Minnesota SR-22 Insurance

You may need Minnesota SR-22 insurance if you have a DUI, are caught driving uninsured, or are a high-risk driver. The Minnesota SR-22 filing can be done by most car insurance companies.

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rachael Brennan

Licensed Auto Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health in...

Licensed Auto Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

If you’ve been told you need SR-22 insurance, you’re probably a bit confused. What is a Minnesota SR-22 filing, and how do you get one? Do all insurance companies sell Minnesota SR-22 insurance?

SR-22 Minnesota requirements are requested of any driver that has violated certain laws. These include the financial responsibility law (driving without proof of insurance), a DUI, or having multiple tickets. If you need an SR-22 certificate, that may mean you need high-risk car insurance in MN. It can be costly, but in order to maintain your driving privileges, it is necessary.

Read on to learn all there is to know about an SR-22 in Minnesota, and then get MN SR-22 insurance quotes by entering your ZIP code today.

What is the average cost of Minnesota SR-22 Insurance?

How much does it cost to get an SR-22?

SR-22 insurance is more expensive than standard insurance. Minnesota car insurance rates average $112/month. Average rates for Minnesota SR-22 insurance are $217.58.

That means an SR-22 can double your rates, but the biggest factor contributing to hikes in someone’s insurance is a less-than-desirable poor driving record.

