New Hampshire SR-22 Insurance for 2024

New Hampshire SR-22 insurance can cost drivers $15-$25 just to file an NH SR-22 insurance form. Although auto insurance in New Hampshire isn’t mandatory, SR-22 insurance in New Hampshire can be required in some cases, such as being convicted of a DUI or having your license suspended.

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rachael Brennan

Licensed Auto Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health in...

Licensed Auto Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

- New Hampshire does not require drivers to have car insurance

- New Hampshire SR-22 insurance can be required for various reasons, including being convicted of a DUI

- The SR-22 form itself isn’t very expensive, but your car insurance rates will be much higher

Finding the best New Hampshire SR-22 Insurance can be time-consuming and difficult to navigate. We’ve created this comprehensive guide to tell you everything you need to know about finding the right SR-22 auto insurance in New Hampshire.

Car insurance in New Hampshire isn’t mandatory, but drivers may be required to have SR-22 insurance in New Hampshire under certain circumstances.

What is New Hampshire SR-22 insurance, and when is it needed? We go into detail about what an SR-22 in New Hampshire is, why you might need it, how to get it, and how to find cheap SR-22 insurance rates.

Need to buy New Hampshire SR-22 insurance? You can get New Hampshire SR-22 insurance quotes with our online quote tool. Enter your ZIP code now to find the best New Hampshire SR-22 insurance rates near you.

Is SR-22 auto insurance required in New Hampshire?

What is SR-22 car insurance and what does it cover?

SR-22 insurance forms are documents to verify that a person holds financial responsibility in the event of an accident. The SR-22 form proves continuous coverage is and will be maintained by the motorist for a certain amount of time.

Do you need car insurance in New Hampshire?

Since New Hampshire doesn’t require auto insurance for every driver, they will notify you in writing if you require an SR-22.

If you are notified, your car insurance provider will have to file a New Hampshire SR-22 auto insurance form as proof that you, the driver, are carrying at least auto insurance liability in the event you cause an accident.

According to the New Hampshire DMV, if you choose not to carry car insurance and are in an accident, you may be required to file SR-22 insurance to show NH DMV financial responsibility. Also, if you have your license suspended or revoked, or have been convicted of DWI, you will have to have SR-22 insurance in New Hampshire.

