Montana SR-22 Insurance

SR-22 insurance in Montana averages $286 per month. Montana SR-22 insurance is required for drivers who are high-risk, usually due to moving violations, as proof of coverage financial responsibility

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rachael Brennan

Licensed Auto Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health in...

Licensed Auto Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

SR-22 insurance in Montana is $3,427 per year or $286 per month. SR-22 insurance costs can be more expensive from different car insurance companies. Read through this guide to get more information on Montana SR-22 insurance.

Start comparing Montana SR-22 insurance with car insurance in your local area by entering your ZIP code in the FREE comparison tool!

What is Montana SR-22 insurance?

Montana SR-22 car insurance is one way the state of Montana is able to keep track of drivers that have not continuously proven financial responsibility by having car insurance. It is also required for “high-risk” drivers.

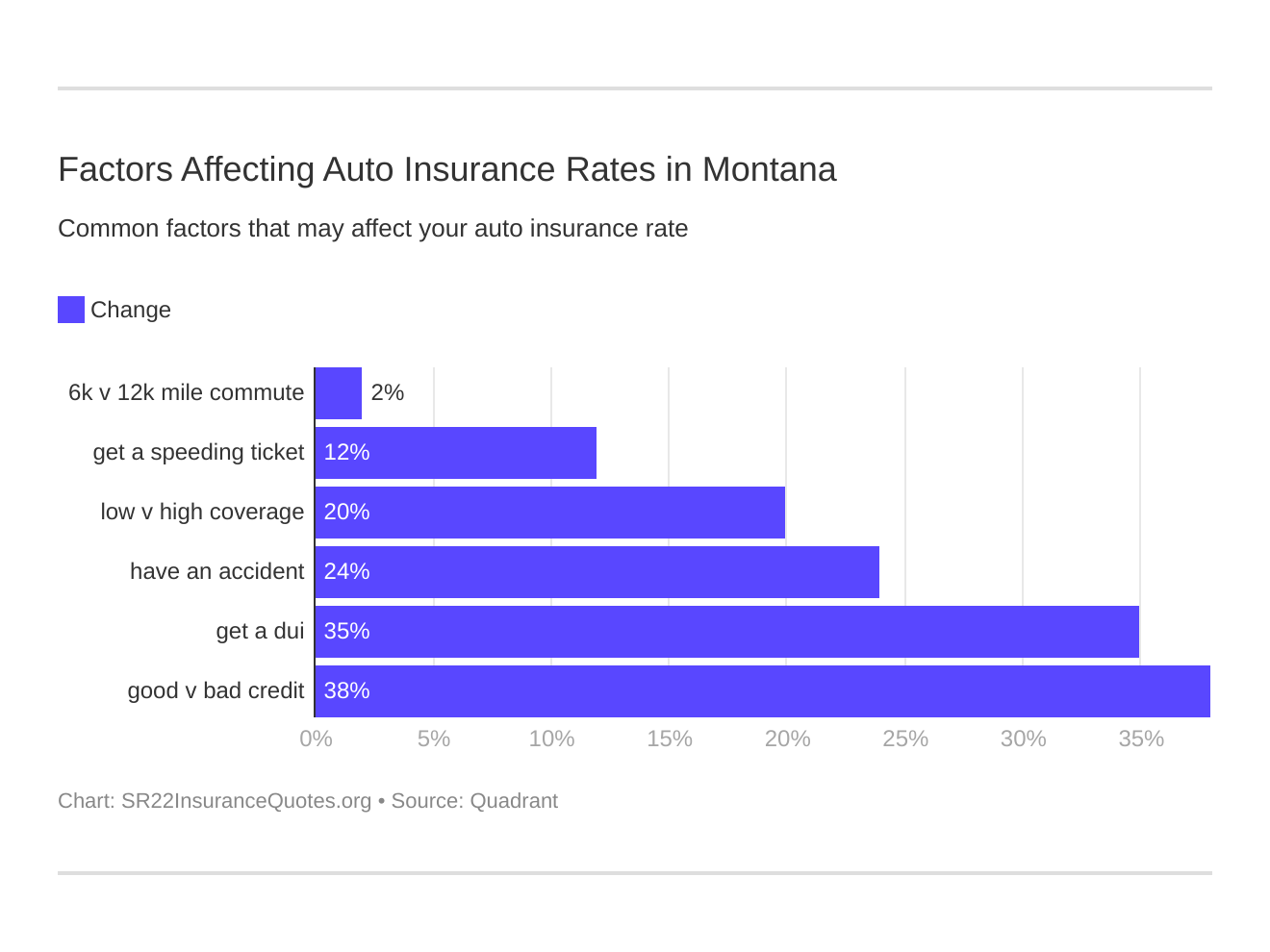

Six major factors affect car insurance rates in Montana. Which auto insurance factors will affect Montana SR-22 insurance rates the most? Typically that’s a MT DUI convictions.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

Who Needs SR-22 insurance in Montana?

