Virginia SR-22 Auto Insurance

Filling out an SR-22 Form in Virginia is required for high-risk drivers convicted of DUI and multiple traffic violations. Virginia SR-22 auto insurance rates are $175 to $275 a month.

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rachael Brennan

Licensed Auto Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health in...

Licensed Auto Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Virginia SR-22 auto insurance, or high-risk driver auto insurance, has auto insurance rates that are $175 to $275 a month. This guide explains how you can properly fill out the form for SR-22 insurance in Virginia and ensure you are covered.

Compare auto insurance rates for the best Virginia SR-22 insurance quotes from different companies by entering your ZIP code in the free comparison tool.

What is Virginia SR-22 insurance?

A Virginia SR-22 auto insurance form is also known as an SR-22 financial responsibility insurance form. The SR-22 form of Virginia monitors the auto insurance coverage of drivers who have been convicted of certain serious moving violations.

In Virginia, a form for SR-22 certificate of insurance needs to be filed with the Virginia Department Of Motor Vehicles to prove that the driver is financially responsible for carrying the state required minimums for auto insurance on the vehicles that they drive or own.

The Virginia SR-22 auto insurance form should show that the driver has at least the state minimum amount of coverage: $25,000 per person per accident, $50,000 for more than one person per accident, and $25,000 in property damage liability auto insurance.

Find out how much minimum requirement rates cost in your local area by entering your ZIP code in the free comparison tool below.

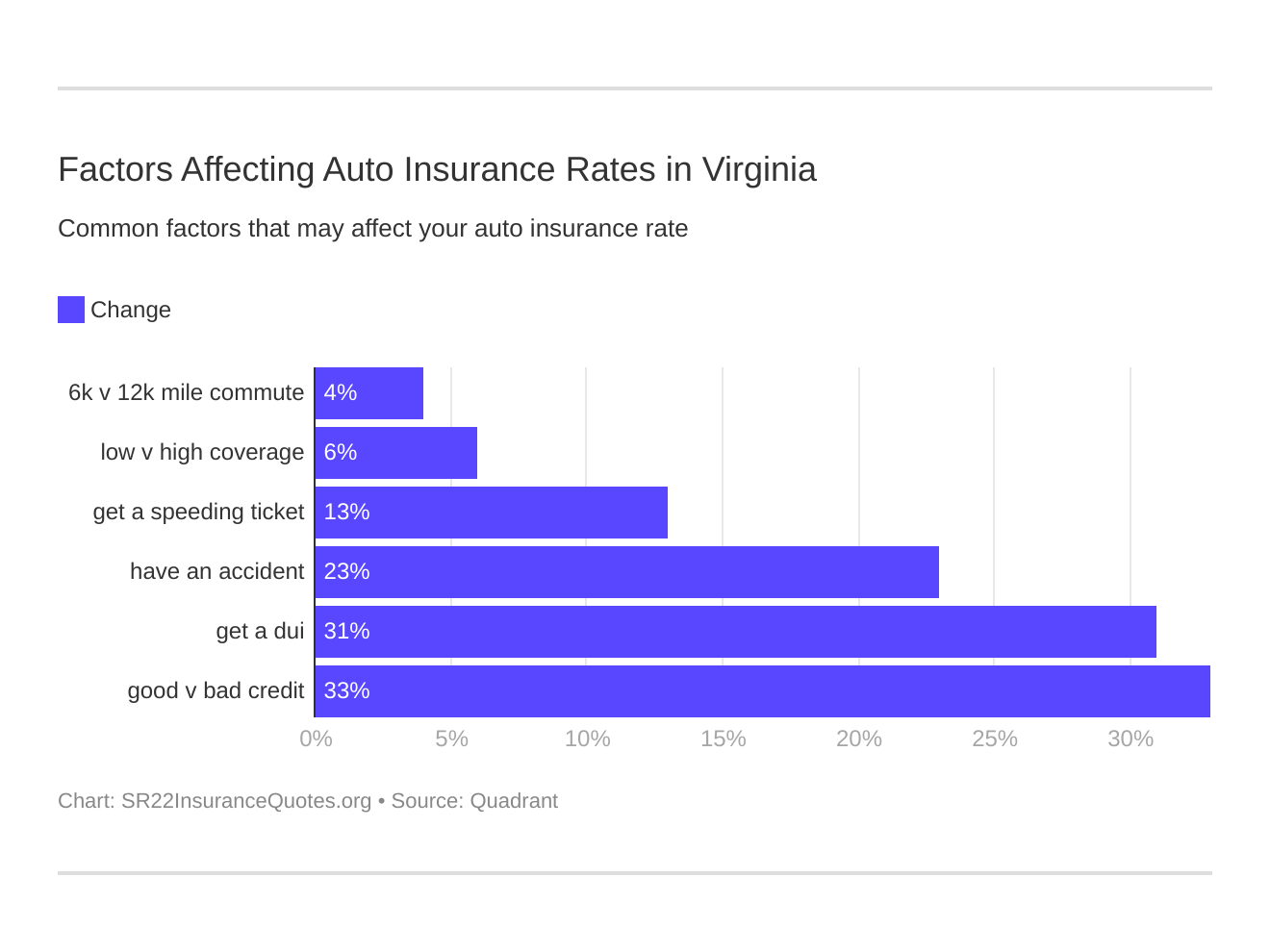

Six major factors affect car insurance rates in Virginia. Which auto insurance factors will affect SR-22 rates the most? Typically, that’s a VA DUI conviction.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

How much is a Virginia SR-22 auto insurance policy?

