New York SR-22 Insurance

In New York SR-22 insurance is not required, but your auto insurance will still go up based on your driving record. You will still need an SR-22 in New York if you move from a state with SR-22 insurance requirements based on your driving history.

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Mar 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

New York SR-22 insurance works differently than in other states. Many states will require SR-22 insurance if a driver has a DUI or has caused an accident without having auto insurance. It is up to each state to decide if SR-22 forms will be required and for what reasons.

In New York, SR-22 forms for insurance are not required unless you move from a state that does require them. Even though you don’t need SR-22 insurance in New York, your car insurance rates are still influenced by your driving.

Since different companies charge different rates, the best way to get cheap insurance is to compare quotes. Enter your ZIP now to get quotes, whether you need basic coverage or SR-22 insurance from out of state.

- SR-22 in New York is not required.

- If you move from a different state with an SR-22 requirement, you will still have to maintain that coverage.

- New York does have minimum car insurance requirements.

- If you don’t carry car insurance in New York, you can be fined and possibly have your driver’s license suspended.

What is SR-22 insurance?

What is SR-22 insurance and what is an SR-22 insurance form? SR-22 actually refers to special auto insurance forms that are typically used in cases of motorists who have had certain serious moving violations like DUI or DWI, lost their license, or are considered high risk by insurers.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

Is New York SR-22 insurance required?

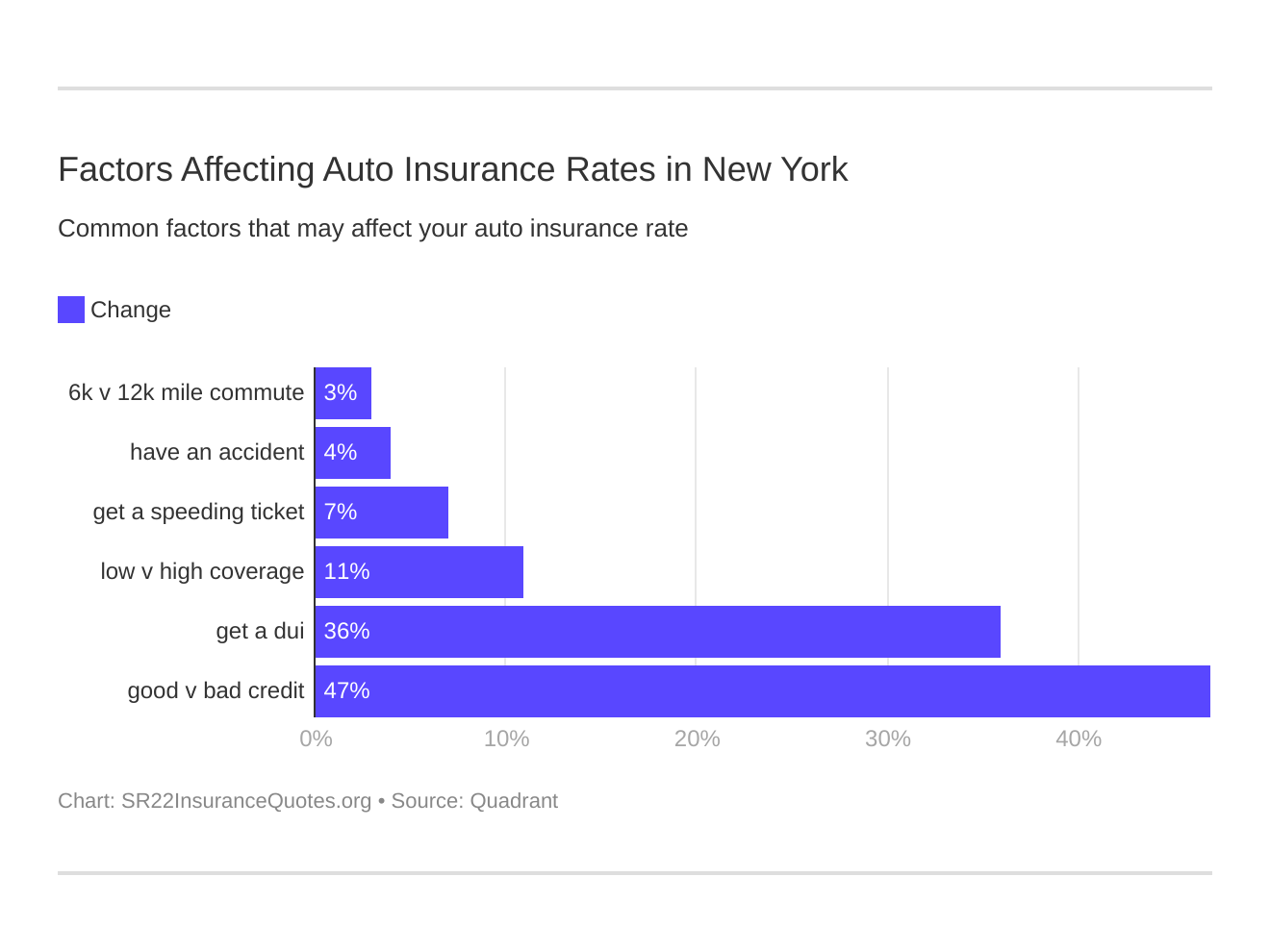

Does New York require SR-22 insurance? In the State of New York, there are no SR-22 insurance requirements, though the state has certain laws about car insurance. If you’re in New York and you’re looking for “cheap SR-22 insurance near me” or “cheapest SR-22 insurance near me”, you might be looking for the wrong thing. Six major factors affect car insurance rates in New York. If you’re wondering which auto insurance factors will impact SR-22 rates the most, it will typically be a DUI.

