Nebraska SR-22 Insurance

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Mar 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

What is Nebraska SR-22 Insurance?

A Nebraska SR-22 is a form filed with the DMV showing that a driver maintains adequate financial responsibility for any damages that may be incurred during the operation of a motor vehicle. Keeping the minimum insurance requirements on the vehicle does this.

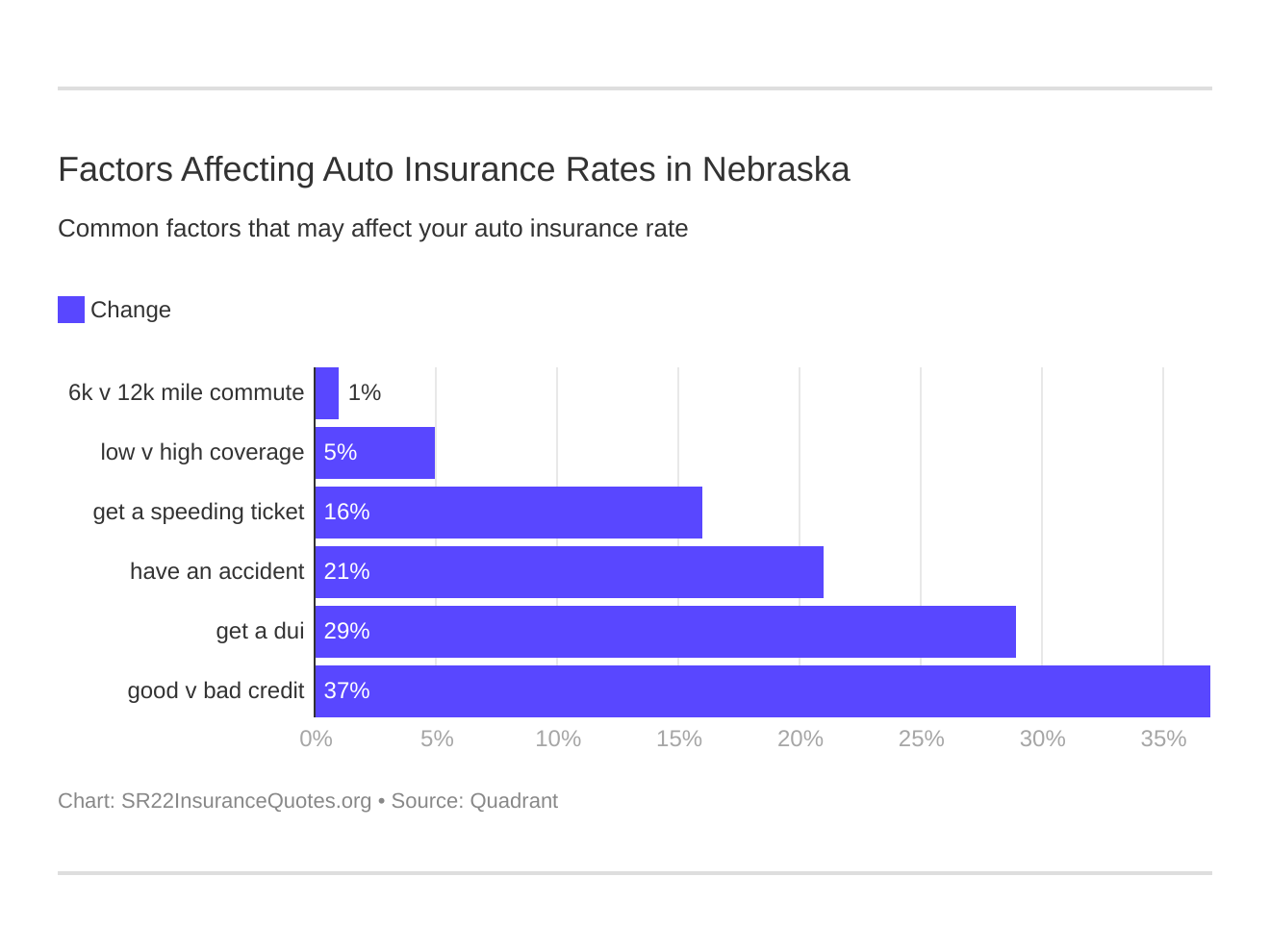

Six major factors affect car insurance rates in Nebraska. Which auto insurance factors will affect SR-22 rates the most? Typically that’s a NE DUI.

Who Needs SR-22 Insurance in Nebraska?

The State of Nebraska mandates that any driver that has had their license suspended for any reason must have a Nebraska SR-22 auto insurance form on file. Drivers that fail to keep their insurance policy current are also required to file one. Additionally, a driver that has not met all the expenses from a previous car accident due to underinsurance must keep a Nebraska SR-22 car insurance form on file.

Are There Different Types of Nebraska SR-22 Forms?

Yes, you may have an Operator’s Certificate, an Owner’s Certificate, or an Operators-Owner’s Certificate depending on whether you own one or several cars or none at all.

Is SR-22 Car Insurance Required in Nebraska?

If you fall into one of the categories that require a Nebraska SR-22 auto insurance form you will be required to maintain one on file for three years. To be sure you are compliant with the minimum insurance requirement you must at all times maintain at least $25,000 for injuries to one person, $50,000 for injuries to more than one person in any one accident, and $25,000 for damage to property that is not yours. There is no option to having a Nebraska SR-22 car insurance form. The form must be filled out and sent directly from your insurance company, the DMV will not accept a faxed or photocopy of the Nebraska SR-22 car insurance form.

How Do I File a Nebraska SR-22 Insurance Form?

To file a Nebraska SR-22 auto insurance form you will need to request one from your insurance provider. Most insurance companies will ask if one is needed when you first apply for insurance. The company will fill out the form and send it by mail to the DMV. There will be an additional charge to your insurance policy for this. To find out how much extra it will cost you to have NE SR-22 insurance, fill in your information.