Pennsylvania SR-22 Insurance

After 3 violations, you will need Pennsylvania SR-22 Insurance. 7.6% of Pennsylvania drivers are uninsured. SR-22 insurance in Pennsylvania must be filed by an insurance company with the state to prove that you have car insurance.

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rachael Brennan

Licensed Auto Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health in...

Licensed Auto Insurance Agent

UPDATED: Feb 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

- 7.6 percent of Pennsylvania drivers are uninsured

- Is SR-22 insurance in Pennsylvania required? No

- If you move to PA from another state where you were required to have an SR-22, you will need to get Pennsylvania SR-22 insurance

- Can I get an SR-22 without having car insurance? No, you must have insurance first.

If you are in need of Pennsylvania SR-22 insurance and find the whole process confusing, know that you are not alone. No one wants to need an SR-22 because it means a far-from-perfect driving record.

Who needs a Pennsylvania SR-22 insurance certificate, how do you get one, and how does it fit into the rest of the Pennsylvania auto insurance laws? Together we will get through the fog of uncertainty in regards to just what you need for SR-22 insurance in Pennsylvania and what you don’t need.

We can help you find the SR-22 insurance in Pennsylvania you need. Just enter your ZIP code above to get great rates from multiple companies all at once.

Now, let’s start by defining just what PA SR-22 insurance is.

What is Pennsylvania SR-22 insurance?

What is SR-22 insurance? That’s a good place to start. A Pennsylvania SR-22 auto insurance certificate, or financial responsibility insurance form, is a document that serves as proof that a driver is financially responsible for carrying the minimum required auto insurance as mandated by state insurance laws. SR-22 filing may be required for high-risk drivers.

The SR-22 can sometimes also be referred to as a certificate of financial responsibility (CFR) and is filed with the local Department of Motor Vehicles.

