West Virginia SR-22 Insurance for 2024

West Virginia SR-22 insurance is required for drivers that have certain past driving offenses. SR-22 insurance in West Virginia proves to the state that you have minimum car insurance. West Virginia SR-22 insurance coverage must include the legal minimum of 20/40/10.

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rachael Brennan

Licensed Auto Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health in...

Licensed Auto Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

- West Virginia SR-22 insurance is required if you have violated the law, including a DUI or failure to carry insurance

- You will pay more for SR-22 insurance in West Virginia because you are considered a high-risk driver

- The SR-22 form is filed by your insurance company with the state

You may have been told you need an SR-22 in order to drive in West Virginia. What is SR-22 insurance? In West Virginia, SR-22 car insurance is a special insurance form filed with the Department of Motor Vehicles to prove that a motorist carries at least the state-mandated minimum amount of coverage on the vehicle they drive or own. SR-22 insurance in West Virginia is required when you have violated one of several laws and are now required to provide proof of financial responsibility to the state.

What does it mean to show proof of financial responsibility? For SR-22 auto insurance, this means stating you have the minimum amount of coverage required by law in your state.

Read on for more information on SR-22 insurance in West Virginia. You can also easily compare West Virginia SR-22 insurance quotes by entering your ZIP code above and find affordable West Virginia SR-22 insurance today.

What Is West Virginia SR-22 insurance?

The state of West Virginia requires that drivers carry at least $20,000 per person in an accident in liability coverage, $40,000 for more than one person per accident, and at least $10,000 in property damage coverage. A West Virginia SR-22 auto insurance form proves that the driver is carrying at least this minimum amount of liability coverage.