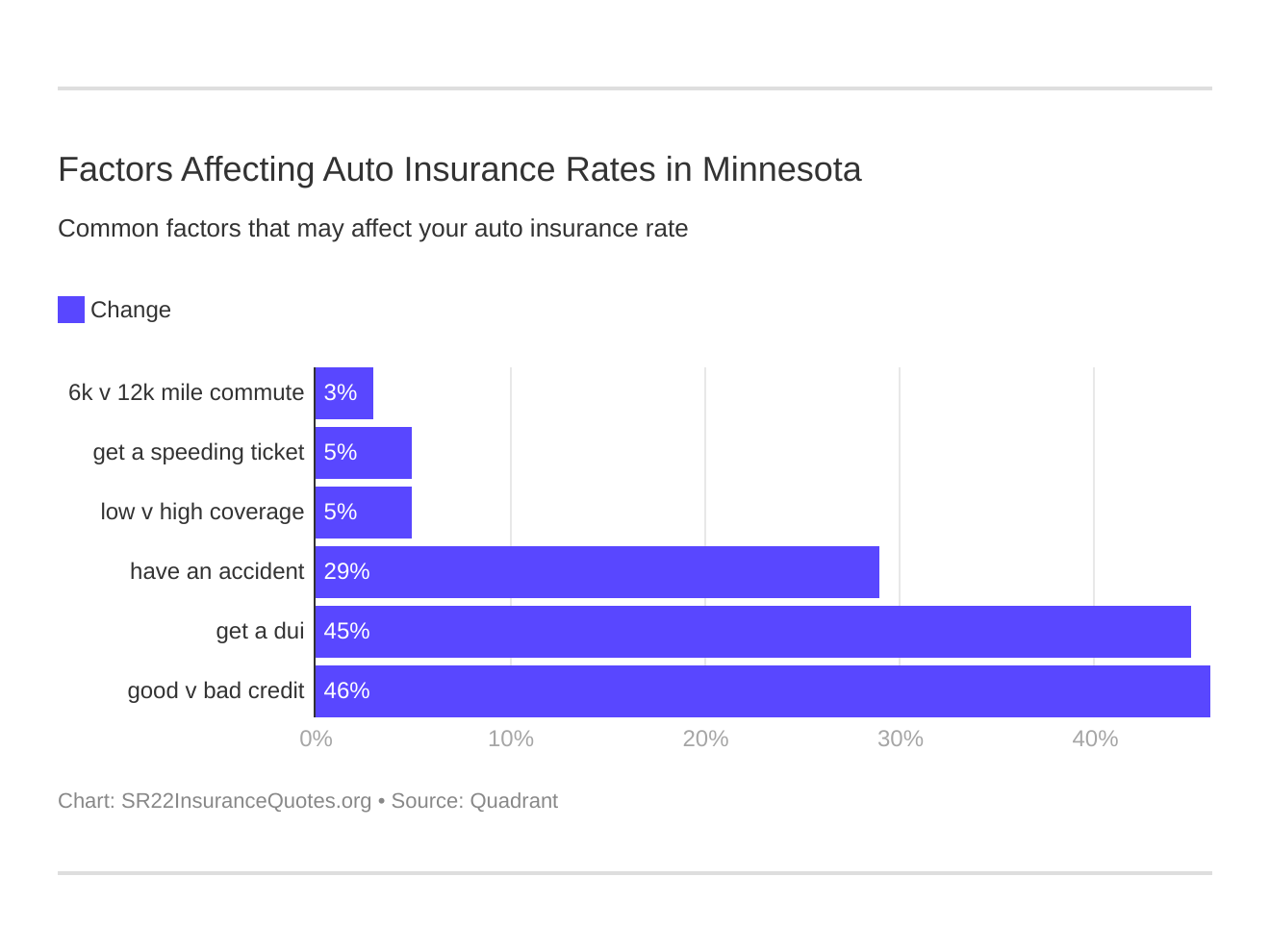

Six major factors affect car insurance rates in Minnesota. Which auto insurance factors will affect SR-22 rates the most? Typically that’s an MN DUI.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

What is Minnesota SR-22 insurance?

So what is SR-22 insurance in MN? And what is an SR-22 filing? An SR-22 is a special form that an insurance company must file with the Minnesota DMV that shows a driver has financial responsibility for any damage caused during the operation of a vehicle. Financial responsibility is met by carrying at least the state’s minimum required auto insurance.

What is MN SR 22 insurance coverage? An SR-22 is a form and not a specific insurance policy. It is filed by the insurance company to show that you have met Minnesota minimum insurance requirements.

Who needs Minnesota SR-22 insurance?

Not all drivers are required to have a Minnesota SR-22 car insurance form on file; it only pertains to people who have exceeded a certain amount of driving violations. This would include drivers that have previously been in an accident and did not have the required insurance, had a judgment against them from a previous auto accident that was never paid, had a coverage lapse in their insurance that was previously reported, or faced a license suspension.

SR-22 insurance is sometimes synonymous with high-risk auto insurance in MN, but it can actually be written by any company. If your driving record is particularly bad, you may need to reach out to a Minnesota high-risk insurance company. These companies specialize in Minnesota SR-22 filings.

How long do you need SR-22 insurance in MN? How do I know if I still need MN SR-22 insurance? You will be informed when its no longer required and how to remove SR-22 insurance in Minnesota. In the meantime, don’t take chances. Keep that filing in place.

Are there different types of Minnesota SR-22 forms?

Yes, there are different types of Minnesota SR-22 auto insurance forms. Motorists that are required to have one but do not have a vehicle must carry an Operator’s Certificate that covers them if they are driving another person’s automobile. An Owner’s Certificate is required when they own a vehicle, and an Operator-Owner’s Certificate covers a motorist if they have multiple cars or are driving one they do not own.

An out-of-state SR-22 form will not be accepted in Minnesota, so you will need to take a period of time to ensure its transfer should you happen to move.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

Is SR-22 insurance required in Minnesota?

Does Minnesota require SR-22 insurance? Only for certain drivers.

The state of Minnesota has mandatory insurance requirements. Any registered auto must have liability coverage of at least $30,000 for injuries to one person, $60,000 for injuries to two or more persons, and $10,000 for property damage. When a driver has been found to not maintain these insurance requirements they will be required to have a Minnesota SR-22 auto insurance form filed on their behalf. Anyone that has had their license suspended will also need one.

How do I file a Minnesota SR-22 insurance form?

Filing an SR-22 is not hard. Any state-licensed insurance agency can fill out the form (found online at the DVS website) and submit it to the Minnesota Department of Public Safety Department of Vehicle Services (commonly called the MN DMV). Once the fee has been paid the form will be sent. You will receive a copy within thirty days. You can get a quote on what the fee for your Minnesota SR-22 car insurance premium will be by entering your information.

Does GEICO sell SR-22 insurance? Does State Farm carry SR-22 insurance, and can you get it from Progressive? You will need to call the company directly to find out if they will insure you and if they can file the MN SR-22 insurance form on your behalf.

If you need non-owner SR-22 insurance in Minnesota, you may have to shop around a bit more, as fewer companies offer it. It may also be referred to as an operator’s policy SR-22.

Now that you know what it is, get cheap SR-22 insurance in MN by entering your ZIP code below for rates.