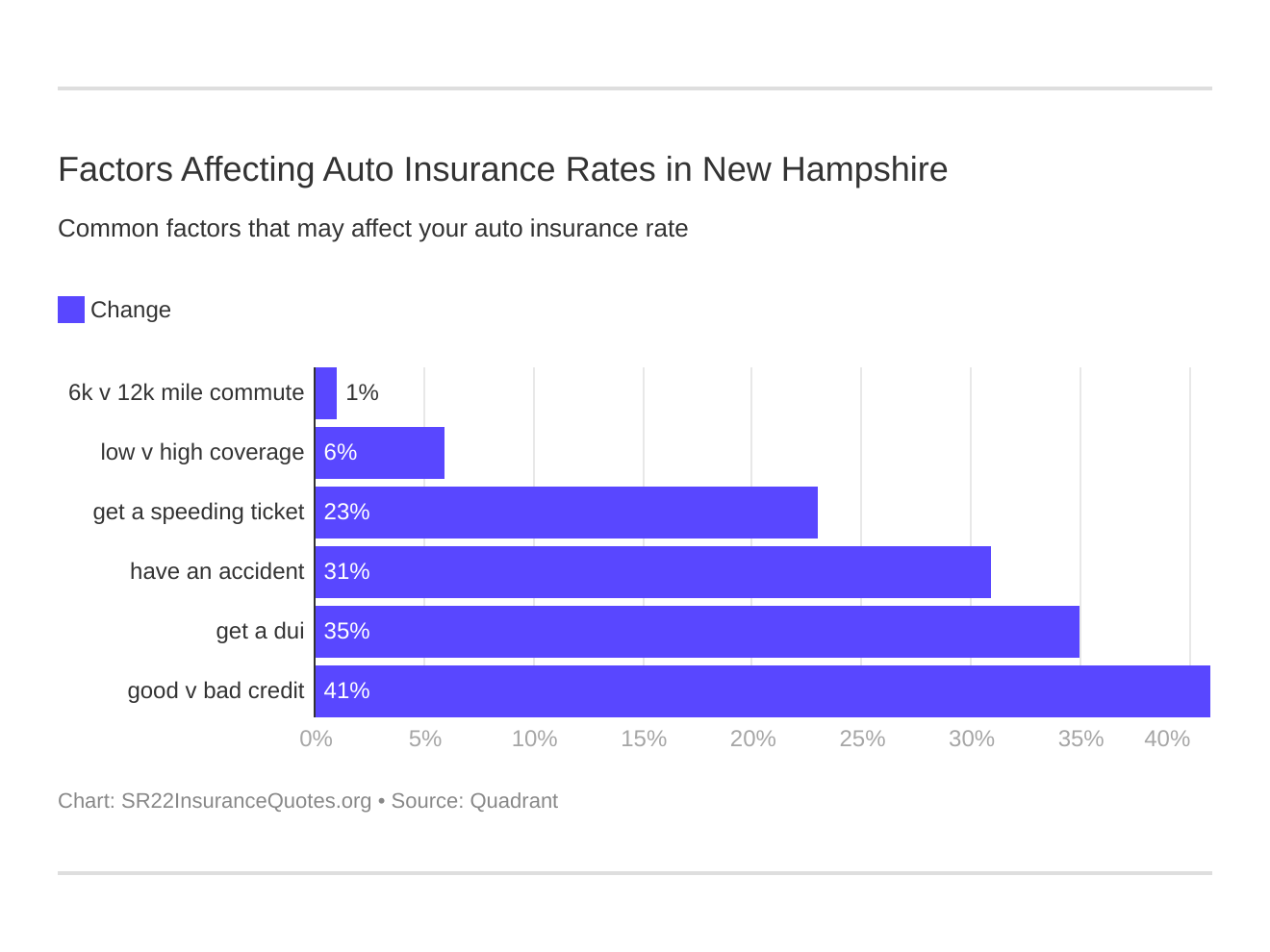

Six major factors affect car insurance rates in New Hampshire. Which auto insurance factors will affect SR-22 rates the most? Typically, that’s an NH DUI conviction.

You can see other factors like credit rating and type of coverage all affect your rates. Some factors, such as your driving record, are up to you and can be improved for better car insurance rates. Other factors, like your age, are out of your control.

Having a clean driving record can lower your car insurance rates immensely. Pay attention when driving and learn better driving habits to keep more of your money.

How does an SR-22 change your rates with auto insurance companies in New Hampshire?

It should be obvious that your driving record will affect your car insurance rates. If you’re driving record shows you have risky behaviors like speeding, insurance companies are going to charge you more since you are more likely to be in an accident. The riskier driving, the higher the car insurance.

Your NH driving record affects your auto insurance rates. Risky driving will also lead to NH SR-22 being required.

| Companies | Clean Record | One Speeding Violation | One Accident Violation | One DUI Violation |

|---|---|---|---|---|

| GEICO | $1,437.50 | $1,437.50 | $1,590.83 | $1,980.83 |

| USAA | $1,483.03 | $1,724.12 | $1,996.60 | $2,480.96 |

| Nationwide | $1,914.01 | $2,129.05 | $2,657.49 | $3,249.78 |

| State Farm | $2,013.89 | $2,013.89 | $2,157.23 | $2,562.23 |

| Allstate | $2,276.40 | $2,655.21 | $3,095.98 | $2,923.20 |

| Progressive | $2,312.48 | $2,711.71 | $3,190.12 | $2,550.23 |

| Liberty Mutual | $5,324.37 | $9,084.16 | $9,624.42 | $9,874.47 |

GEICO is the company with the cheapest rates if you have any tickets, and Liberty Mutual is the most expensive. Poor driving habits can cost you thousands of dollars every year.