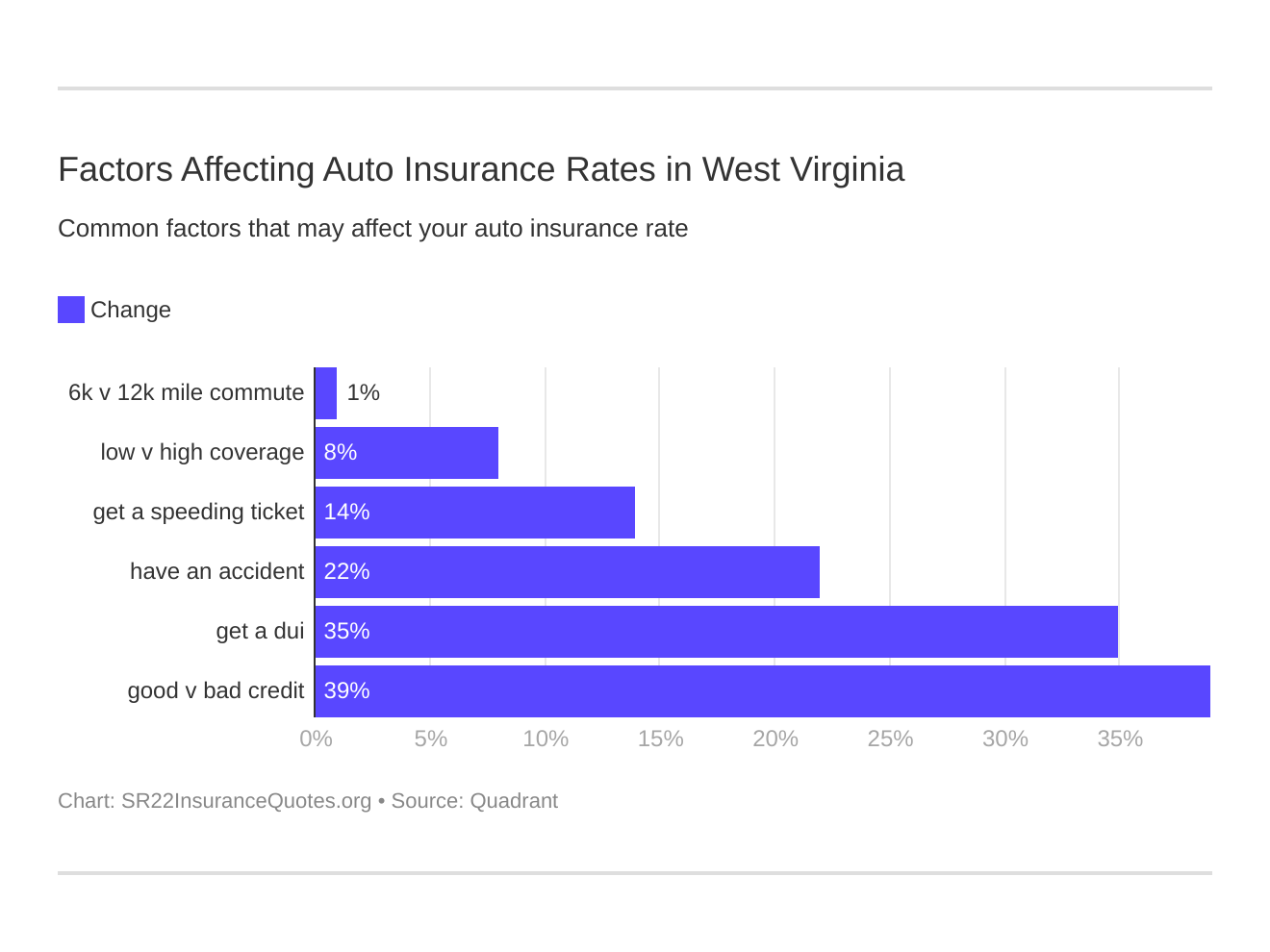

How much does an SR-22 cost per month? Six major factors affect car insurance rates in West Virginia. Which auto insurance factors will affect SR-22 rates the most? Typically, a DUI will impact SR-22 rates more than any other factor. The average cost of SR-22 insurance varies depending on your record and other factors like where you. live.

Non-owner SR-22 insurance is also available, which can be used if you are driving someone else’s vehicle. These rates can average between $15 and $25, depending on several factors.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

Who must file for SR-22 insurance in West Virginia?

Why would you need an SR-22 insurance form? SR-22 car insurance forms are required for drivers whose licenses have been suspended or revoked. SR-22 forms are also required in cases of mandatory car insurance supervision, or if a driver has an unsatisfied judgment against them. This means that if a driver does not pay the compensation they were ordered to by the court, they must file an SR-22 form to show that they are financially responsible and driving with car insurance.

Other states that require SR-22 insurance can be seen in the chart below.

| State | SR-22 Requirement |

|---|---|

| Alabama | Yes |

| Alaska | Yes |

| Arizona | Yes |

| Arkansas | Yes |

| California | Yes |

| Colorado | Yes |

| Connecticut | Yes |

| Delaware | No |

| District of Columbia | Yes |

| Florida | No, FR-44 Requirement |

| Georgia | Yes |

| Hawaii | Yes |

| Idaho | Yes |

| Illinois | Yes |

| Indiana | Yes |

| Iowa | Yes |

| Kansas | Yes |

| Kentucky | No |

| Louisiana | Yes |

| Maine | Yes |

| Maryland | Yes |

| Massachusetts | Yes |

| Michigan | Yes |

| Minnesota | No |

| Mississippi | Yes |

| Missouri | Yes |

| Montana | Yes |

| Nebraska | Yes |

| Nevada | Yes |

| New Hampshire | Yes |

| New Jersey | Yes |

| New Mexico | No |

| New York | No |

| North Carolina | No |

| North Dakota | Yes |

| Ohio | Yes |

| Oklahoma | No |

| Oregon | Yes |

| Pennsylvania | No |

| Rhode Island | Yes |

| South Carolina | Yes |

| South Dakota | Yes |

| Tennessee | Yes |

| Texas | Yes |

| Utah | Yes |

| Vermont | Yes |

| Virginia | No, FR-44 Requirement |

| Washington | Yes |

| West Virginia | Yes |

| Wisconsin | Yes |

| Wyoming | Yes |

Most states in the United States have an SR-22 insurance requirement. Remember that SR-22 insurance is not a particular insurance policy, but a form that proves you have an insurance policy. You can get an SR-22 filed by most insurers, there is no specific West Virginia SR-22 insurance company.

How do I file a West Virginia SR-22 insurance form?

A West Virginia driver must request that their car insurance company file the SR-22 form. They must also usually pay a processing fee to their insurance company. Their insurer is then responsible for filing an SR-22 insurance form with the West Virginia Department of Transportation.

West Virginia state laws for car insurance require that this form stays on file until the requirement is lifted, usually in three years.

How long do I have to file a West Virginia SR-22 insurance form?

In West Virginia, drivers must maintain their SR-22 insurance filing for a period of three years. They must continuously file the form by reinstating it before the expiration date or the insurance agency will notify the state that the SR-22 has lapsed. If a West Virginia SR-22 form lapses, the state may suspend the driving record until the SR-22 insurance is reinstated.

To find low-cost West Virginia SR-22 car insurance, you can start by getting a free online quote. Cheap SR-22 insurance in West Virginia can be harder to find, as high-risk drivers are expensive to insure.

Looking for a car insurance quote in West Virginia? Buy West Virginia SR-22 insurance and get back on the road. Enter your ZIP code below to compare West Virginia SR-22 insurance rates.

Frequently Asked Questions: West Virginia SR-22 Insurance

Still have a few questions about SR-22 insurance in West Virginia? Read on.

#1 – What is the difference between SR-22 and regular insurance?

There is not much difference between the two except that SR-22 insurance requires users to file a separate form, mostly due to past driving offenses. This may also be called an SR-22 bond.

#2 – What car insurance companies are in West Virginia?

Most major car insurance companies can be found in West Virginia. The cheapest car insurance in West Virginia can depend on a number of factors, including your driving record, credit score, age, and more.