Oklahoma SR-22 Insurance

An SR-22 insurance form must be filed by drivers whose driving privileges have been suspended or revoked for reasons such as DUI/DWI convictions, traffic violations or driving while uninsured. Oklahoma SR-22 insurance is not required.

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rachael Brennan

Licensed Auto Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health in...

Licensed Auto Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

What is Oklahoma SR-22 Insurance?

An SR-22 car insurance certificate, or financial responsibility insurance form, is a document carried by a motorist as proof that he is financially responsible for carrying the minimum required amount of car insurance mandated by law for the state in which they drive. Oklahoma SR-22 insurance is not required.

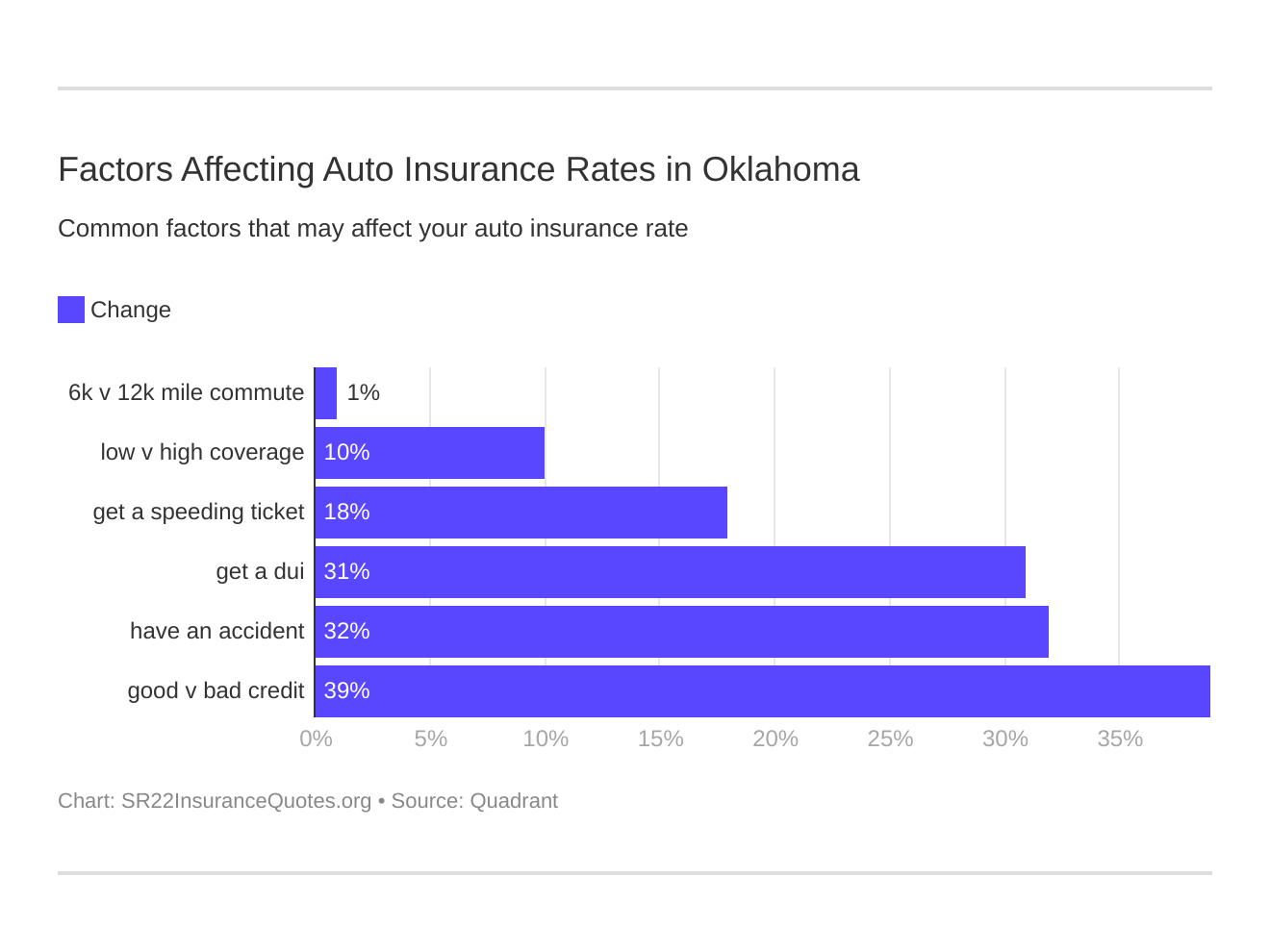

Six major factors affect car insurance rates in Oklahoma. Which auto insurance factors will impact SR-22 rates the most? Typically, that’s an OK DUI.

Who needs SR-22 Insurance in Oklahoma?

An Oklahoma SR-22 insurance form must be filed by drivers whose driving privileges have been suspended or revoked for reasons such as DUI/DWI convictions, traffic violations or driving while uninsured. Failure to carry liability insurance or file an SR-22 will result in a $500 fine and suspension or your drivers’ license and registration.

Are there different types of Oklahoma SR-22 auto insurance forms?

Typically, there are three different types of SR-22 car insurance forms: Operator, Owner and Operator-Owner. Operator’s SR-22 insurance covers drivers that operate but do not own a car. Owner’s SR-22 insurance covers drivers that own and operate a car. Operator’s-Owner’s SR-22 insurance covers all vehicles owned or not owned by a driver.

Is SR-22 car insurance required in Oklahoma?

Drivers in the state of Oklahoma must carry liability insurance, but filing of a form for SR-22 insurance in Oklahoma is not a state requirement. Drivers who are required to file a SR-22 in another state should do so according to that state’s insurance laws. Suspension of your driver’s license in another state could result in the loss of driving privileges in the state of Oklahoma.

How do I file an SR-22 car insurance form?

If you live in another state besides Oklahoma, SR-22 filing is usually filed by your auto insurance company. You will have to pay a filing fee, which varies among agencies. You can go online to request a free SR-22 auto insurance quote from state-authorized agencies in your area. Your insurer will forward the SR-22 car insurance form to you once your filing is accepted by the state. You must maintain the Oklahoma SR-22 insurance form for one to three years, depending on the insurer, and renewed in a timely manner. If your SR-22 lapses, the insurer must notify the state. Your driving record is then suspended until the SR-22 auto insurance coverage is reinstated.

Oklahoma SR-22 Insurance: The Bottom Line

Even though Oklahoma doesn’t require its drivers to have an SR-22 form, if you’re a driver in Oklahoma, and you’re moving to a state that requires SR-22 insurance, you may need to have SR-22 insurance in your new state. A SR-22 certificate is required in a few scenarios in order for you to get your license reinstated. SR-22s are required after you’ve committed certain violations of the law. You may even be required to have SR-22 insurance in Oklahoma if you’ve had a series of small violations within a short span of time.

Like most states, Oklahoma requires all cars to have certain limits of car insurance. If drivers don’t have car insurance, it’s illegal for them to drive. Among many other penalties for driving without insurance, drivers must pay a fine of up to $250 as well as administrative fees and fees to get their license and/or vehicle registration reinstated. You may also face jail time if you fail to meet the minimum coverage requirements.