Washington SR-22 Insurance

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rachael Brennan

Licensed Auto Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health in...

Licensed Auto Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

What Is Washington SR-22 Car Insurance?

A Washington SR-22 car insurance form proves the financial responsibility of a driver for carrying enough car insurance coverage. A Washington SR-22 car insurance form shows the Washington authorities that a driver can carry at least the state minimum amount of liability car insurance coverage, or at least $25,000 per person injured per accident, $50,000 for more than one person injured in an accident, and $10,000 property damage.

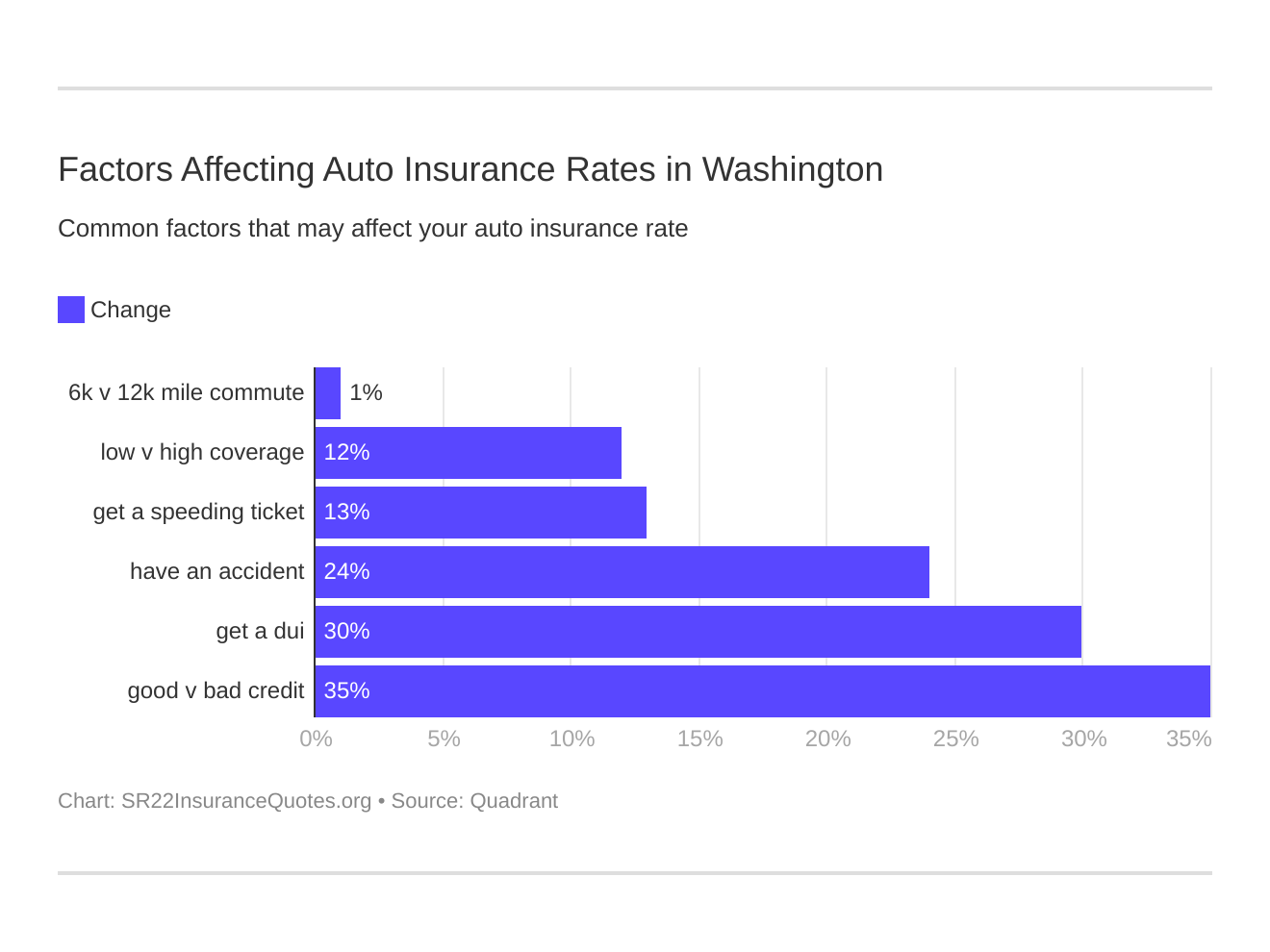

Six major factors affect car insurance rates in Washington. Which auto insurance factors will affect SR-22 rates the most? Typically that’s a WA DUI.

Who Needs a Washington SR-22 Insurance Form?

In Washington, SR-22 auto insurance forms are required for drivers who have had their licenses suspended. Other cases where a SR-22 insurance form is required include drivers who have had unsatisfactory judgments entered against them, or if a driver hasn’t paid their ordered compensation for an accident. Drivers who have had more than three convictions for auto insurance violations are also required to file a WA SR-22 car insurance form to prove that they are carrying continuous car insurance.

Are There Different Types of Washington SR-22 Forms?

In Washington, SR-22 car insurance forms come in three different types: the Operator’s Certificate, the Owner’s Certificate and the Operators-Owners Certificate. The Washington SR-22 Operator’s Certificate proves that the operator of a motor vehicle is financially responsible for carrying car insurance, even if they don’t own a vehicle. The Owner’s Certificate SR-22 form in Washington proves financial responsibility for a driver who owns their vehicle and for all vehicles they own. The Washington SR-22 Operators-Owners Certificate combines both types of certificate by covering both the driver and all their vehicles.

Who is Responsible for Filing an SR-22 Insurance Form in Washington?

In Washington, the state does not notify the driver or their insurance company that they need to file a SR-22 insurance form. The driver’s car insurance company is responsible for filing the Washington SR-22 auto insurance form with the Washington Department of Licensing.

How Does a Washington SR-22 Insurance Form Cost Extra?

In most states, a SR-22 processing fee is associated with filing an SR-22 insurance form, but the SR-22 processing fee may be included in the car insurance policy. The best way to find low cost Washington SR-22 car insurance is to get a free online quote!