | +/- Compared to Michigan State Average (rate) | +/- Compared to Michigan State Average (%) |

|---|---|---|---|

| USAA | $3,618.06 | -$6,808.70 | -188.19% |

| Progressive | $5,354.18 | -$5,072.58 | -94.74% |

| Nationwide Mutual | $6,287.43 | -$4,139.33 | -65.84% |

| GEICO | $6,382.54 | -$4,044.22 | -63.36% |

| Farmers | $8,275.23 | -$2,151.53 | -26.00% |

| Travelers | $8,707.10 | -$1,719.67 | -19.75% |

| State Farm | $12,481.81 | $2,055.05 | +16.46% |

| Liberty Mutual | $19,913.09 | $9,486.33 | +47.64% |

| Allstate | $22,821.42 | $12,394.66 | +54.31% |

It’s important to remember that these rates are just general guidelines. Your car insurance policy’s actual price will be determined by multiple factors such as coverage type, driving record, commute time, etc. And Michigan SR-22 auto insurance rates may be higher than average, based on why you’re required to obtain SR-22 insurance in Michigan.

Michigan SR-22 Insurance: The Bottom Line

You may be required to obtain an SR-22 in Michigan for several reasons, including reckless driving, racing, fleeing the scene of an accident, a DUI, and speeding. Rates for SR-22 insurance in Michigan can be as much as 40 percent higher than average rates in the state because of the perceived risk of drivers required to carry an SR-22.

There are three types of SR-22 coverage in Michigan: operator, owner, and operator-owner certificate insurance. The kind of SR-22 coverage you need and the amount of time you’ll be required to carry it will vary depending on your circumstances.

If your auto insurance company offers SR-22 form filings, all you have to do is call them and they’ll take care of it.

Ready to buy Michigan SR-22 auto insurance? What is the cheapest SR-22 insurance? Whether you need an SR-22 or are just shopping around, you can compare Michigan SR-22 insurance quotes today using our free online quote tool. Enter your ZIP code to get started.