North Dakota SR-22 Insurance

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rachael Brennan

Licensed Auto Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health in...

Licensed Auto Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

What is North Dakota SR-22 Insurance?

A North Dakota SR-22 car insurance certificate, or financial responsibility insurance form, is a document carried by a motorist as proof that he is financially responsible for maintaining the minimum required car insurance as mandated by law.

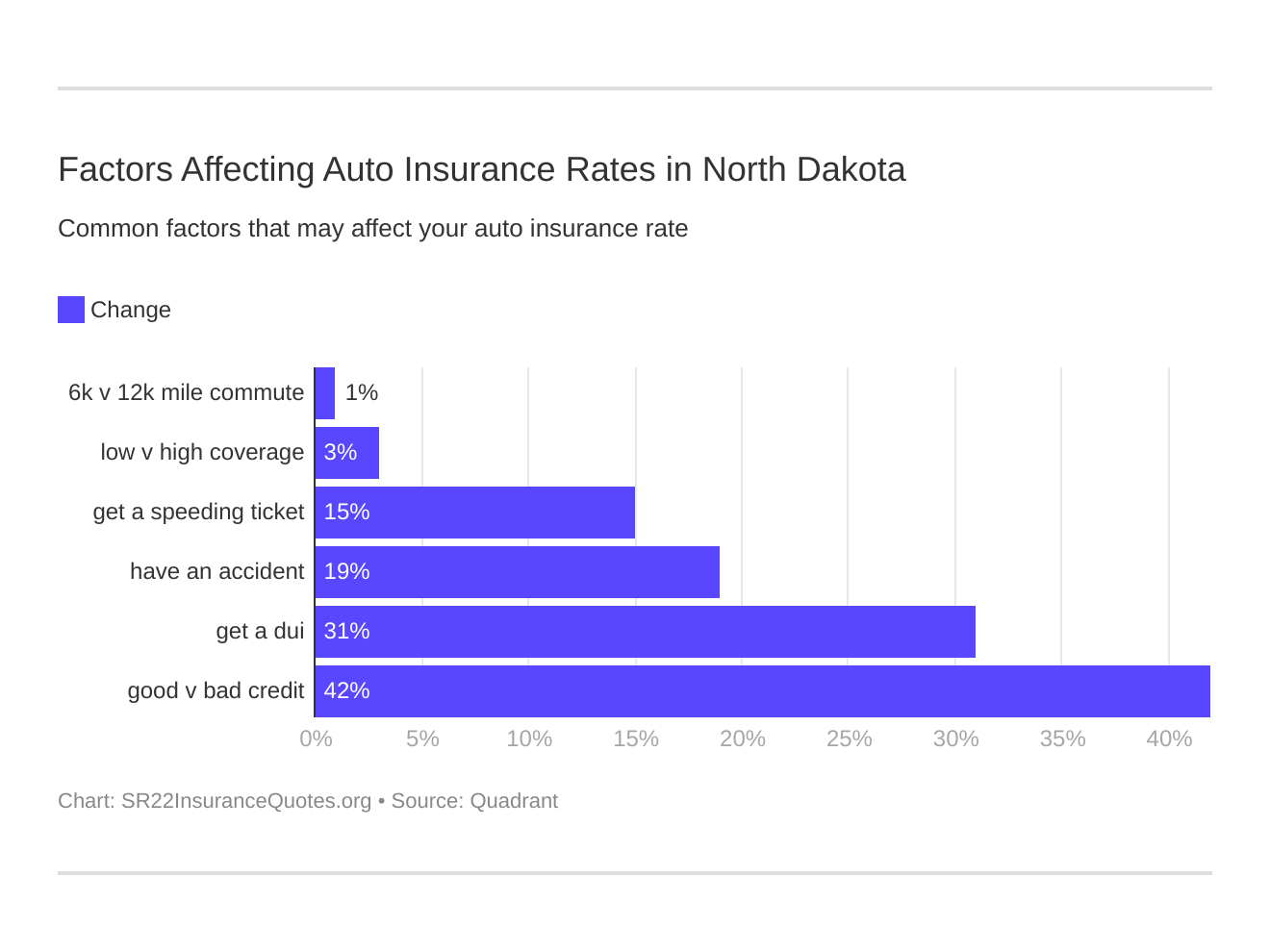

Six major factors affect car insurance rates in North Dakota. Which auto insurance factors will affect SR-22 rates the most? Typically that’s a ND DUI conviction.

Who Needs SR-22 Insurance in North Dakota?

In the state of North Dakota, SR-22 car insurance form must be filed by drivers who lost their driving privileges due to being convicted of driving under the influence of drugs or alcohol, drivers who refused a breath analyzer test, and drivers whose licenses were suspended due to driving while uninsured or some other violation.

Are There Different Types of North Dakota SR-22 Insurance Forms?

There are three types of SR-22 insurance forms for drivers in North Dakota. An Operator SR-22 Certificate covers financial responsibility for drivers who operate but do not own a car. An Owner SR-22 Certificate covers financial responsibility for drivers who own and operate a car. An Operator-Owner SR-22 Certificate covers financial responsibility for all vehicles a driver owns and does not own.

Is SR-22 Car Insurance Required in North Dakota?

In North Dakota, SR-22 car insurance is required if a driver’s license or registration is suspended for any reason. All other drivers must carry liability insurance. Failure to have liability insurance or file a SR-22 with the State can result in a $500 fine and suspension of your license and registration, and you may have to pay a fee to have them reinstated.

How Do I File a North Dakota SR-22 Insurance Form?

Your insurer can file a North Dakota SR-22 auto insurance form with the North Dakota Department of Transportation. There is generally a processing fee, which varies between different car insurance agencies. You can request a quote online from insurance agencies in your area. The insurer must file the SR-22 insurance within 30 days. You should receive a copy of your ND SR-22 insurance certificate along with a letter from the North Dakota DOT once it is accepted. The SR-22 must be maintained for one year and renewed at least 15 days before it expires. If you fail to renew your North Carolina SR-22 car insurance form, the insurer must notify the State, and your driving record is suspended until the SR-22 insurance form is reinstated.