Alabama SR-22 Insurance

The SR-22 is needed for drivers in Alabama who are under mandatory insurance supervision and drivers who have had their licenses revoked. Additionally, those who are considered high risk, such as those who have had a DUI or other reckless driving issues, will also need to file an Alabama SR-22.

Free High-Risk Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rachael Brennan

Licensed Auto Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health in...

Licensed Auto Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

What Is Alabama SR-22 Car Insurance?

An Alabama SR-22 car insurance form is often referred to as a SR-22 Financial Responsibility Insurance Form. This is a special insurance form that will reveal to Alabama authorities that the owner or driver of the vehicle is fiscally responsible for maintaining continuous car insurance and meeting the minimum liability insurance requirements as outlined by the state. Both the insurance company and the driver or owner of the motor vehicle will need to file an SR-22 form with the Alabama Department of Public Safety. This is to ensure that the department of motor vehicles can be confident that those on its roadways are safe and insurance will be in place, in the event of an accident.

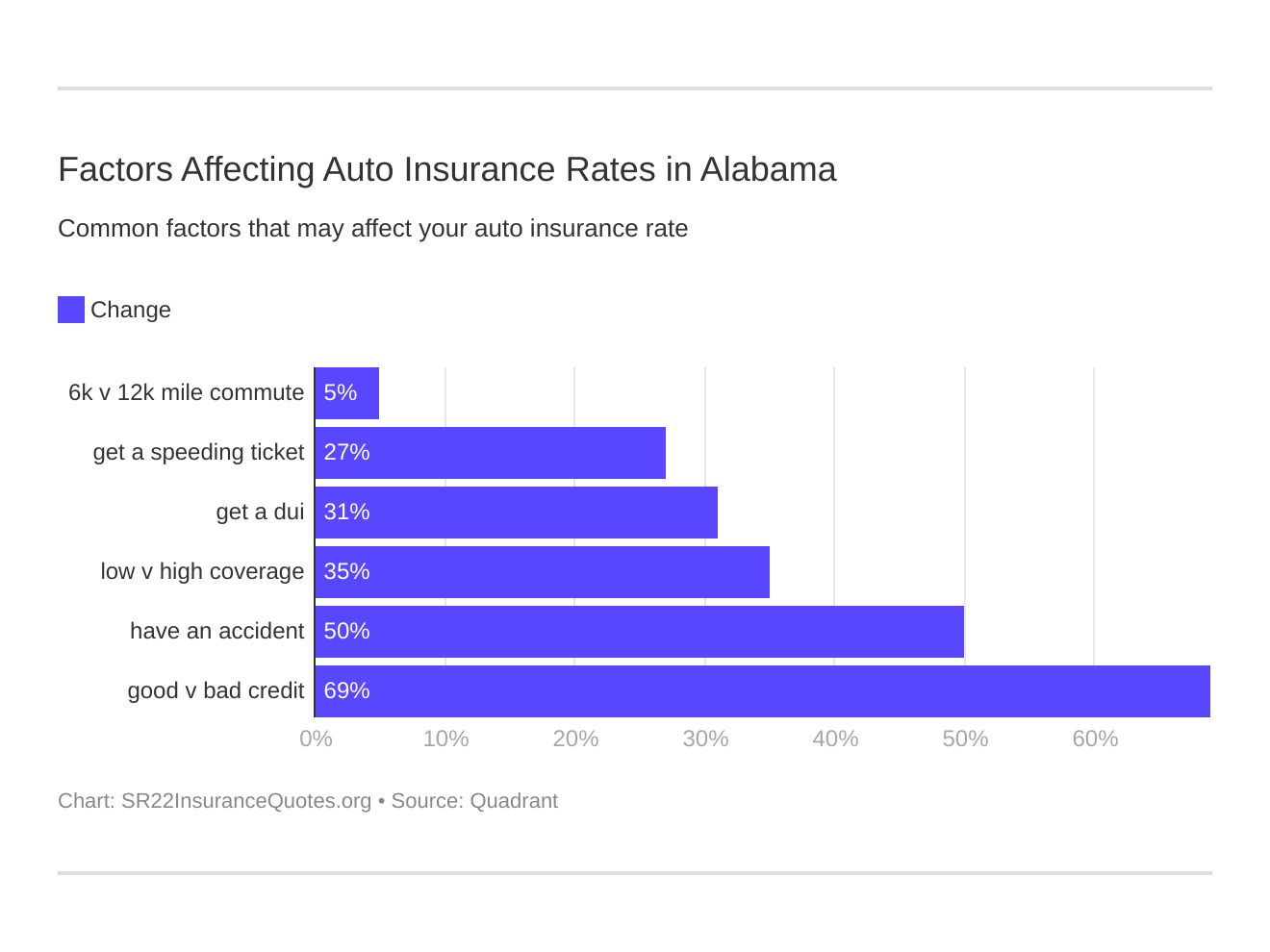

Six major factors affect car insurance rates in Alabama. Which auto insurance factors will impact SR-22 rates the most? Typically, that’s an AL DUI.

Who needs SR-22 Insurance in Alabama?

The SR-22 is needed for drivers in Alabama who are under mandatory insurance supervision and drivers who have had their licenses revoked. Additionally, those who are considered high risk, such as those who have had a DUI or other reckless driving issues, will also need to file an Alabama SR-22. Those drivers who have had unsatisfactory judgments levied against them in the event of an accident will also need to file the form, as well as drivers who have any sort of safety responsibility suspensions.

Are there different types of Alabama SR-22 Insurance Forms?

There are actually two types of Alabama SR-22 Insurance forms: The Owner and the Operator. Anyone who owns a vehicle will need to carry an Owner’s certificate as this covers fiscal responsibility for vehicles that the motorist may own. The Operator certificate is coverage for those who do not own a vehicle, but may drive.

Is SR-22 Insurance required in Alabama?

The State of Alabama does require Alabama SR-22 insurance in cases of high-risk drivers and in the other situations mentioned above. It can be required for anywhere from 36 months to five years. However, often, without additional violations, it may no longer be required. The State of Alabama requires that all drivers carry a minimum of $20,000 coverage in the event that one person is killed or injured, $40,000 in case two are injured or die, and $10,000 worth of coverage for property damage.

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

How do I file an Alabama SR-22 Form?

It is the responsibility of the driver to contact a state licensed insurance agency to request an Alabama SR-22 filing. The motorist will then pay a fee, which varies from insurance carrier to carrier, and the agency will then submit the form to the Department of Public Safety. Finding low cost SR-22 insurance quotes is important to making sure that you’re getting the right coverage at the right price; enter your information in today for a free online Alabama SR-22 quote.

The Bottom Line

SR-22 is not an auto insurance policy — it’s a form submitted by your car insurance company to the government certifying that you meet the state’s minimum car insurance requirements. Drivers convicted of a serious traffic offense, like reckless driving ,a DUI, need, or you are deemed a high-risk driver to file an SR-22 form. Your insurance premium after committing a DUI can be costly. In Alabama, car insurance companies need to file the SR-22 form digitally. Check with your insurer to see if they can do this on your behalf.