Driving safely and obeying traffic laws are easy ways to keep more money in your pocket.

Who needs New Hampshire SR-22 insurance?

There are many reasons someone would need SR-22 insurance in New Hampshire.

In New Hampshire, those who have been in crashes that resulted in injury, death, or property damage resulting in excess of one thousand dollars are required to file a NH SR-22 auto insurance form, if they did not have adequate liability coverage at the time.

Also, those who are convicted of driving while intoxicated (DWI) and/or have license suspensions or revocations will need to file. Scroll down to learn more about New Hampshire DUI laws and how they can affect your car insurance rates.

Even though car insurance isn’t required in New Hampshire, if you are in an accident and do not have car insurance, you will have to provide proof that you can cover the required amounts for property damage and bodily injury. If you can’t supply that proof, you may have to file SR-22 insurance in NH to show that you are covered going forward.

How much is New Hampshire SR-22 insurance?

Filing for SR-22 insurance in NH can cost $15-$25 depending on your age, gender, driving history, and credit score. However, this fee may be tacked onto the driver’s rates.

Does SR-22 raise your insurance? Yes, it can.

If SR-22 is required, your auto insurance provider might consider you a high-risk driver. High-risk car insurance rates run higher than low-risk driving rates, and they will be influenced by your age, gender, driving history, and credit score, too.

Take a look at this table to see the average rates of high-risk car insurance in New Hampshire:

| Average Monthly High-Risk Insurance Rate | Average Monthly Rate with DUI/DWI | Average Monthly Rate with Speeding Violation |

|---|---|---|

| $110 | $146 | $168 |

Remember, these rates are just the average car insurance costs for high-risk policies in New Hampshire. Why you need an SR-22 will affect your individual car insurance price, because not every SR-22 will increase your risk, and not every high-risk driver will need an SR-22.

How long do you need New Hampshire SR-22 insurance?

If you’re required to file an SR-22, coverage must be carried for a minimum of 3 years. Those on a second offense DWI will have to remain covered for 5 years. Depending on your driving record, how long you need an SR-22 may vary.

Can you be denied New Hampshire SR-22 Insurance?

No, in New Hampshire, auto insurance companies are required to offer you coverage. You can’t be denied SR-22 coverage by your car insurance company, but they can still charge you more as a high-risk driver.

Can you appeal the New Hampshire SR-22 Insurance requirement?

Yes, you can hire an attorney and fight the requirements. You would need to find a law firm that handles traffic law to appeal the decision.

If you are issued a relief filing, your auto insurance company will be notified.

If your NH SR-22 requirement stands, you will have to abide by the restrictions for the duration of the required time period.

What are the different types of New Hampshire SR-22 forms?

The State of New Hampshire recognizes three types of New Hampshire SR-22 car insurance forms. Those would be the Owner Certificate, the Operator Certificate, and the Owner-Operator Certificate.

The Owner’s Certificate is meant for those who do own vehicles, the Operator’s for those who do not but still drive, and the Owner-Operator’s Certificate is intended for those who own vehicles but may drive vehicles that they do not own.

How do you file a New Hampshire SR-22 auto insurance form?

Your best SR-22 insurance filing option is to contact your insurance agent. New Hampshire requires that all SR-22 insurance forms be filed by an authorized insurance agency. The insurer will then file the form with the Bureau of Financial Responsibility of the Department of Safety.

Motorists must contact the insurance company to file the form, and this may require a small fee.

What is non-owner NH SR-22 auto insurance?

If your New Hampshire driver’s license is suspended or revoked, you will need to file a NH SR-22 if you want it reinstated, even if you don’t actually own a car. You would file what is called non-owner SR-22 insurance in order to reinstate your driving privileges.

The New Hampshire DMV may also refer to this kind of SR-22 as an “Operator SR-22”. This kind of SR-22 insurance means you are allowed to operate a motor vehicle but aren’t allowed to own or register a motor vehicle. Your car insurance company may use different terminology than the DMV, so make sure to clarify with your local agent if you have any questions.