Any driver that has had a lapse in their car insurance policy will be required to keep a Montana SR-22 car insurance form on file with the State for three years. In addition, any driver that has received a DUI offense or has had their license suspended for too many moving violations will also be required to carry Montana SR-22 auto insurance.

Let’s look at the average annual rates from the top car insurance companies in Montana based on driving records.

| Company | Average Annual Rates With Clean Record | Average Annual Rates With 1 Speeding Violation | Average Annual Rates With 1 Accident | Average Annual Rates With 1 DUI |

|---|---|---|---|---|

| Liberty Mutual | $904 | $1,260 | $1,571 | $1,571 |

| USAA | $1,531 | $1,868 | $1,902 | $2,827 |

| State Farm | $2,256 | $2,418 | $2,580 | $2,418 |

| GEICO | $2,316 | $2,767 | $3,665 | $5,662 |

| Nationwide | $2,526 | $3,051 | $3,638 | $4,698 |

| Farmers | $3,434 | $3,434 | $4,437 | $4,326 |

| Progressive | $3,740 | $4,147 | $4,820 | $4,616 |

| Allstate | $3,925 | $4,485 | $4,642 | $5,635 |

USAA is usually the cheapest car insurance company, but Liberty Mutual has taken the place as the cheapest car insurance company in Montana. Under Montana SR-22 insurance, you can pay up to $5,700 per year for car insurance.

How much does Montana SR-22 insurance cost a month?

Based on the information in the previous section, Montana SR-22 insurance can cost up to $475 per month. That’s based on car insurance rates from the biggest car insurance companies in Montana. On average, you can pay $268 per month.

Find out how much you’ll pay for car insurance by entering your ZIP code in the FREE comparison tool!

Are there different types of Montana SR-22 forms?

There are three different Montana SR-22 auto insurance forms that can be filed. One is the Operator’s Certificate. This is filed when a driver does not own a motor vehicle. The second type is filed when the driver does own a vehicle; this is the Owner’s Certificate. If the driver owns more than one vehicle the Operator-Owner’s Certificate is used.

Is SR-22 insurance required in Montana?

The simple answer is yes. If a driver falls into one of the categories that require it, then they must file. The minimum insurance requirement is $25,000 for one person’s injuries, $50,000 for two or more persons injured, and $10,000 for property damage.

Compare car insurance rates from companies in your local area by entering your ZIP code in the FREE comparison tool!

How do I file a Montana SR-22 insurance form?

To file an SR-22 in the state of Montana you will need to request one from your insurance company. They will charge as an additional fee to your insurance policy and send the form to the Secretary of State within 30 days. To get a free quote on the fee for a Montana SR-22 insurance enter your information.

Do I need an SR-22 in Montana to reinstate my license?

Yes. You will need to have Montana SR-22 insurance to reinstate your license. This could be one of the conditions for reinstating a suspended license. Expect this from the state law if you’ve been convicted of a DUI or if you’ve been multiple accidents.

Enter your ZIP code in our FREE comparison tool to start comparing SR-22 insurance rates in your local area!

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

Montana SR-22 Insurance FAQs

For the final section of this guide, we’ll cover frequently asked questions you see in search engines across the web. In addition to things people ask about Montana SR-22 insurance, we’ll cover other related searches.

You can skip these questions and enter your ZIP code to start comparing Montana SR-22 insurance using our FREE comparison tool below!

What is SR-22 insurance?

SR-22 is a certificate of insurance that proves you carry car insurance as a high-risk driver. SR-22 car insurance is more expensive than voluntary car insurance. Out-of-state SR-22 drivers should alert the DMV if they plan to change residency to avoid any penalties.

Does Allstate offer SR-22 insurance?

Yes. Allstate offers car insurance for high-risk drivers even if you are required to carry an SR-22 form.

Is motorcycle insurance required in Montana?

No. Motorcycle insurance is not required in the state of Montana. You can get motorcycle insurance as long as it meets the minimum insurance requirements for vehicles.

Can I get my license back without SR-22?

No. One of the conditions to getting your license reinstated is getting SR-22 insurance. The car insurance companies and state government will need proof that you’re doing your due diligence to respond appropriately to violations you’ve committed as a motorist.

What is Serenity Insurance?

Serenity Insurance is a car insurance company located in Spokane, Washington with a 3.6 rating on Google Reviews.