Mississippi SR-22 Insurance

Mississippi SR-22 insurance can be required for three years if you have a DUI or choose to drive while being uninsured. The biggest contributing factor to the cost of SR-22 insurance in Mississippi is your driving record.

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rachael Brennan

Licensed Auto Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health in...

Licensed Auto Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

- SR-22 insurance is a form from your car insurance company that tells the state that you are carrying at least the minimum amount of insurance required

- There are multiple reasons you can be required to carry Mississippi SR-22 insurance

- Your car insurance rates will greatly increase if you are required to have SR-22 insurance in Mississippi

An SR-22 in Mississippi is a required form in certain circumstances. If you’ve been caught driving without car insurance, have been convicted of a DUI, or have committed multiple driving violations, then you can be required to file the Mississippi SR-22 insurance form.

Even if you have to have SR-22 car insurance in Mississippi, you can still shop around to get the best deals. Enter your ZIP to compare auto insurance quotes for Mississippi drivers with or without an SR-22 insurance Mississippi requirement.

Mississippi SR-22 Insurance

A Mississippi SR-22 car insurance form is a special insurance form that is filed with the DPS to ensure that a driver carries the state’s minimum required liability insurance on their motor vehicle. This is the state’s way of being certain that high-risk drivers maintain their coverage.

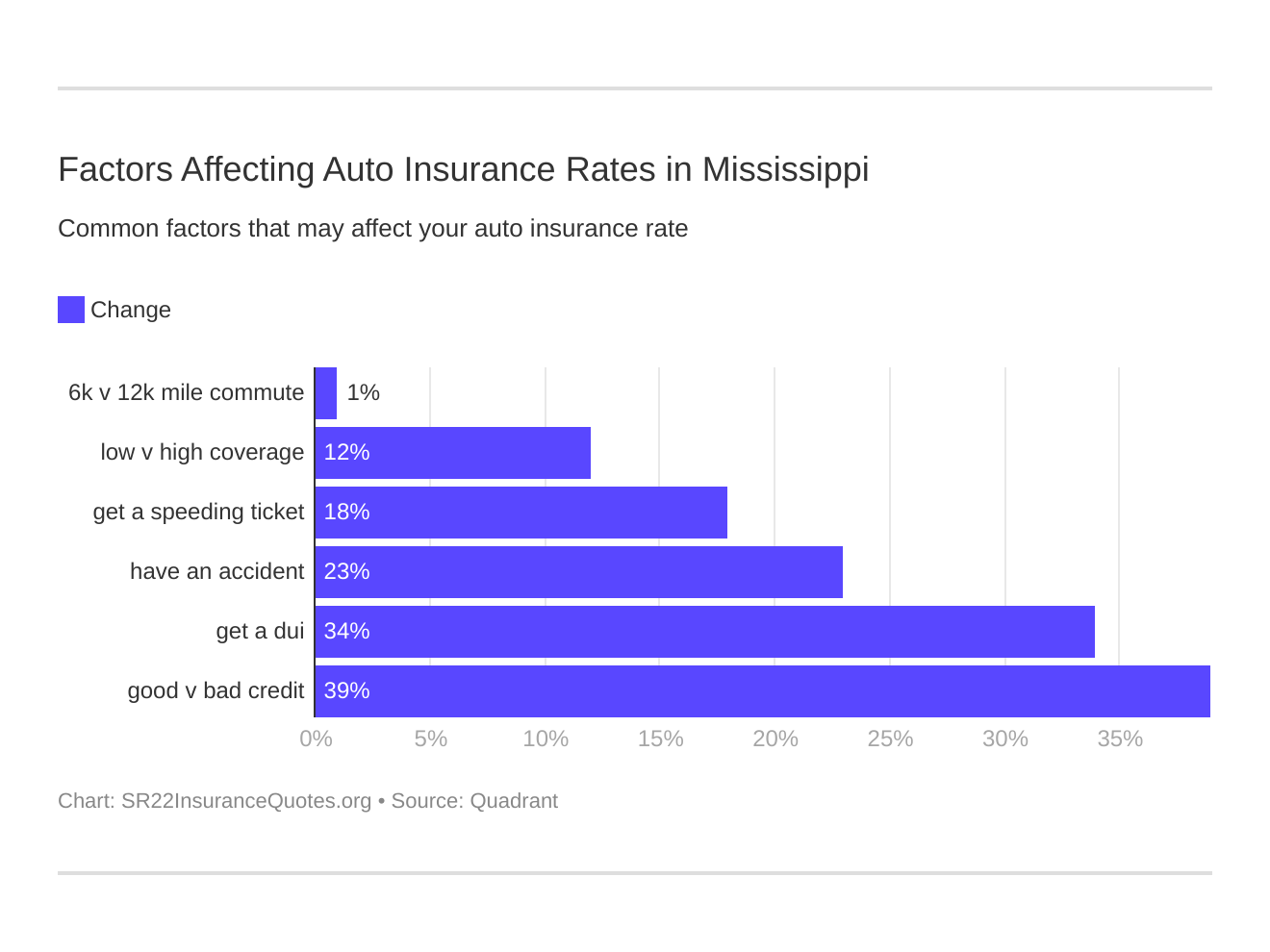

Six major factors affect car insurance rates in Mississippi. Which auto insurance factors will affect SR-22 rates the most? Typically, it is an MS DUI.