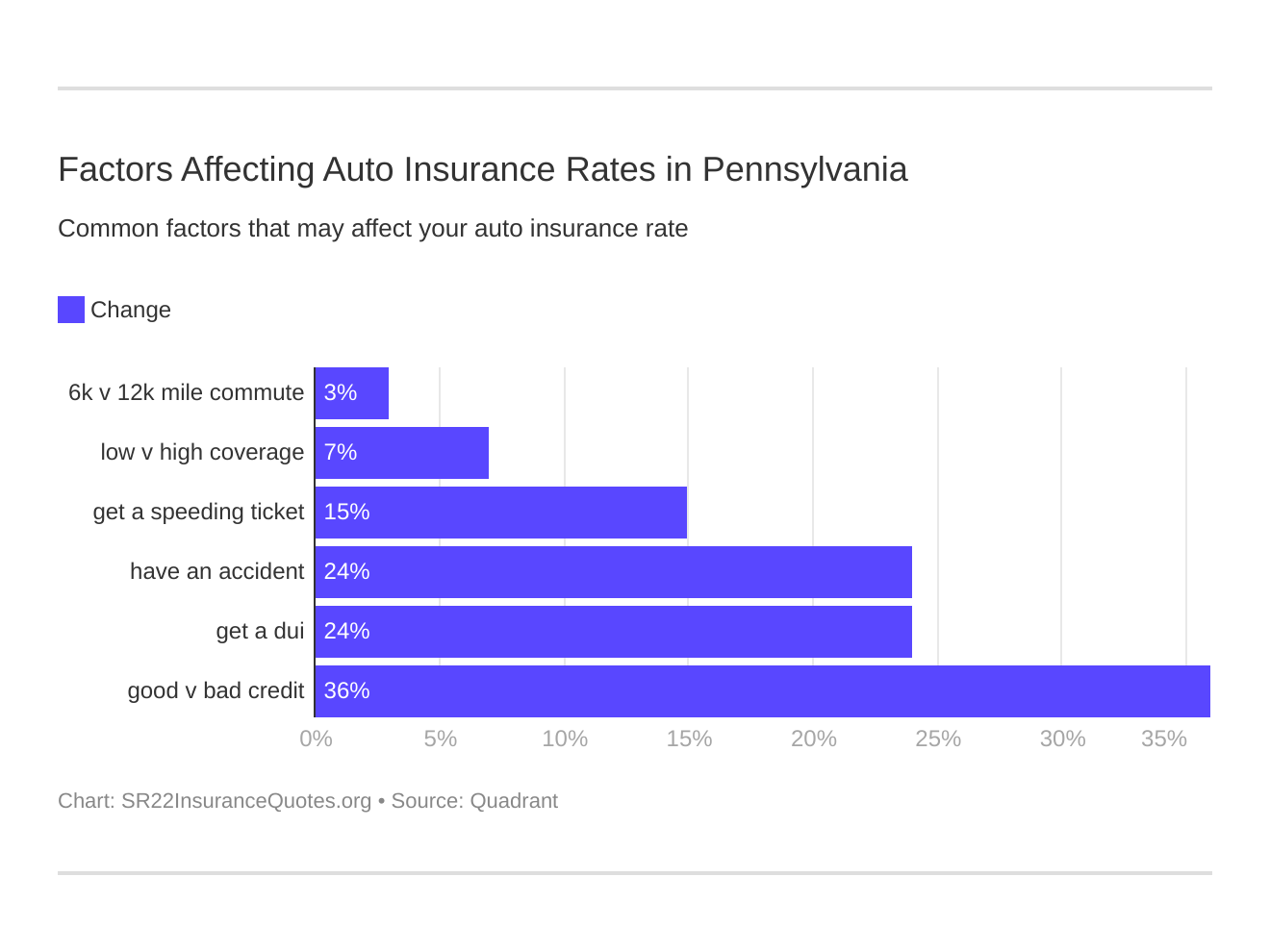

Six major factors affect car insurance rates in Pennsylvania. Which auto insurance factors will affect Pennsylvania SR-22 insurance rates the most? Typically that’s a PA DUI arrest.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

Who needs SR-22 insurance in Pennsylvania?

In the state of Pennsylvania, SR-22 auto insurance forms must be filed by uninsured drivers who were involved in an accident and did not pay for any damage or personal injury they caused.

Other examples of those who must file the SR-22 auto Insurance form are drivers with unsatisfied judgments, drivers with revoked licenses or who are under mandatory insurance supervision, and drivers with three or more mandatory insurance violation convictions.

There are several reasons why an individual may have a revoked license. For instance, a license can be revoked for a period of time due to driving without a valid insurance policy.

Other examples of why an individual may have their license revoked are driving while under the influence of drugs or alcohol, receiving too many speeding tickets within a certain timeframe, and driving either with an expired license or with no license at all.

Drivers convicted of these aforementioned serious moving violations in Pennsylvania must carry liability insurance. Failure to do so is what results in the necessity of the SR-22 in most states.

In Pennsylvania, if an individual fails to show proof of insurance upon request by a law enforcement officer, they face a $500 fine and suspension of their driver’s license and registration. According to the Insurance Information Institute (III), 7.6 percent of motorists are uninsured in Pennsylvania.

Is Pennsylvania SR-22 insurance required?

While many states require SR-22 insurance if a driver is convicted of a DUI, Pennsylvania is not one of them.

Keep in mind that just because Pennsylvania does not technically require the SR-22, if you were to move to another state that does require it, they would need to obtain the SR-22. The same goes for individuals moving to Pennsylvania from a state that requires one. Under California law, for example, you may need an SR-1P, in addition to the possible need for an SR-22, which is a different type of insurance filing altogether (and not in use in Pennsylvania at all).

So, for example, if an individual is convicted of a DUI in a state other than Pennsylvania and then they move to Pennsylvania, they will need to still carry their SR-22 insurance in Pennsylvania.

The following table will explain whether or not your current state, or a state you’re moving to, requires the SR-22.

| State | SR-22 Requirement |

|---|---|

| Alabama | Yes |

| Alaska | Yes |

| Arizona | Yes |

| Arkansas | Yes |

| California | Yes |

| Colorado | Yes |

| Connecticut | Yes |

| Delaware | No |

| District of Columbia | Yes |

| Florida | No, FR-44 Requirement |

| Georgia | Yes |

| Hawaii | Yes |

| Idaho | Yes |

| Illinois | Yes |

| Indiana | Yes |

| Iowa | Yes |

| Kansas | Yes |

| Kentucky | No |

| Louisiana | Yes |

| Maine | Yes |

| Maryland | Yes |

| Massachusetts | Yes |

| Michigan | Yes |

| Minnesota | No |

| Mississippi | Yes |

| Missouri | Yes |

| Montana | Yes |

| Nebraska | Yes |

| Nevada | Yes |

| New Hampshire | Yes |

| New Jersey | Yes |

| New Mexico | No |

| New York | No |

| North Carolina | No |

| North Dakota | Yes |

| Ohio | Yes |

| Oklahoma | No |

| Oregon | Yes |

| Pennsylvania | No |

| Rhode Island | Yes |

| South Carolina | Yes |

| South Dakota | Yes |

| Tennessee | Yes |

| Texas | Yes |

| Utah | Yes |

| Vermont | Yes |

| Virginia | No, FR-44 Requirement |

| Washington | Yes |

| West Virginia | Yes |

| Wisconsin | Yes |

| Wyoming | Yes |

Read more: SR-22 Car Insurance in Your State: Which States Require an SR-22

As you can see, most states do require an SR-22. In fact, 40 out of the 50 states (and D.C.) require it.

