Wyoming SR-22 Insurance

Wyoming SR-22 insurance may feel complicated, but there's a way to get affordable rates on SR-22 insurance in Wyoming. Get quotes from the best Wyoming SR-22 insurance companies by using our FREE quote tool.

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rachael Brennan

Licensed Auto Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health in...

Licensed Auto Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

- Wyoming SR-22 insurance is an indication that you’re a high-risk driver, which the auto insurance company reports to local government.

- SR-22 car insurance is required in Wyoming for reinstatement of a driver’s license after a motorist has been convicted of a DUI or other significant driving offense.

- Wyoming requires SR22-insured motorists to carry at least 25/50/20 liability coverage.

If you’ve been convicted of a DUI, or have multiple accidents or unpaid tickets, you may have to enroll in SR-22 insurance in Wyoming. SR-22 insurance is one of the requirements to reinstate a Wyoming driver’s license. Once reinstated, you’ll need to carry Wyoming SR-22 insurance.

What does Wyoming SR-22 insurance cost? The average cost of SR-22 insurance varies by company. However, we’ll help you compare general auto insurance rates per year in the sections below.

Continue reading our Wyoming SR-22 auto insurance guide to learn how you can save money on auto insurance rates. If you’re in the early stages of SR-22 insurance, you can still find insurance in the voluntary market.

Before learning more about SR-22 in Wyoming, enter your ZIP code in the FREE comparison tool above to compare car insurance in your area. Get quotes from the best Wyoming SR-22 insurance companies near you now.

What is Wyoming SR-22 insurance?

Wyoming SR-22 car insurance is required for Wyoming reinstatement of a driver’s license after a motorist has been convicted of a DUI or a similar significant driving offense. SR-22 is a form or certificate that proves that you are financially responsible for carrying the minimum requirements for liability auto insurance coverage required by the state of Wyoming.

According to the Wyoming Department of Transportation (Wyoming DOT or WyDot), drivers who need SR-22 insurance can contact a car insurance company in the state of Wyoming and fill out an SR-22 insurance form. If you can’t find a company that will insure within 60 days, report this to the Wyoming Department of Motor Vehicles (Wyoming DMV).

It’s important that you report to a local DMV.

For example, if you got your license in Lander, you should go to the Lander, WY DMV rather than the DMV in Riverton, WY.

Wyoming SR-22 insurance requirements are auto insurance forms that prove a motorist is carrying at least $25,000 per person in an accident, $50,000 for more than one person injured in an accident, and $20,000 in property damage liability coverage.

The driver’s car insurance policyholder is then responsible for filing and maintaining the SR-22 insurance in Wyoming.