Let’s look at how a DUI affects New York insurance costs. This table displays how insurance rates will rise based on your driving history.

New York Average Annual Car Insurance Rates Based on Driving History| Companies | Average Annual Rates with a Clean Record | Average Annual Rates with 1 Speeding Ticket | Average Annual Rates with 1 Accident | Average Annual Rates with 1 DUI |

|---|---|---|---|---|

| Geico | $1,894.00 | $1,894.00 | $2,064.88 | $3,860.07 |

| Nationwide | $3,042.44 | $3,113.84 | $3,042.44 | $6,853.01 |

| USAA | $3,348.28 | $3,402.69 | $3,402.69 | $4,893.09 |

| Progressive | $3,664.67 | $3,688.99 | $3,664.67 | $4,066.27 |

| Travelers | $3,901.71 | $4,552.21 | $4,896.91 | $4,964.33 |

| Allstate | $4,004.39 | $5,070.67 | $4,004.39 | $5,884.41 |

| State Farm | $4,267.85 | $4,701.32 | $4,267.85 | $4,701.32 |

| Liberty Mutual | $5,197.79 | $5,197.79 | $5,197.79 | $10,569.55 |

The monthly average for a New York driver with a clean driving record is $305, but one DUI elevates the monthly average to $477. That’s an extra $172 a month, and that rate can skyrocket if you have multiple accidents, tickets, or DUIs.

Although you don’t need an SR-22 in New York, poor driving habits will increase your car insurance rates. Your driving record isn’t the only thing that influences your premium. Watch this video to learn what else companies look at to calculate your rates.

Improving your credit score and driving safely are two factors that you can work on to decrease your auto insurance rates.

Who needs SR-22 insurance in New York?

How does an SR-22 work in New York? If a motorist has lost his or her driver’s license in another state and is required by that state to have an SR-22 insurance form filed in order to reinstate their license, they will need to continue to file with that state.

Before moving, it is always a good idea to check with the state that you are moving to if they have SR-22 auto insurance form requirements.

If they do not, like New York, you will likely still need to file with the state where you formerly resided. How do you get an SR-22 if you need one? If you are from a state that requires an SR-22 form, you can get it through your car insurance company.

Are there different types of New York SR-22 insurance forms?

In the State of New York, no. However, the state in which you have previously filed an SR-22 car insurance form may require you to have certain certificates depending on your status as a driver and if you own your own vehicle or not.

- The Operator’s Certificate is for a person that drives but does not have a vehicle. This would come into play if you borrow a car from a friend or family member. This is also called non-owner SR-22 insurance. If you need SR-22 insurance without a vehicle, non-owner SR-22 would be the right choice for you.

- The Owner’s Certificate is used when a motorist requiring one has a licensed vehicle.

- An Operator-Owner’s Certificate is used when a driver has more than one automobile. An example would be if you have multiple cars in your household and there is a chance you may drive more than one of them.

If you are in a state that requires SR-22 forms, your car insurance company will handle the SR-22 filing for you.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

What does SR-22 stand for?

SR-22 stands for safety responsibility, as you are meeting your minimum car insurance responsibility.

Is a New York SR-22 car insurance form required?

No, however, New York auto insurance is required. You will need to both prove that you have a minimum level of liability auto insurance coverage in order to register your vehicle, and maintain that level of coverage.

These minimums are liability coverage for bodily injury in the amount of either $25,000 per person with a total of $50,000 per accident and $10,000 of property damage coverage per accident. Additionally, you will need to obtain PIP or Personal Injury Protection coverage in the amount of $50,000 as well as 25/50 underinsured/uninsured motorist coverage limits.

Although SR-22 car insurance forms are not required, motorists must still maintain these minimum amounts of car insurance coverage.

Do you need car insurance in New York? Yes, it is illegal to drive with no car insurance in New York according to the New York DMV. The penalty for no car insurance includes a $1,500 fine and possible driver’s license suspension for one year.

The Insurance Information Insititute shows that uninsured drivers made up around 13 percent of drivers nationwide in 2015. However, there were only around six percent of uninsured drivers in New York. This means that most drivers in New York have the coverage they need in case of an accident.

New York SR-22 Insurance: The Bottom Line

Drivers in New York are not required to obtain an SR-22 policy. However, certain drivers pay higher rates for car insurance based on risk. However, the court or state may require you to submit an SR-22 certificate certifying that you have at least the state’s minimum insurance requirements to meet financial responsibility. If this is the case, you can check with the DMV or your auto insurance company to determine the best course of action.

There are many different options for auto insurance in New York. Enter your ZIP to start getting quotes for New York car insurance, no matter your driving record.