What is FR-44 insurance you may be asking? Perhaps you noticed that for two states, Virginia and Florida, you need an FR-44 insurance filing as opposed to an SR-22. The FR-44 is very similar in that it is proof of financial responsibility.

The difference between the two is that the FR-44 requires one’s liability coverage limits to be significantly higher than that of the SR-22, perhaps even twice as much.

Are there different types of Pennsylvania SR-22 insurance forms?

Yes, and the different types of Pennsylvania SR-22 auto insurance forms prove the financial responsibility of the operator, owner, or operator/owner of a vehicle. Next, we will cover the differences between owner SR-22 insurance, operator SR-22 insurance (or non-owner SR-22 insurance), and owner-operator SR-22 insurance.

Owner SR-22 insurance covers financial responsibility for drivers who own and operate a vehicle.

If you have violations on your record that necessitate the SR-22, the owner SR-22 just states that you are responsible for the vehicle that you are driving in a financial sense should an accident occur.

Operator SR-22 insurance covers financial responsibility for drivers who operate but do not own a vehicle. It is also referred to as the non-owner SR-22. This non-owner SR-22, in layman’s terms, is for those who need coverage despite not owning a vehicle. Even if one individual is to drive another’s vehicle, they would be required to carry this SR-22 insurance to use the vehicle legally.

Not unlike liability insurance, non-owner SR-22 insurance covers the damage to the other individual involved in the accident’s vehicle, personal property, or bodily injury. The holder of the non-owner SR-22 would not have their borrowed vehicle’s damage, personal property damage, or bodily injury medical bills covered. Furthermore, the vehicle the individual has borrowed would have to have its damage fixed out of pocket by the non-owner SR-22 policyholder.

It is an ethical and legal priority to inform the owner of the car you are borrowing that your non-owner SR-22 would not cover damage to their vehicle. Just because you have non-owner coverage does not mean you can drive any car. If you intend to drive multiple vehicles or vehicles from multiple individuals, you would need to discuss obtaining a different form of SR-22 policy with your insurance company.

Now, we will cover the third type of SR-22 insurance policy, the operator-owner SR-22. Operator-owner SR-22 insurance covers financial responsibility for all vehicles, whether or not they are owned by the driver.

The individual’s insurance company can help them discern which policy type is the most prudent for them to have. It is of the utmost importance, though, that if the policy type is changed or the insurance company is changed, the state is given proper notice.

Essentially, even if you were to get a different policy immediately, there is still a chance that there would be a lapse in coverage. If the state is informed of this ahead of time, there would be no recourse in suspending or revoking your license a second time.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

How do I file a Pennsylvania SR-22 auto insurance form?

Your insurer files your request for an SR-22 insurance form with the Pennsylvania Secretary of State. You will be charged a processing fee, which can vary among agencies.

Getting an SR-22, no matter what type is not done by the individual alone. The process is completed in collaboration with their insurance carrier.

The chosen insurance company generally files the SR-22 within 30 days and will send the form to you once it is accepted, along with a letter from the Pennsylvania Secretary of State. No matter what company you choose, the SR-22 filing is the same. GEICO SR-22 insurance filings are the same as Allstate SR-22 filings, although the coverage and rate may differ.

The SR-22 auto insurance form must be maintained for three years. Your insurer is required by law to notify the state if you fail to renew your SR-22 insurance form at least 15 days before the expiration date.

Should this renewal negligence occur, the state may then suspend your driving record until your Pennsylvania SR-22 auto Insurance is reinstated.

Even if the payment lapse is comparatively small, the state has every right to revoke your legal driving privileges.

How do I find out if I still need an SR-22 in Pennsylvania?

There should be a specific date after which you’re no longer required to have an SR-22 filing, but if you can’t recall, contact your insurance company. The Pennsylvania DMV can also tell you when the requirement will fall off of your record.

Your insurance company should continue providing the filing for as long as it’s needed and the coverage is in force. Don’t be tempted to drop the coverage early – it will come back to haunt you when the DMV finds out.

Pennsylvania Safety Laws and High-Risk Auto Insurance

Everyone knows that cellphone use, as well as drugs and alcohol, are primary causes of accidents on the roadway. Let’s take a closer look at the Pennsylvania safety law violations that are most likely to result in the need for SR-22 insurance.