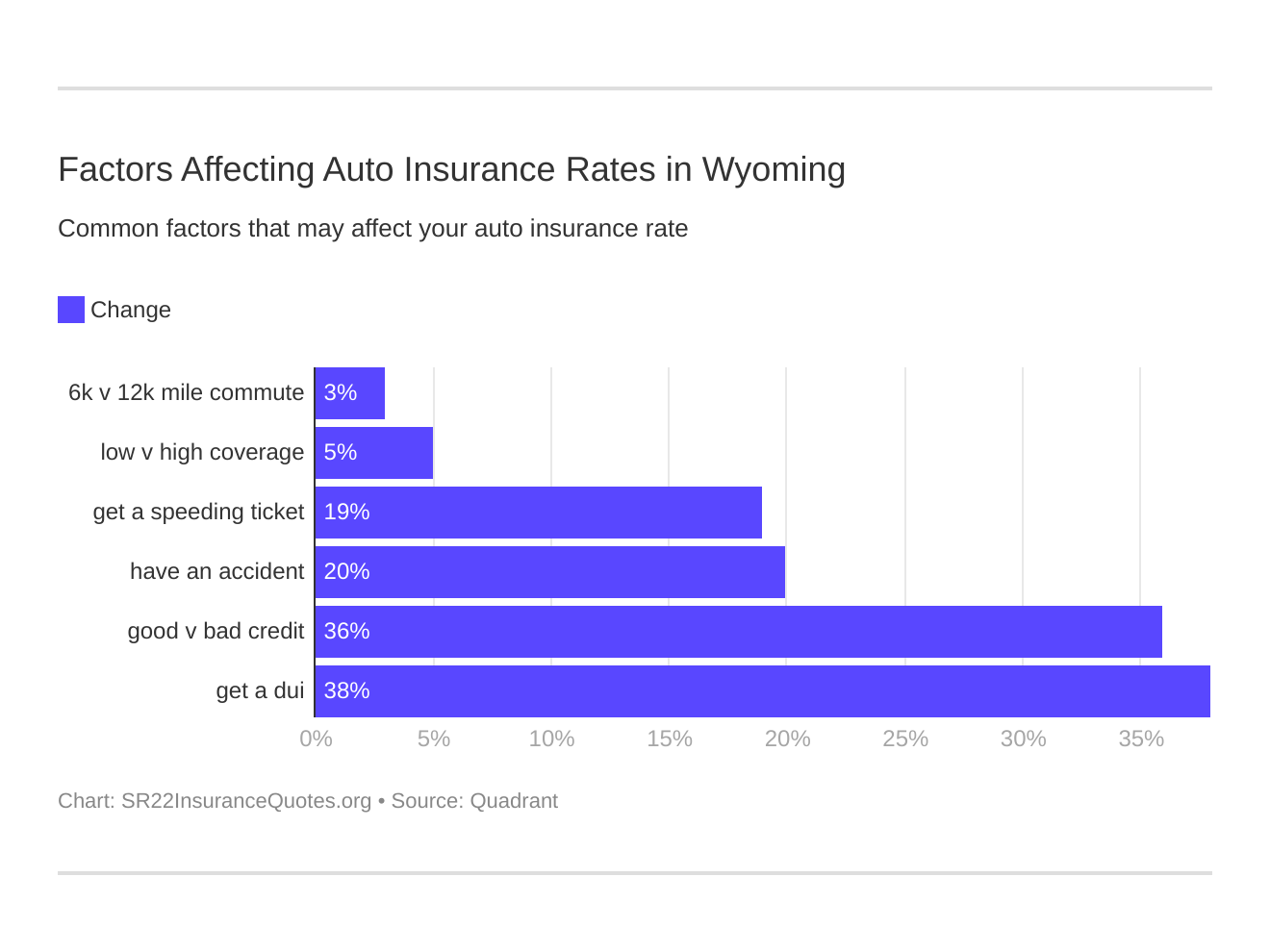

Six significant factors affect car insurance rates in Wyoming. Which auto insurance factors will affect Wyoming SR-22 insurance rates the most? Typically, a WY DUI arrest will be the most significant.

DUIs, poor credit, and accidents have the biggest impact on auto insurance. But why credit? According to the Federal Trade Commission, consumers with good credit are less likely to file a claim, while consumers with poor credit file claims more frequently. The biggest increase in car insurance rates comes when you have a DUI conviction.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

When is a Wyoming SR-22 insurance form required?

Wyoming SR-22 car insurance forms are required in all cases when a driver’s license has been suspended or revoked. The reason for the Wyoming driver’s license suspension or revocation doesn’t matter — an SR-22 form is required. For WY drivers, filing an SR-22 insurance form with the state of Wyoming is an essential part of getting their license reinstated.

A Wyoming court will ask anyone convicted of DUI or several driving violations to get SR-22 insurance as a condition of getting their license reinstated. Also, it’s a good idea to present SR-22 insurance to a state of Wyoming court to decrease the degree of punishment from a judge.

Are there different types of Wyoming SR-22 insurance forms?

Absolutely! There are three different types of state of Wyoming SR-22 forms: an Operator’s Certificate, an Owner’s Certificate, and an Owners-Operators Certificate. An Operator’s SR-22 form proves the financial responsibility of operators of motor vehicles who do not own a car. Here’s a summary of each form.

| Wyoming SR-22 Certificates and Forms | SR-22 Coverage Details |

|---|---|

| Wyoming SR-22 Operators Certificate | Coverage for a Wyoming driver who operates any non-owned vehicle they have been given permission to drive. |

| Wyoming SR-22 Owners Certificate | Coverage for a Wyoming driver to operate any vehicles owned by the driver. Make and model information are included. |

| Wyoming SR-22 Operators-Owners Certificate | Coverage for any vehicles owned by the Wyoming driver and any other vehicle not owned by the driver. SR-22 recipient must have permission to drive the car. |

An Owner’s SR-22 form in Wyoming proves the financial responsibility for vehicles that the motorist owns. The Operators-Owners SR-22 Certificate covers the operator and the cars they drive, even if they don’t own those vehicles. Non-Owner SR-22 insurance is important in case a convicted driver lives in the household with a person who allows them to borrow their vehicle.