Let’s look at how a DUI affects Mississippi SR-22 insurance costs. This table shows you how your insurance rates will rise based on your driving history.

| Company | Clean Record | Average Annual Rates with 1 Speeding Ticket | Average Annual Rates with 1 Accident | Average Annual Rates with 1 DUI |

|---|---|---|---|---|

| Allstate | $4,169.28 | $4,726.86 | $4,912.99 | $5,956.24 |

| GEICO | $2,541.48 | $4,078.45 | $3,856.26 | $5,869.23 |

| Liberty Mutual | $3,162.70 | $4,442.21 | $5,046.99 | $5,170.33 |

| Nationwide | $2,202.58 | $2,438.23 | $2,809.29 | $3,574.60 |

| Progressive | $3,692.78 | $4,338.27 | $4,952.25 | $4,267.10 |

| State Farm | $2,707.79 | $2,949.82 | $3,312.87 | $2,949.82 |

| Travelers | $3,260.37 | $3,558.80 | $3,413.50 | $4,688.01 |

| USAA | $1,605.19 | $1,785.46 | $2,050.45 | $2,783.92 |

How much does an SR-22 cost per month?

The monthly average for a Mississippi driver with a clean driving record is $243 but one DUI jumps the monthly average to $367. That’s an extra $124 a month, which is far from the lowest rates that a driver should see.

You’re driving record isn’t the only thing that influences whether or not you will be able to find affordable car insurance. Watch this video to learn what else companies look at to calculate your rates.

According to Experian, the average credit score in the US is 703, which is considered a good score. However, the average score in Mississippi is 667, which is considered fair.

Improving your credit score and driving safely are two factors that you can work on to decrease your auto insurance rates.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

Who needs Mississippi SR-22 car insurance?

How long do you have to keep SR-22 insurance in Mississippi?

The SR-22 insurance Mississippi requirements are that any motorist that has been caught without adequate liability insurance or anyone convicted of a DUI have a Mississippi SR-22 car insurance form on file for at least 36 months.

How long does an SR-22 stay on your record? Generally, a driver can remove the SR-22 certificate from their insurance record after the required three years are met.

Different Types of Mississippi SR-22 Insurance Forms

There are three different types of SR-22 certificates in the state of Mississippi.

The operator’s certificate is for a person that drives but does not have a vehicle. This would come into play if you borrow a car from a friend or family member. This is also called non-owner SR-22 insurance.

The owner’s certificate is used when a motorist requires one has a licensed vehicle.

An operator-owner’s Certificate is used when the driver has more than one automobile. An example would be if you have multiple cars in your household and there is a chance you may drive more than just one.

Mississippi SR-22 Auto Insurance Requirement

Do you need car insurance in Mississippi? Yes, it is illegal to drive with no car insurance in Mississippi. The penalty for no car insurance in Mississippi includes a $1,000 fine and possible loss of driving privileges that come with a license suspension.

The Insurance Information Institute shows that in 2015 uninsured drivers made up around 13 percent of drivers nationwide. However, in Mississippi, there were around 24 percent of uninsured drivers. That is over 10 percent higher than the national average.

Mississippi SR-22 laws require any driver that has had a DUI or has failed to maintain auto insurance in the past three years to have an MS SR-22 car insurance form filed proving they are maintaining the state’s minimum required insurance coverage or have a bond deposited with the State Treasurer in the amount of $50,000.

The minimum liability insurance required covers up to $25,000 per person per single accident, $50,000 per accident for bodily injury, and $25,000 per accident for property damage. A driver may choose to keep an additional bond of $30,000 to $50,000 in lieu of the Mississippi SR-22 auto insurance.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

How to File a Mississippi SR-22 Insurance Form

The SR-22 filing must be done by your current insurance company with the DPS. This is not something you can hand carry. To get SR-22 insurance in Mississippi, you need to request it from your auto insurance carrier and pay the price of the associated fee.

You can get a free online SR-22 insurance quote for Mississippi drivers by entering your information. Just enter your ZIP to find the cheapest SR-22 insurance in Mississippi.