SR-22 auto insurance is more expensive than regular auto insurance. For instance, if your SR-22 auto insurance costs $75 per month before filing Virginia’s SR-22 form, you could pay as much as $175 to $275 per month under SR-22 in Virginia.

Let’s look at Virginia auto insurance rates based on driving records.

| Driving Record | Average Annual Car Insurance Rates |

|---|---|

| Clean record | $1,924 |

| With 1 speeding violation | $2,214 |

| With 1 accident | $2,507 |

| With 1 DUI | $2,786 |

Based on Virginia’s average annual rates, auto insurance is cheaper for drivers with a clean driving record. Drivers with a DUI, likely to be on SR-22 insurance, pay the most expensive rate.

Virginia’s SR-22 auto insurance costs may be different for each auto insurance company. GEICO’s SR-22 insurance in Richmond, VA is going to have a different rate than Progressive SR-22 insurance in Richmond, VA.

Who needs SR-22 insurance in Virginia?

A form for SR-22 in Virginia should be filed by drivers who are caught driving with a suspended license due to a major moving violation like driving without auto insurance or manslaughter while driving a motor vehicle.

The form for SR-22 certificate of insurance is an important step in getting a driver’s license reinstated in Virginia. People who want to insure a vehicle for a driver who’s been previously convicted of DUI or other offenses resulting in SR-22 have to get non-owner SR-22 auto insurance.

Get the latest auto insurance rates from companies in your local area by entering your ZIP code in the free comparison tool.

Are there different types of Virginia SR-22 forms?

In Virginia, there are three types of SR-22 insurance form. The SR-22 Owner’s Certificate shows the financial responsibility of the owner of the vehicle. The Virginia SR-22 Operator’s Certificate covers the operator of a motor vehicle if they do not own the vehicle.

The combined Operator-Owners Certificate covers both the driver and all the vehicles, whether they are owned by the driver. Virginia also has a special type of SR-22 form called a FR-44 insurance form that is used in DUI cases.

The form for SR-22 in Virginia must prove that the driver is carrying twice the legally required minimum amount of auto insurance.

Compare liability coverage rates using our free comparison tool. Enter your ZIP code in the dialog box below to get started.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

Do you need to go to the DMV in VA to get an SR-22?

No. Some auto insurance companies offer SR-22 auto insurance. For example, Progressive SR-22 program files SR-22 status for you and complies with the regulations in the state you live in.

How do I file a form for SR-22 in Virginia?

The state does not notify drivers and the driver must tell their auto insurance company to file a Virginia SR-22 auto insurance form with the state.

The driver will usually have to pay a processing fee to their auto insurance company. The driver’s auto insurance company then files the SR-22 form with the Virginia Department of Motor Vehicles.

To find low-cost Virginia SR-22 insurance quotes, you can start by entering your ZIP code for a free online SR-22 quote.

How do I get SR-22 removed?

Contact your auto insurance company and confirm that you have legal documents from the state that prove that you no longer need SR-22. You may have to e-mail, fax, or show an auto insurance agent proof of your court documents. The auto insurance company will remove the SR-22 from your auto insurance after everything is processed.

What is a Virginia SR-22 Bond?

This is also known as a Certificate of Financial Responsibility. An SR-22 Bond is an easier way to file your SR-22. In Virginia, FR-44 is required, which is similar to the SR-22 but requires more liability coverage.

What is SR-22 insurance VA GEICO?

GEICO has an SR-22 and FR-44 auto insurance program. GEICO customers who need SR-22 auto insurance need to turn in an SR-22 Bond to GEICO to sign up for SR-22 auto insurance.

Is there a Virginia SR-22 form in PDF?

SR-22 forms in PDFs are available through auto insurance companies that offer SR-22 insurance and through the DMV. Virginia requires SR-22 drivers to go through their auto insurance company or through an account on Virginia’s DMV website.

Can I have FR-44 insurance without a vehicle?

Yes. If you’re insuring a vehicle for someone who needs FR-44 auto insurance to drive, you will need to fill out an SR-22 Bond and give it to your auto insurance company.

Virginia SR-22 Auto Insurance: The Bottom Line

An SR-22 filing in Virginia provides local drivers with proof of insurance coverage or legal recognition that they carry the minimum liability insurance requirements in Virginia. SR-22 requirements in Virginia are a little different from most other states.

Your insurance premium can vary depending on the severity of your violation. A lapse in SR-22 coverage can result in license suspension, reinstatement fees and increased auto insurance rates.