How do I file a Wyoming SR-22 car insurance form?

The state of Wyoming does not notify insurance companies that a person needs a Wyoming SR-22 form. The driver is responsible for asking their car insurance company to file an SR-22 insurance form with the state of Wyoming.

A processing fee is usually charged for filing an SR-22 in Wyoming, but this fee is often included in the insurance premium. This can make Wyoming SR-22 auto insurance policies more expensive, but anyone can find cheap SR-22 car insurance by searching for free online car insurance quotes.

See which companies have affordable SR-22 insurance in your area by entering your ZIP code in the FREE comparison tool below.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

Wyoming SR-22 Insurance Rates

How much does it cost? The average cost of SR-22 insurance in Wyoming is between $620 and $1,170 per year. Rates will vary with different car insurance companies. Let’s review the cost of insurance from the top auto insurance companies in Wyoming.

| Companies | Average Annual Rates With 1 DUI | Average Annual Rates With 1 Accident | Average Annual Rates With 1 Speeding Violation |

|---|---|---|---|

| State Farm | $2,303 | $2,478 | $2,303 |

| Liberty Mutual | $2,366 | $2,184 | $1,980 |

| USAA | $3,904 | $2,649 | $2,380 |

| Farmers | $4,736 | $2,750 | $2,466 |

| Geico | $4,785 | $3,062 | $3,845 |

| Allstate | $4,813 | $4,508 | $4,387 |

As you can see in the chart, a DUI will result in the most expensive car insurance rates in Wyoming. Some companies show leniency for individuals who have at least one DUI on their driving record. Several DUIs could be a problem, and car insurance companies may deny your request for a policy altogether.

SR-22 Insurance in Wyoming: The Bottom Line

You won’t be able to avoid SR-22 insurance if you have a DUI. A Wyoming driver’s license search will list your status as a licensed driver. According to Steven Titus Law Firm, Wyoming DUI laws state that a DUI conviction remains on your driving record for 10 years, and may also result in up to $10,000 in fines and a lifelong ignition interlock requirement.

A Wyoming CDL DUI will disqualify the CDL driver and hurt their chances of getting another job for CDL drivers. The penalties are much more severe than those for standard Wyoming drivers convicted of DUI.

You can still get auto insurance with a DUI on your driving record. Get Wyoming SR-22 auto insurance quotes right now by entering your ZIP code in the FREE comparison tool below. Get rates from the best Wyoming SR-22 insurance companies now.

Frequently Asked Questions: Wyoming SR-22 Insurance

Let’s recap what you’ve learned about Wyoming SR-22 insurance by answering a few frequently asked questions. These questions appear on search engines across the web and will add to what you’ve learned in the guide so far.

#1 – How much does SR-22 insurance in Wyoming cost?

The average cost of SR-22 insurance in Wyoming is $622 to $1,170 per year.

#2 – Does SR-22 go away?

SR-22 insurance lasts for three years. If your car insurance company still sees you as a high-risk driver, you’ll have to reapply for SR-22 insurance. Since DUIs are on your driving record for 10 years in Wyoming, you’ll likely have to reapply every three years.

#3 – How much is SR-22 insurance in Wyoming per month?

You could pay up $98 per month for liability-only SR-22 insurance. Rates will vary by insurance company.

#4 – What is an SR22, and how much does it cost?

SR-22 insurance is an indication that you’re a high-risk driver, which the auto insurance company reports to your local government. In Wyoming, the SR-22 insurance fee costs $15 to $25 to file. However, your car insurance rates could vary based on your company, vehicle, age, and credit history.

#5 – How long does an SR-22 stay on your insurance?

DUIs stay on your driving record for up to 10 years. SR-22 lasts for at least three years.

#6 – How do I get my SR-22 from Progressive?

Contact a Progressive agent and tell them you need SR22. If you’re already a policyholder, they’ll request additional information and file within seven to 10 business days. If you’re not a policyholder, they’ll need additional information to determine whether or not they’ll insure you.