Pennsylvania DUI Laws

A primary reason why an individual might require an SR-22 is having a DUI on their record

What follows is a table showing the penalties Pennsylvania state law has for driving a motor vehicle under the influence.

| Laws | Details |

|---|---|

| Name of offense | Driving After Imbibing (DAI) |

| BAC limit | 0.08 |

| High BAC limit | 0.16 |

| Criminal status | First and second offenses are misdemeanors; third+ are second-degree misdemeanors |

| Look-back period | 10 years |

Of note is the fact that Pennsylvania is the only state that formally refers to the offense as driving after imbibing (DAI).

| Offense | License Revocation | Jail Time | Fines | IID Lock | Other |

|---|---|---|---|---|---|

| First | No minimum | No minimum; up to six months probation | $300 | N/A | Alcohol highway safety school; treatment when ordered |

| Second | One year | Five days to six months | $300 to $1,500 | One year | Alcohol highway safety school; treatment when ordered |

| Third | One year | 10 days to two years | $500 to $5,000 | One year | Treatment when ordered |

Having a DUI, or DAI in this state can prove extremely detrimental to one’s premium rates. What follows is a table showing the rates of several companies with policies available in Pennsylvania. A clean driving record, a record with one DAI, a record with one speeding violation, and a record with one accident will all be compared.

| Company | Clean Record | With One Accident | With One Speeding Violation | With One DAI |

|---|---|---|---|---|

| USAA | $1,442.82 | $1,992.43 | $1,612.21 | $2,126.01 |

| Geico | $1,916.13 | $3,282.78 | $2,653.35 | $2,568.60 |

| Nationwide | $2,021.90 | $2,703.02 | $2,707.29 | $3,769.26 |

| State Farm | $2,512.31 | $2,976.14 | $2,744.22 | $2,744.22 |

| Allstate | $3,813.11 | $4,497.16 | $3,813.11 | $3,813.11 |

| Progressive | $4,034.71 | $5,570.34 | $4,045.00 | $4,153.94 |

| Liberty Mutual | $5,525.34 | $6,328.15 | $6,183.64 | $6,183.64 |

| Travelers | $5,566.16 | $7,914.42 | $7,914.42 | $9,974.88 |

With each of the eight companies, having a DAI increases your insurance rates.

Furthermore, having a DAI on one’s record increased the rate even higher than having one accident, or one speeding violation, for three of the eight companies: Nationwide, Travelers, and USAA.

Pennsylvania Marijuana Driving Laws

While a bill was submitted in late 2019 for consideration, Pennsylvania has yet to legalize marijuana. The state does, however, have a medical marijuana program, but this requires user registration in order to access dispensaries.

No matter whether or not you are eligible for medical marijuana, Pennsylvania has a ban on driving under the influence. Furthermore, it is illegal to operate a motor vehicle with an amount above one nanogram per milliliter of THC, according to responsibility.org.

First-time offenders can receive anywhere from three days to six months in jail as well as a fine ranging from $1,000 to $5,000. Furthermore, they may have their license suspended for one year and be required to attend a safety school as well as a court-ordered treatment program.

Pennsylvania High-Risk Auto Insurance

If you were in an accident or received a moving violation with any of these convictions, you may be considered a high-risk driver. High-risk auto insurance is really the SR-22 in layman’s terms.

As we have seen thus far, the SR-22 is truly indicative of increased car insurance rates to tag along with the pre-existing headache caused by negligent driving. Keep in mind that while most insurance companies provide SR-22 insurance as an option, not all do.

Who has the best Pennsylvania SR-22 insurance?

The short answer: comparing quotes is the only way to find the best coverage. Use our FREE tool below to obtain insurance quotes. Here is an SR-22 insurance company list:

- Acceptance Insurance

- 21st Century

- The General

- SafeAuto

- Infinity Insurance

- Esurance

- Liberty Mutual

- State Farm

- Direct Auto Insurance

- Nationwide Insurance

- Dairyland Insurance

- Allstate

- USAA

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

SR-22 Insurance in Pennsylvania

While Pennsylvania does not require an SR-22 of its residents, if you are traveling there from a state that does require the SR-22, you will need to hold on to it even while in Pennsylvania. You will need SR-22 insurance if you plan to move from Pennsylvania to another state, or if you are moving to Pennsylvania from a state that legally requires SR-22.

The SR-22 generally costs $25, which sounds small, but it will increase your premiums. While this sounds like a burden, it would be nothing compared to a payment lapse in car insurance that results in further legal penalties.

To avoid this headache, enter your ZIP code and find great SR-22 insurance rates with multiple car insurance companies in Pennsylvania.