Will NH SR-22 insurance affect your New Hampshire boat trailer registration?

Depending on your insurance provider and why you need an SR-22, you might not be able to insure or register other vehicles in New Hampshire. If you are filing for non-owner SR-22 insurance in NH, you won’t be able to register any other vehicles, including boats and boat trailers.

If you are applying for an SR-22 and you own a car and other vehicles, it will be up to your insurance provider to decide whether your risk influences your ability to insure boats and other vehicles. Contact a car insurance agent near you to find out more.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

Who are the cheapest auto insurance companies in New Hampshire?

Now we are going to get the part you’ve been waiting for. Which company will give you the most bang for your buck? This table shows you the eight cheapest companies in New Hampshire and their average rates.

| Companies | Average Annual Rates | Compared to State Average | % Difference |

|---|---|---|---|

| GEICO | $1,611.67 | -$1,547.32 | -96.01% |

| USAA | $1,921.18 | -$1,237.81 | -64.43% |

| State Farm | $2,186.81 | -$972.18 | -44.46% |

| Nationwide | $2,487.58 | -$671.41 | -26.99% |

| Progressive | $2,691.13 | -$467.86 | -17.39% |

| Allstate | $2,737.70 | -$421.29 | -15.39% |

| Safeco | $8,476.85 | $5,317.87 | 62.73% |

| State Average | $3,158.99 | $0.00 | 0.00% |

GEICO has the cheapest rates for car insurance in New Hampshire, at almost half of the state average of $3,158.99. That is a huge saving every year.

USAA comes in second but is only available to the military and their family members.

Keep in mind, these rates are not for high-risk drivers or drivers with a NH SR-22. Those rates will be much higher, as shown above.

What are the New Hampshire DWI laws and penalties?

New Hampshire considers you to be driving while impaired if you have a blood alcohol content of 0.08 percent or higher or are under the influence of various drugs that impair your ability to drive.

Penalties will depend on if it is your first, second, or third offense. Penalties include:

- First offense: Fine of $500-$1,200 and a license suspension of nine months to two years

- Second offense: at least 17 days in jail, $750-$2,000 fine, and three years license suspension

- Third offense: six months to two years in jail, $750-$2,000 fine, and lifetime driver’s license revocation

New Hampshire has an implied consent law also. That means that when you drive in the state, you consent to be tested for DWI. If you refuse the test, your driver’s license will automatically be suspended for 180 days.

What are the New Hampshire minimum auto insurance requirements?

New Hampshire is one of the few states that does not require that a driver carry car insurance. However, if you choose not to carry insurance, you are personally responsible for damages.

Many companies offer car insurance coverage in New Hampshire, so it’s important to shop around for the coverage that fits your specific needs.

If you do choose to carry car insurance in New Hampshire, you must meet these liability coverage minimums:

- $25,000 for bodily injury for one person

- $50,000 for bodily injury for multiple people

- $25,000 for property damage

Remember, minimum liability car insurance only covers damages to property and people not in your vehicle. You may want to add additional coverage to make sure you are covered in any eventuality.

Although it is not required, most people realize the importance of having insurance anyway. That’s why only less than 10 percent of the population in New Hampshire drives without insurance.

If you choose to carry car insurance in New Hampshire, then you must also carry medical payments and uninsured/under-insured motorist coverage.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

New Hampshire SR-22 Insurance for 2022: The Bottom Line

If you’re convicted of a DUI or a DWI in New Hampshire and you don’t have an SR-22, you may be required to get one. SR-22 insurance policies and standard insurance coverage are basically the same, but high-risk violations often result in increased insurance premiums.

Your New Hampshire SR-22 insurance must not lapse; failure to pay your premium will result in an invalid NH SR-22 and a suspended license.

Are you currently paying more or less than the state average? It is definitely worth getting quotes from multiple companies to make sure you are getting the best deal out there for an auto insurance policy.

Whether you need affordable New Hampshire SR-22 insurance or just want to compare rates, we can help. Enter your ZIP code below to get started comparing New Hampshire SR-22 insurance company options.